ARIMAX/SARIMAX/VAR

ARIMAX

ARIMAX model assumes that future values of a variable linearly depend on its past values, as well as on the values of past (stochastic) shocks. It is an extended version of the ARIMA model, with other independent (predictor) variables. The model is also referred to as the dynamic regression model. The X added to the end stands for “exogenous”. In other words, it suggests adding a separate different outside variable to help measure our endogenous variable.

The ‘exogenous’ variables added here are COVID-19 case numbers and COVID-19 vaccine rates. The number of COVID-19 cases in US can affect healthcare stock prices, e.g. UNH. Higher case numbers may result in increased demand for healthcare services, such as hospitalizations, treatments, and testing, which could positively impact the stock prices of healthcare companies involved in providing those services. Conversely, lower case numbers may lead to reduced demand for healthcare services, potentially resulting in lower stock prices for healthcare companies.

Vaccine rates, specifically the rate at which a population is vaccinated against COVID-19, can also impact healthcare stock prices. Higher vaccine rates are generally seen as positive for healthcare companies, as vaccines are considered a key tool in controlling the spread of the virus and reducing the severity of illness. Higher vaccine rates may lead to decreased demand for COVID-19 treatments and testing, but increased demand for vaccines and other preventive healthcare measures, which could positively impact the stock prices of healthcare companies involved in vaccine production or distribution, as well as other preventive healthcare services.

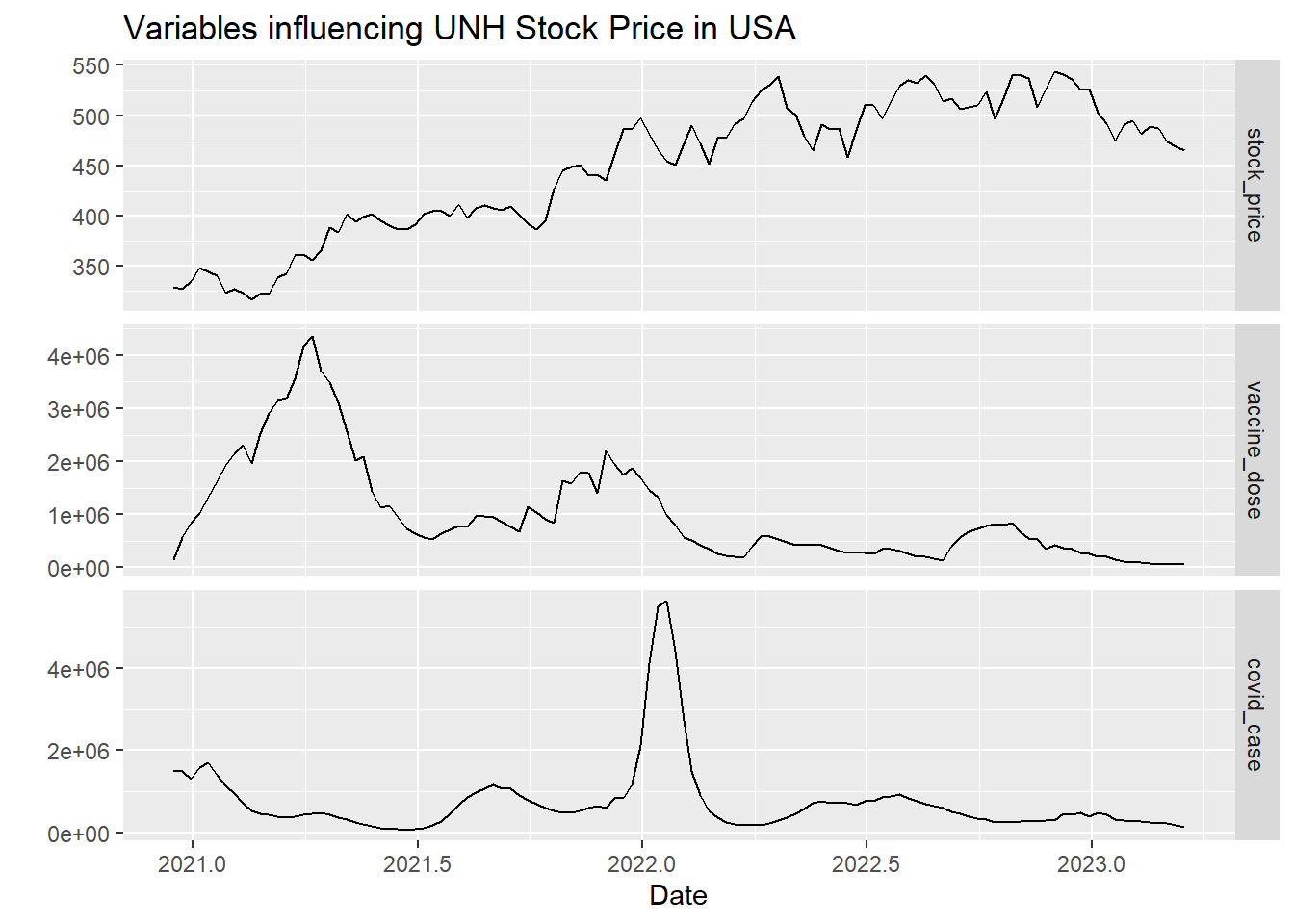

In this section, we choose the UNH stock price to fit ARIMAX model with COVID-19 case numbers and COVID-19 vaccine rates.

Step 1: Data Prepare

Show the code

getSymbols("UNH", from="2020-12-16", src="yahoo")Show the code

UNH_df <- as.data.frame(UNH)

UNH_df$Date <- rownames(UNH_df)

UNH_df <- UNH_df[c('Date','UNH.Adjusted')]

UNH_df <- UNH_df %>%

mutate(Date = as.Date(Date)) %>%

complete(Date = seq.Date(min(Date), max(Date), by="day"))

# fill missing values in stock

UNH_df <- UNH_df %>% fill(UNH.Adjusted)

new_dates <- seq(as.Date('2020-12-16'), as.Date('2023-3-21'),'week')

UNH_df <- UNH_df[which((UNH_df$Date) %in% new_dates),]

vaccine_df <- read.csv('data/vaccine_clean.csv')

new_dates <- seq(as.Date('2020-12-16'), as.Date('2023-3-22'),'week')

#vaccine_df

vaccine_df$Date <- as.Date(vaccine_df$Date)

vaccine_df <- vaccine_df[which((vaccine_df$Date) %in% new_dates),]

#covid_df

covid_df <- read.csv('data/covid.csv')

#covid_ts <- ts(covid_df$Weekly.Cases, start = c(2020,1,29), frequency = 54)

covid_df$Date <- as.Date(covid_df$Date)

covid_df <- covid_df[covid_df$Date >= '2020-12-16'&covid_df$Date < '2023-03-22',]

# combine all data, create dataframe

df <- data.frame(UNH_df, vaccine_df$total_doses, covid_df$Weekly.Cases)

colnames(df) <- c('Date', 'stock_price', 'vaccine_dose','covid_case')

knitr::kable(head(df))| Date | stock_price | vaccine_dose | covid_case |

|---|---|---|---|

| 2020-12-16 | 329.2309 | 160010 | 1526464 |

| 2020-12-23 | 327.5330 | 577895 | 1499703 |

| 2020-12-30 | 334.7126 | 848447 | 1299023 |

| 2021-01-06 | 348.5672 | 1029958 | 1584212 |

| 2021-01-13 | 344.4632 | 1334188 | 1716354 |

| 2021-01-20 | 340.3883 | 1614134 | 1391546 |

Step 2: Plotting the Data

Show the code

df.ts<-ts(df,star=decimal_date(as.Date("2020-12-16",format = "%Y-%m-%d")),frequency = 52)

autoplot(df.ts[,c(2:4)], facets=TRUE) +

xlab("Date") + ylab("") +

ggtitle("Variables influencing UNH Stock Price in USA")

UNH stock price, Covid, Vaccine values

Step 3: Fitting the model using ’auto.arima()`

Here I’m using auto.arima() function to fit the ARIMAX model. Here we are trying to predict UNH stock price using COVID vaccine dose and COVID cases. All variables are time series and the exogenous variables in this case are vaccine_dose and covid_case.

Show the code

xreg <- cbind(Vac = df.ts[, "vaccine_dose"],

Imp = df.ts[, "covid_case"])

fit <- auto.arima(df.ts[, "stock_price"], xreg = xreg)

summary(fit)Series: df.ts[, "stock_price"]

Regression with ARIMA(0,1,0) errors

Coefficients:

Vac Imp

0e+00 0e+00

s.e. 1e-04 1e-04

sigma^2 = 177.9: log likelihood = -468.1

AIC=942.2 AICc=942.41 BIC=950.49

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 1.097616 13.16639 10.30662 0.233993 2.273228 0.1046469 0.04011524Show the code

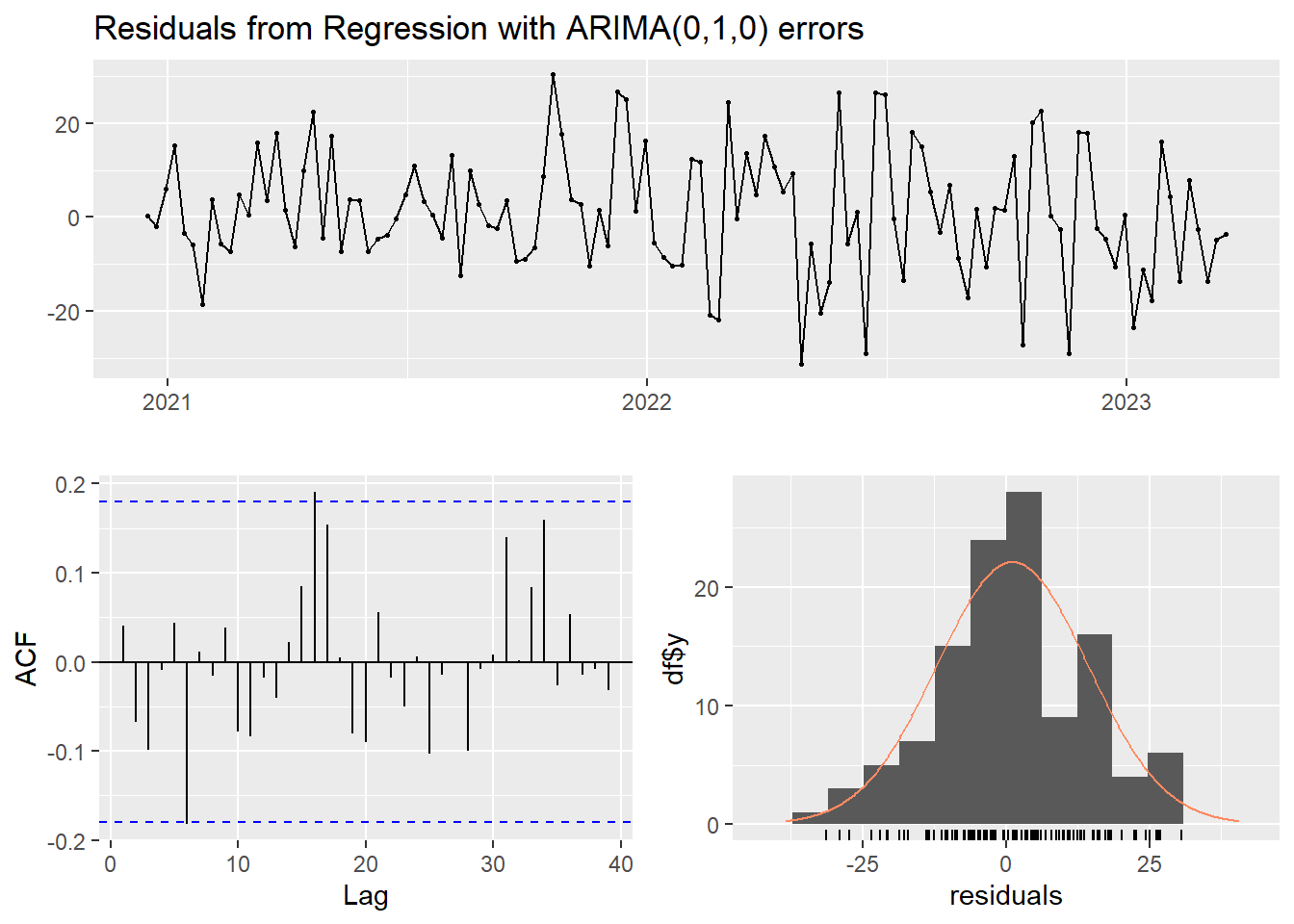

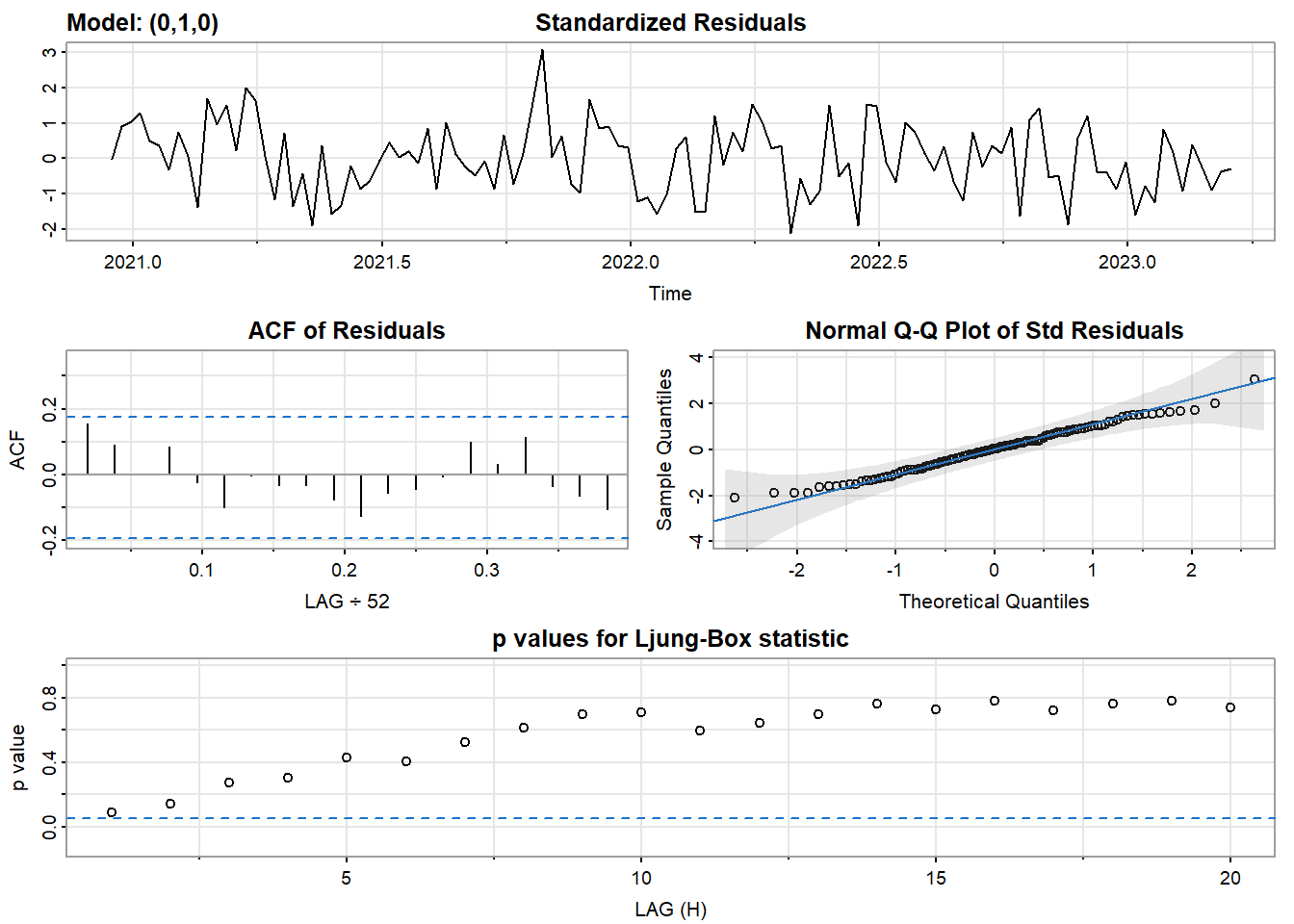

checkresiduals(fit)

Ljung-Box test

data: Residuals from Regression with ARIMA(0,1,0) errors

Q* = 21.112, df = 24, p-value = 0.6321

Model df: 0. Total lags used: 24This is an ARIMA model. This is a Regression model with ARIMA(0,1,0) errors.

Step 4: Fitting the model manually

Here we will first have to fit the linear regression model predicting stock price using Covid cases and vaccine doses.

Then for the residuals, we will fit an ARIMA/SARIMA model.

Show the code

df$stock_price <- ts(df$stock_price,star=decimal_date(as.Date("2020-12-16",format = "%Y-%m-%d")),frequency = 52)

df$vaccine_dose <-ts(df$vaccine_dose,star=decimal_date(as.Date("2020-12-16",format = "%Y-%m-%d")),frequency = 52)

df$covid_case<-ts(df$covid_case,star=decimal_date(as.Date("2020-12-16",format = "%Y-%m-%d")),frequency = 52)

######### First fit the linear model#######

fit.reg <- lm(stock_price ~ vaccine_dose+covid_case, data=df)

summary(fit.reg)

Call:

lm(formula = stock_price ~ vaccine_dose + covid_case, data = df)

Residuals:

Min 1Q Median 3Q Max

-154.24 -42.59 8.62 42.91 82.36

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.954e+02 7.932e+00 62.461 < 2e-16 ***

vaccine_dose -4.341e-05 5.043e-06 -8.607 4.47e-14 ***

covid_case -3.275e-06 5.345e-06 -0.613 0.541

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 52.02 on 115 degrees of freedom

Multiple R-squared: 0.3944, Adjusted R-squared: 0.3839

F-statistic: 37.45 on 2 and 115 DF, p-value: 2.988e-13Show the code

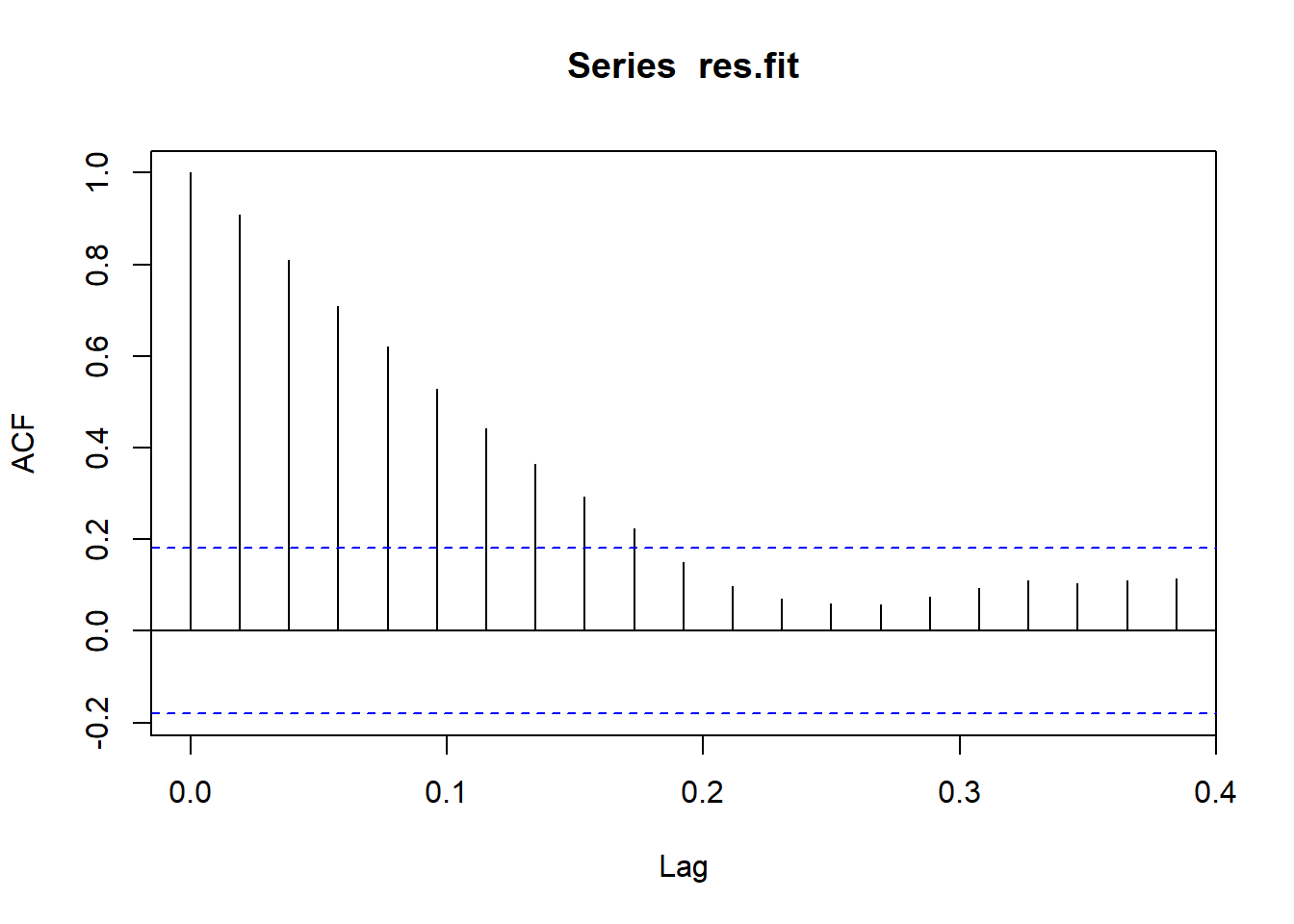

res.fit<-ts(residuals(fit.reg),star=decimal_date(as.Date("2020-12-16",format = "%Y-%m-%d")),frequency = 52)

########## Then look at the residuals ########

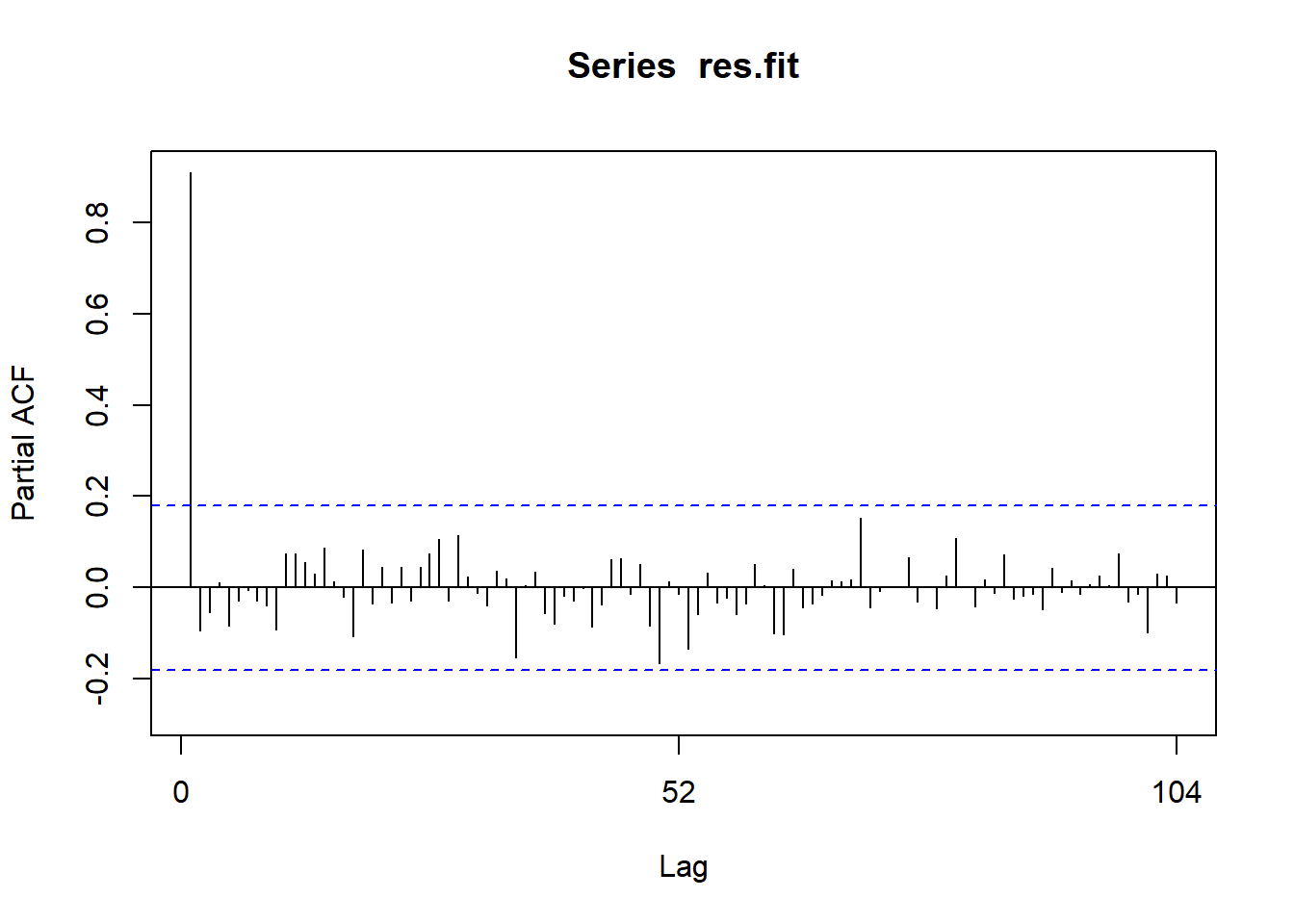

acf(res.fit)

Show the code

Pacf(res.fit)

Show the code

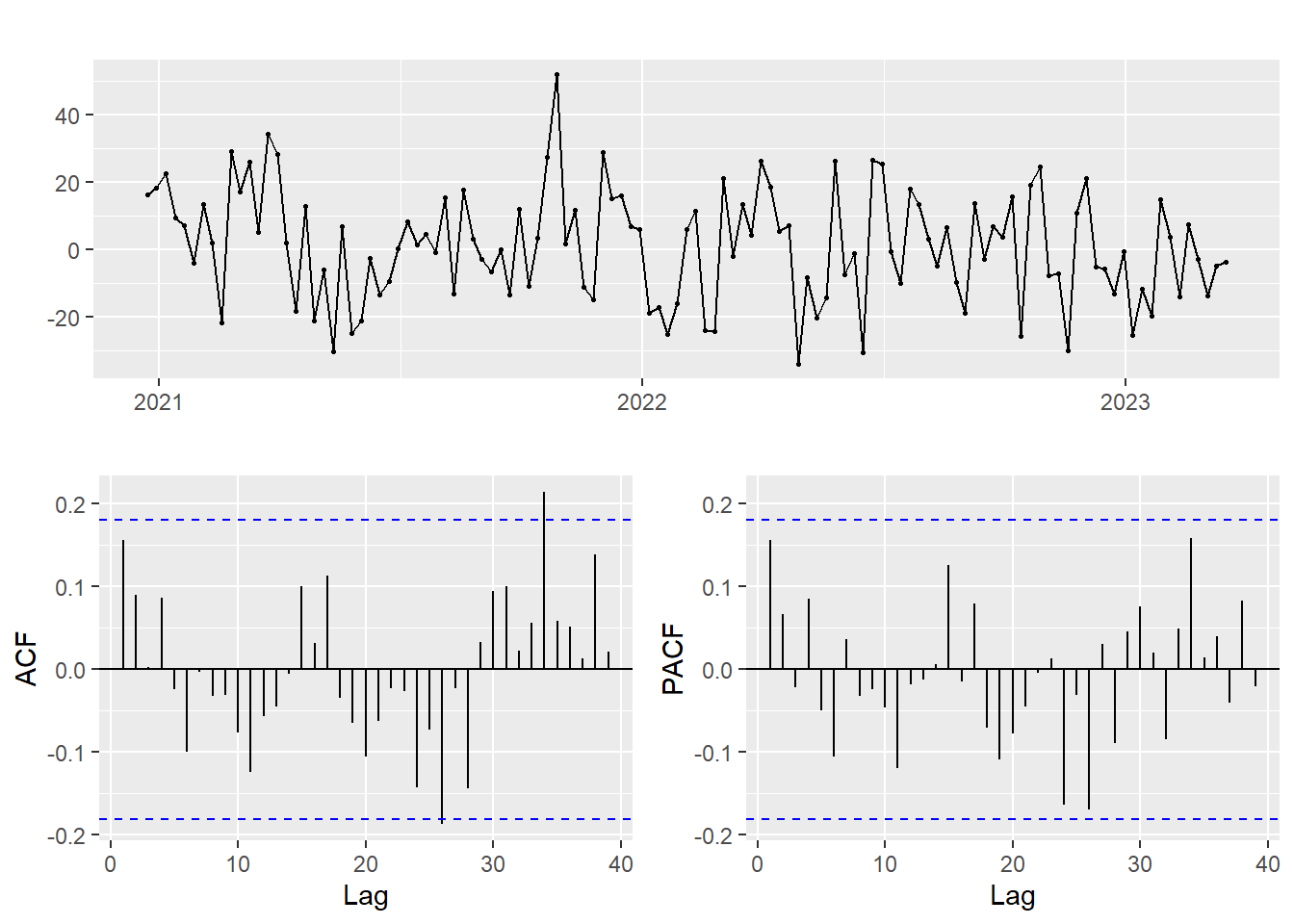

res.fit %>% diff() %>% ggtsdisplay()

Show the code

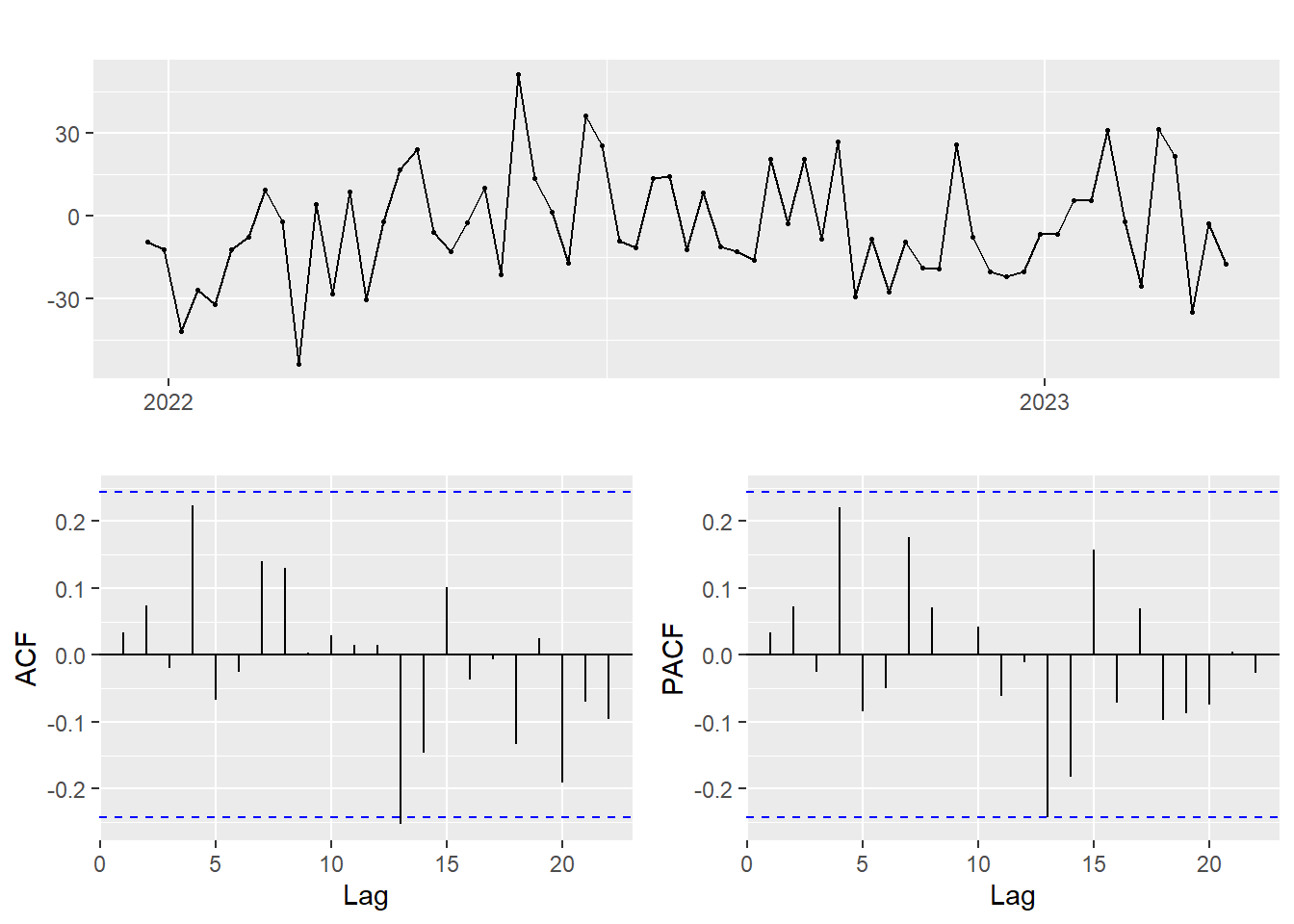

res.fit %>% diff() %>% diff(52) %>% ggtsdisplay()

Finding the model parameters.

Show the code

d=1

i=1

temp= data.frame()

ls=matrix(rep(NA,6*23),nrow=23) # roughly nrow = 3x4x2

for (p in 1:3)# p=1,2,

{

for(q in 1:3)# q=1,2,

{

for(d in 0:1)#

{

if(p-1+d+q-1<=8)

{

model<- Arima(res.fit,order=c(p-1,d,q-1),include.drift=TRUE)

ls[i,]= c(p-1,d,q-1,model$aic,model$bic,model$aicc)

i=i+1

#print(i)

}

}

}

}

temp= as.data.frame(ls)

names(temp)= c("p","d","q","AIC","BIC","AICc")

#temp

knitr::kable(temp)| p | d | q | AIC | BIC | AICc |

|---|---|---|---|---|---|

| 0 | 0 | 0 | 1217.4187 | 1225.7307 | 1217.6292 |

| 0 | 1 | 0 | 993.5902 | 999.1146 | 993.6955 |

| 0 | 0 | 1 | 1117.7725 | 1128.8552 | 1118.1264 |

| 0 | 1 | 1 | 993.1256 | 1001.4121 | 993.3380 |

| 0 | 0 | 2 | 1058.3969 | 1072.2503 | 1058.9326 |

| 0 | 1 | 2 | 994.2046 | 1005.2533 | 994.5617 |

| 1 | 0 | 0 | 1005.4074 | 1016.4901 | 1005.7614 |

| 1 | 1 | 0 | 992.7214 | 1001.0079 | 992.9338 |

| 1 | 0 | 1 | 1003.8974 | 1017.7508 | 1004.4331 |

| 1 | 1 | 1 | 994.2405 | 1005.2892 | 994.5976 |

| 1 | 0 | 2 | 1003.9563 | 1020.5804 | 1004.7130 |

| 1 | 1 | 2 | 995.7980 | 1009.6089 | 996.3386 |

| 2 | 0 | 0 | 1002.8800 | 1016.7334 | 1003.4157 |

| 2 | 1 | 0 | 994.1790 | 1005.2277 | 994.5362 |

| 2 | 0 | 1 | 999.6163 | 1016.2404 | 1000.3730 |

| 2 | 1 | 1 | 995.8971 | 1009.7080 | 996.4376 |

| 2 | 0 | 2 | 1005.7699 | 1025.1647 | 1006.7881 |

| 2 | 1 | 2 | 995.6381 | 1012.2111 | 996.4017 |

| NA | NA | NA | NA | NA | NA |

| NA | NA | NA | NA | NA | NA |

| NA | NA | NA | NA | NA | NA |

| NA | NA | NA | NA | NA | NA |

| NA | NA | NA | NA | NA | NA |

Show the code

print('Minimum AIC')[1] "Minimum AIC"Show the code

temp[which.min(temp$AIC),] p d q AIC BIC AICc

8 1 1 0 992.7214 1001.008 992.9338Show the code

print('Minimum BIC')[1] "Minimum BIC"Show the code

temp[which.min(temp$BIC),] p d q AIC BIC AICc

2 0 1 0 993.5902 999.1146 993.6955Show the code

print('Minimum AICc')[1] "Minimum AICc"Show the code

temp[which.min(temp$AICc),] p d q AIC BIC AICc

8 1 1 0 992.7214 1001.008 992.9338Show the code

set.seed(1234)

model_output12 <- capture.output(sarima(res.fit, 0,1,0))

Show the code

cat(model_output12[9:38], model_output12[length(model_output12)], sep = "\n")$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

constant

1.0885

s.e. 1.5357

sigma^2 estimated as 275.9: log likelihood = -494.8, aic = 993.59

$degrees_of_freedom

[1] 116

$ttable

Estimate SE t.value p.value

constant 1.0885 1.5357 0.7088 0.4799

$AIC

[1] 8.492224

$AICc

[1] 8.492522

$BIC

[1] 8.539441Show the code

set.seed(1234)

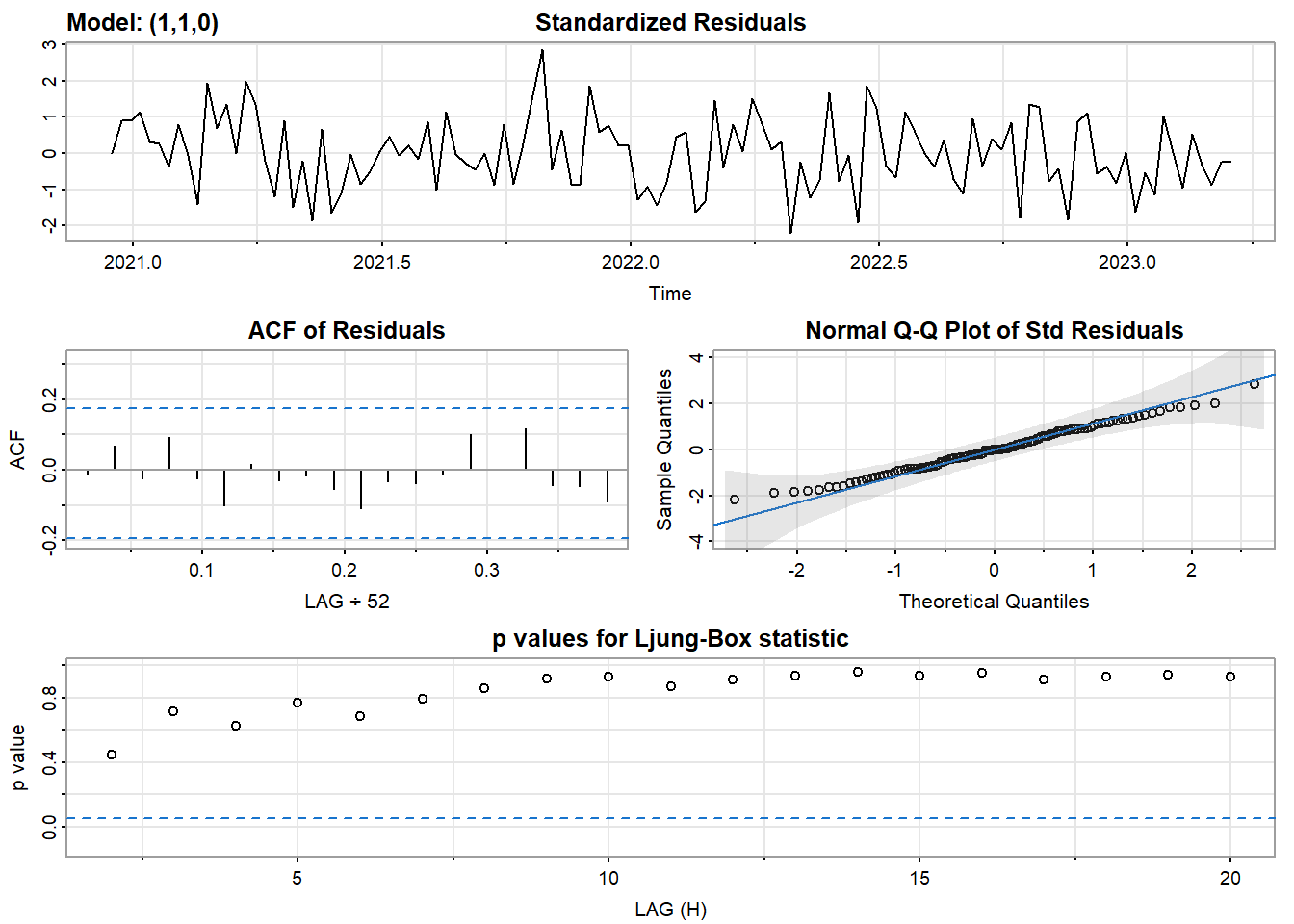

model_output13 <- capture.output(sarima(res.fit, 1,1,0))

Show the code

cat(model_output13[16:46], model_output13[length(model_output13)], sep = "\n")$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

ar1 constant

0.1556 1.1047

s.e. 0.0913 1.7935

sigma^2 estimated as 269.2: log likelihood = -493.36, aic = 992.72

$degrees_of_freedom

[1] 115

$ttable

Estimate SE t.value p.value

ar1 0.1556 0.0913 1.7049 0.0909

constant 1.1047 1.7935 0.6160 0.5391

$AIC

[1] 8.484798

$AICc

[1] 8.485698

$BIC

[1] 8.555623ARIMA(0,1,0) and ARIMA(1,1,0) both look okay.

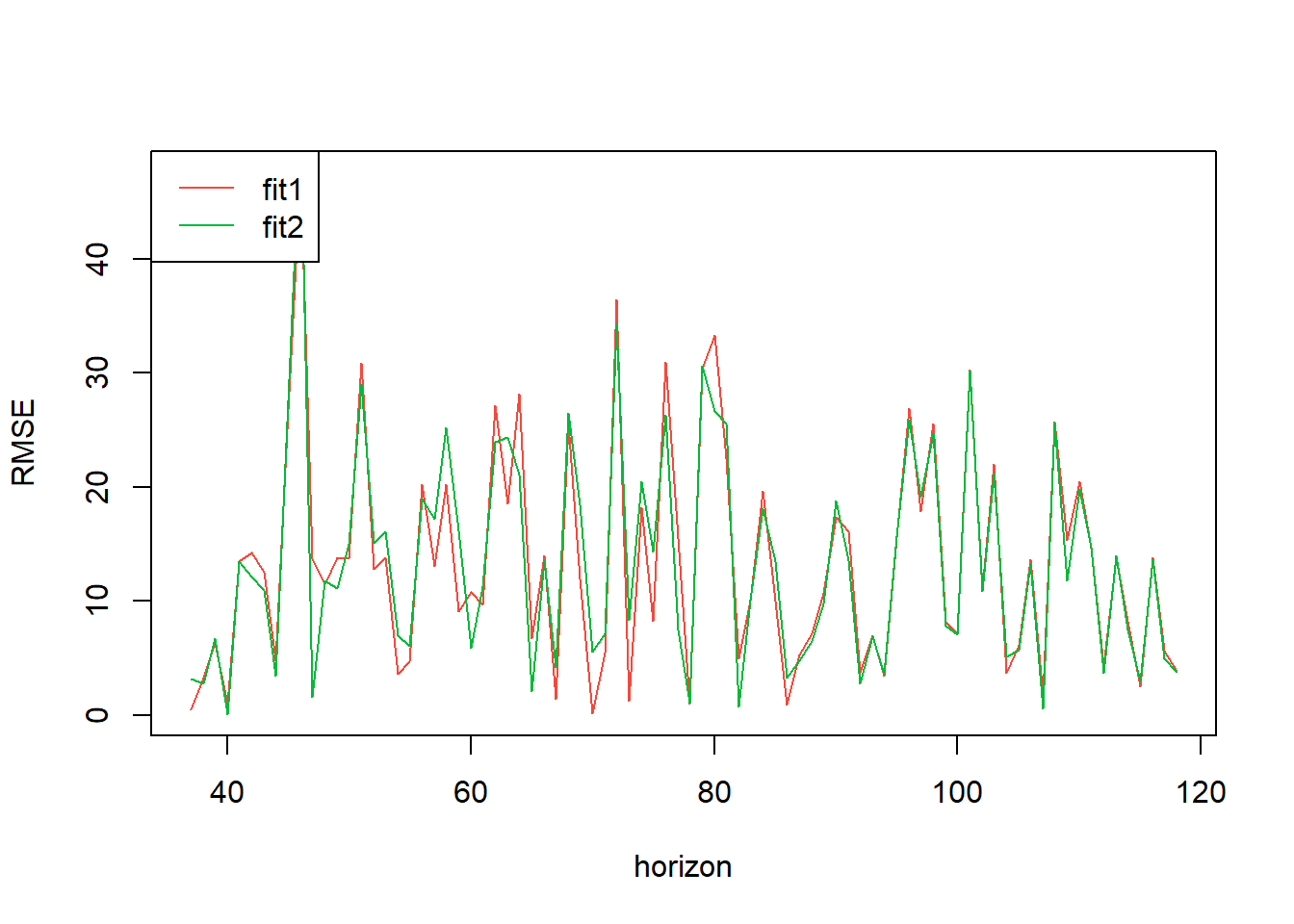

Step 5: Using Cross Validation

Show the code

k <- 36 # minimum data length for fitting a model

n <- length(res.fit)

n-k # rest of the observations[1] 82Show the code

i=1

err1 = c()

err2 = c()

rmse1 <- c()

rmse2 <- c()

for(i in 1:(n-k))

{

xtrain <- res.fit[1:(k-1)+i] #observations from 1 to 75

xtest <- res.fit[k+i] #76th observation as the test set

fit <- Arima(xtrain, order=c(1,1,0),include.drift=FALSE, method="ML")

fcast1 <- forecast(fit, h=1)

fit2 <- Arima(xtrain, order=c(0,1,0),include.drift=FALSE, method="ML")

fcast2 <- forecast(fit2, h=1)

#capture error for each iteration

# This is mean absolute error

err1 = c(err1, abs(fcast1$mean-xtest))

err2 = c(err2, abs(fcast2$mean-xtest))

# This is mean squared error

err3 = c(err1, (fcast1$mean-xtest)^2)

err4 = c(err2, (fcast2$mean-xtest)^2)

rmse1 <- c(rmse1, sqrt((fcast1$mean-xtest)^2))

rmse2 <- c(rmse2, sqrt((fcast2$mean-xtest)^2))

}

(MAE1=mean(err1)) # This is mean absolute error[1] 13.45554Show the code

(MAE2=mean(err2)) #has slightly higher error[1] 13.46804Show the code

MSE1=mean(err1) #fit 1,1,0

MSE2=mean(err2)#fit 0,1,0

MSE1[1] 13.45554Show the code

MSE2[1] 13.46804Show the code

rmse_df <- data.frame(rmse1,rmse2)

rmse_df$x <- as.numeric(rownames(rmse_df))

plot(rmse_df$x, rmse_df$rmse1, type = 'l', col=2, xlab="horizon", ylab="RMSE")

lines(rmse_df$x, rmse_df$rmse2, type="l",col=3)

legend("topleft",legend=c("fit1","fit2"),col=2:4,lty=1)

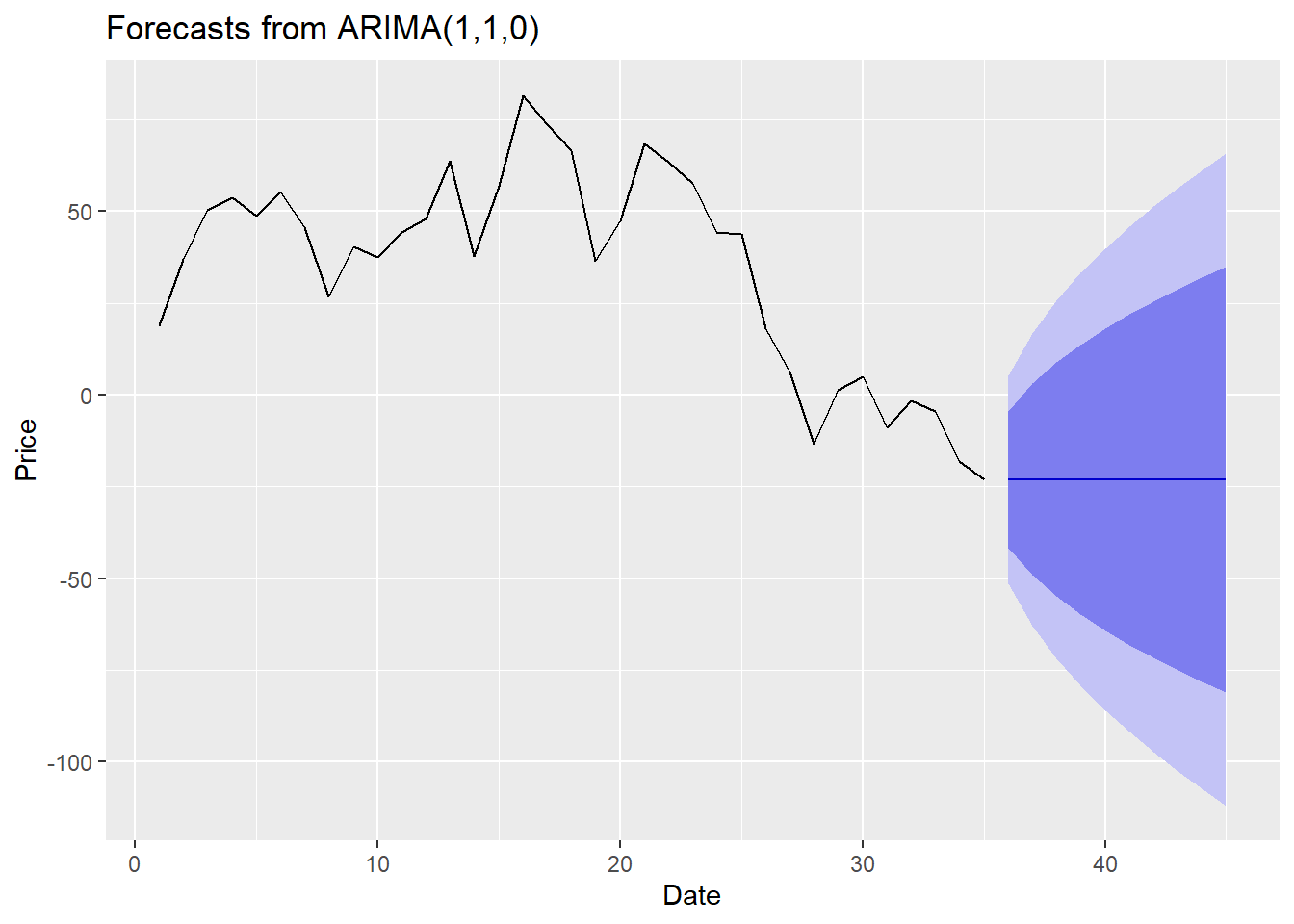

Step 6: forcasting

Show the code

vac_fit<-auto.arima(df$vaccine_dose) #fiting an ARIMA model to the vaccine_dose variable

summary(vac_fit)Series: df$vaccine_dose

ARIMA(1,1,1)

Coefficients:

ar1 ma1

0.8341 -0.6298

s.e. 0.0916 0.1128

sigma^2 = 4.824e+10: log likelihood = -1604.18

AIC=3214.36 AICc=3214.57 BIC=3222.65

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -1592.486 216829.1 132002.8 0.0009291879 13.08388 0.1149613

ACF1

Training set -0.06829849Show the code

fvac<-forecast(vac_fit)

covid_fit<-auto.arima(df$covid_case) #fiting an ARIMA model to the covid_case variable

summary(covid_fit)Series: df$covid_case

ARIMA(2,0,2) with non-zero mean

Coefficients:

ar1 ar2 ma1 ma2 mean

1.3306 -0.5128 0.8165 0.4848 733469.2

s.e. 0.1153 0.1117 0.1363 0.1076 189902.4

sigma^2 = 2.904e+10: log likelihood = -1588.94

AIC=3189.87 AICc=3190.63 BIC=3206.5

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -424.0988 166757.6 99191.78 -6.959882 17.02194 0.1095754

ACF1

Training set -0.00122146Show the code

fcov<-forecast(covid_fit)

fxreg <- cbind(Vac = fvac$mean,

Cov = fcov$mean)

fcast <- forecast(fit, xreg=fxreg) #fimp$mean gives the forecasted valuesWarning in forecast.forecast_ARIMA(fit, xreg = fxreg): xreg not required by this

model, ignoring the provided regressorsShow the code

autoplot(fcast) + xlab("Date") +

ylab("Price")

Discussion

Based on the result above, the number of daily COVID-19 vaccination number is not significant on predicting the UNH stock price, while the number of COVID-19 cases is. Though the number of COVID-19 vaccination number is not significant here, it does not mean that it does not affect healthcare stock price. While UNH is a healthcare company that is involved in health insurance, healthcare services, and technology solutions, it is not directly involved in COVID-19 vaccine development or production. Therefore, the number of COVID-19 vaccine doses administered may not have a direct impact on UNH’s operations or revenue.

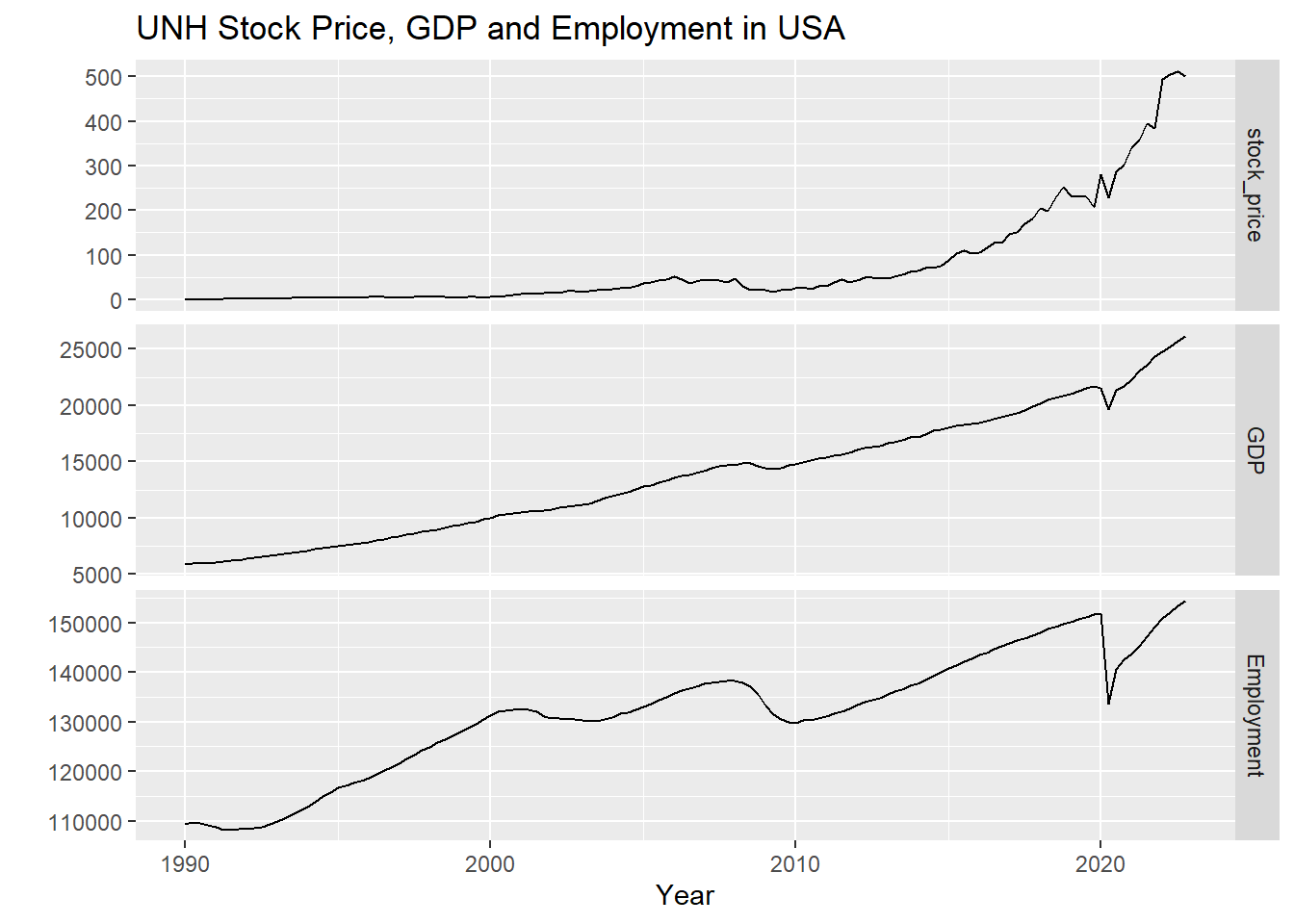

VAR

VAR models (vector autoregressive models) are used for multivariate time series. The structure is that each variable is a linear function of past lags of itself and past lags of the other variables. A Vector autoregressive (VAR) model is useful when one is interested in predicting multiple time series variables using a single model.

The variables we are interested here are GDP and Unemployment rate in US. The overall health of the economy, as reflected by the GDP, can influence healthcare stock prices. A strong GDP generally indicates a healthy economy with higher levels of consumer spending, business investment, and economic growth. In such an environment, healthcare companies may experience increased demand for their products and services, which could positively impact their stock prices. Conversely, a weak GDP may signal an economic slowdown or recession, which could result in reduced demand for healthcare products and services, potentially leading to lower stock prices for healthcare companies. The unemployment rate, which reflects the percentage of the labor force that is unemployed, can also affect healthcare stock prices. A low unemployment rate is generally indicative of a strong labor market, with more people employed and potentially having access to employer-sponsored healthcare benefits. This may result in increased demand for healthcare services, positively impacting healthcare stock prices. On the other hand, a high unemployment rate may indicate a weak labor market, with more people losing their jobs and potentially losing access to healthcare benefits, leading to reduced demand for healthcare services and potentially lower stock prices for healthcare companies.

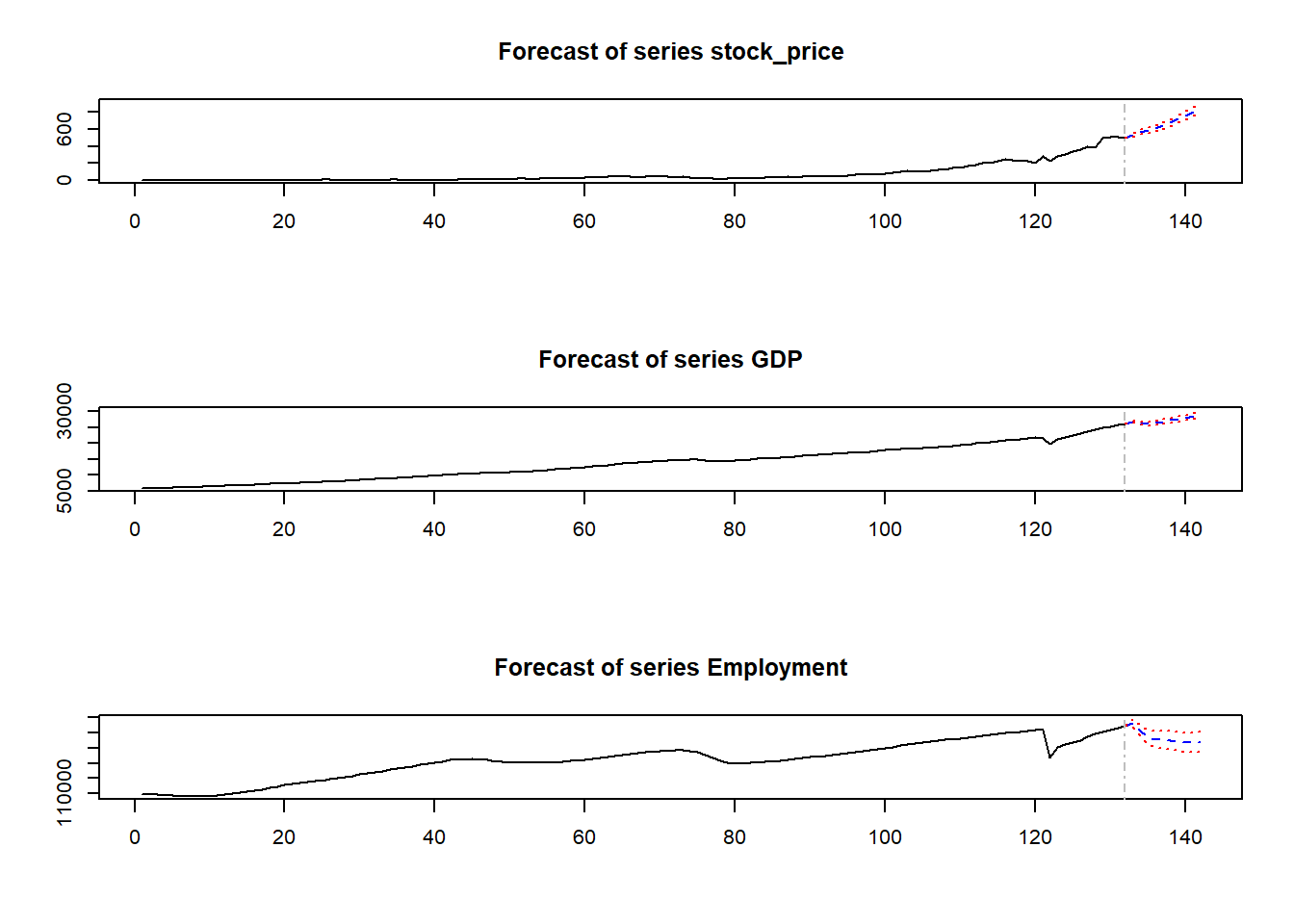

In this section, I’m fitting a VAR model to find multivariate relationship between the series UNH stock price, GDP, and Employment.

Step 1: Data Preparing

Show the code

getSymbols("UNH", from="1989-12-29", src="yahoo")[1] "UNH"Show the code

UNH_df <- as.data.frame(UNH)

UNH_df$Date <- rownames(UNH_df)

UNH_df <- UNH_df[c('Date','UNH.Adjusted')]

UNH_df <- UNH_df %>%

mutate(Date = as.Date(Date)) %>%

complete(Date = seq.Date(min(Date), max(Date), by="day"))

# fill missing values in stock

UNH_df <- UNH_df %>% fill(UNH.Adjusted)

#UNH_df

new_dates <- seq(as.Date('1990-01-01'), as.Date('2022-10-01'),'quarter')

#new_dates

UNH_df <- UNH_df[which((UNH_df$Date) %in% new_dates),]

gdp <- read.csv('data/GDP59.CSV')

gdp$DATE <- as.Date(gdp$DATE)

gdp <- gdp[which((gdp$DATE) %in% new_dates),]

emp <- read.csv('data/Employment59.CSV')

emp$DATE <- as.Date(emp$DATE)

emp <- emp[which((emp$DATE) %in% new_dates),]Show the code

dd <- data.frame(UNH_df,gdp,emp)

dd <- dd[,c(1,2,4,6)]

colnames(dd) <- c('DATE', 'stock_price','GDP','Employment')

knitr::kable(head(dd))| DATE | stock_price | GDP | Employment | |

|---|---|---|---|---|

| 125 | 1990-01-01 | 0.308110 | 5872.701 | 109418.7 |

| 126 | 1990-04-01 | 0.247759 | 5960.028 | 109786.7 |

| 127 | 1990-07-01 | 0.438343 | 6015.116 | 109651.0 |

| 128 | 1990-10-01 | 0.435356 | 6004.733 | 109255.0 |

| 129 | 1991-01-01 | 0.591069 | 6035.178 | 108783.0 |

| 130 | 1991-04-01 | 0.985114 | 6126.862 | 108312.3 |

Step 2: Plotting the data

Show the code

dd.ts<-ts(dd,star=decimal_date(as.Date("1990-01-01",format = "%Y-%m-%d")),frequency = 4)

autoplot(dd.ts[,c(2:4)], facets=TRUE) +

xlab("Year") + ylab("") +

ggtitle("UNH Stock Price, GDP and Employment in USA")

Step 3: Fitting a VAR model

Show the code

VARselect(dd[, c(2:4)], lag.max=10, type="both")$selection

AIC(n) HQ(n) SC(n) FPE(n)

10 9 9 9

$criteria

1 2 3 4 5

AIC(n) 2.941404e+01 2.865601e+01 2.849637e+01 2.814189e+01 2.812288e+01

HQ(n) 2.955407e+01 2.888005e+01 2.880444e+01 2.853398e+01 2.859898e+01

SC(n) 2.975880e+01 2.920762e+01 2.925484e+01 2.910721e+01 2.929506e+01

FPE(n) 5.948597e+12 2.788633e+12 2.379347e+12 1.671830e+12 1.644336e+12

6 7 8 9 10

AIC(n) 2.758294e+01 2.723307e+01 2.696700e+01 2.669062e+01 2.668670e+01

HQ(n) 2.814305e+01 2.787720e+01 2.769516e+01 2.750279e+01 2.758289e+01

SC(n) 2.896196e+01 2.881895e+01 2.875974e+01 2.869021e+01 2.889314e+01

FPE(n) 9.616264e+11 6.809549e+11 5.251270e+11 4.014819e+11 4.038690e+11It’s clear that according to selection criteria p=10 and 9 are good.

I’m fitting several models with p=1(for simplicity), 5, and 9.=> VAR(1), VAR(5), VAR(9)

Show the code

summary(VAR(dd[, c(2:4)], p=1, type='both'))

VAR Estimation Results:

=========================

Endogenous variables: stock_price, GDP, Employment

Deterministic variables: both

Sample size: 131

Log Likelihood: -2461.36

Roots of the characteristic polynomial:

1.028 0.9422 0.78

Call:

VAR(y = dd[, c(2:4)], p = 1, type = "both")

Estimation results for equation stock_price:

============================================

stock_price = stock_price.l1 + GDP.l1 + Employment.l1 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 1.0341243 0.0394781 26.195 <2e-16 ***

GDP.l1 -0.0005115 0.0039797 -0.129 0.8979

Employment.l1 -0.0006163 0.0003038 -2.029 0.0446 *

const 69.2145818 34.7475964 1.992 0.0485 *

trend 0.3006699 0.4555344 0.660 0.5104

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 14.62 on 126 degrees of freedom

Multiple R-Squared: 0.9849, Adjusted R-squared: 0.9844

F-statistic: 2057 on 4 and 126 DF, p-value: < 2.2e-16

Estimation results for equation GDP:

====================================

GDP = stock_price.l1 + GDP.l1 + Employment.l1 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 2.55503 0.64584 3.956 0.000126 ***

GDP.l1 0.79020 0.06511 12.137 < 2e-16 ***

Employment.l1 -0.01069 0.00497 -2.151 0.033349 *

const 2355.16290 568.45522 4.143 6.24e-05 ***

trend 27.89290 7.45234 3.743 0.000275 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 239.2 on 126 degrees of freedom

Multiple R-Squared: 0.998, Adjusted R-squared: 0.998

F-statistic: 1.607e+04 on 4 and 126 DF, p-value: < 2.2e-16

Estimation results for equation Employment:

===========================================

Employment = stock_price.l1 + GDP.l1 + Employment.l1 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 6.183e+00 4.862e+00 1.272 0.20584

GDP.l1 -5.610e-01 4.901e-01 -1.145 0.25458

Employment.l1 9.253e-01 3.741e-02 24.733 < 2e-16 ***

const 1.161e+04 4.279e+03 2.712 0.00762 **

trend 8.544e+01 5.610e+01 1.523 0.13028

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1801 on 126 degrees of freedom

Multiple R-Squared: 0.9786, Adjusted R-squared: 0.9779

F-statistic: 1441 on 4 and 126 DF, p-value: < 2.2e-16

Covariance matrix of residuals:

stock_price GDP Employment

stock_price 213.8 1386 12148

GDP 1385.8 57224 396720

Employment 12147.6 396720 3242998

Correlation matrix of residuals:

stock_price GDP Employment

stock_price 1.0000 0.3962 0.4613

GDP 0.3962 1.0000 0.9209

Employment 0.4613 0.9209 1.0000Show the code

summary(VAR(dd[, c(2:4)], p=5, type='both'))

VAR Estimation Results:

=========================

Endogenous variables: stock_price, GDP, Employment

Deterministic variables: both

Sample size: 127

Log Likelihood: -2267.863

Roots of the characteristic polynomial:

1.054 0.9435 0.9435 0.8781 0.8781 0.7952 0.7952 0.7806 0.7806 0.7709 0.7709 0.6959 0.4107 0.4107 0.3355

Call:

VAR(y = dd[, c(2:4)], p = 5, type = "both")

Estimation results for equation stock_price:

============================================

stock_price = stock_price.l1 + GDP.l1 + Employment.l1 + stock_price.l2 + GDP.l2 + Employment.l2 + stock_price.l3 + GDP.l3 + Employment.l3 + stock_price.l4 + GDP.l4 + Employment.l4 + stock_price.l5 + GDP.l5 + Employment.l5 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 5.454e-01 1.048e-01 5.204 9.13e-07 ***

GDP.l1 6.007e-02 1.789e-02 3.358 0.00108 **

Employment.l1 -7.709e-03 2.385e-03 -3.232 0.00162 **

stock_price.l2 2.323e-01 1.468e-01 1.583 0.11639

GDP.l2 -6.188e-02 2.695e-02 -2.297 0.02353 *

Employment.l2 8.708e-03 4.117e-03 2.115 0.03668 *

stock_price.l3 -6.701e-02 1.636e-01 -0.410 0.68293

GDP.l3 1.256e-02 2.614e-02 0.480 0.63198

Employment.l3 -3.778e-03 4.122e-03 -0.917 0.36136

stock_price.l4 2.159e-01 1.796e-01 1.202 0.23192

GDP.l4 -1.114e-02 2.275e-02 -0.490 0.62525

Employment.l4 2.759e-03 3.733e-03 0.739 0.46146

stock_price.l5 2.480e-01 1.956e-01 1.268 0.20751

GDP.l5 -1.060e-02 1.379e-02 -0.769 0.44375

Employment.l5 -6.394e-04 2.197e-03 -0.291 0.77155

const 1.189e+02 3.723e+01 3.194 0.00183 **

trend 1.493e+00 5.610e-01 2.661 0.00897 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 12.06 on 110 degrees of freedom

Multiple R-Squared: 0.9909, Adjusted R-squared: 0.9896

F-statistic: 750.5 on 16 and 110 DF, p-value: < 2.2e-16

Estimation results for equation GDP:

====================================

GDP = stock_price.l1 + GDP.l1 + Employment.l1 + stock_price.l2 + GDP.l2 + Employment.l2 + stock_price.l3 + GDP.l3 + Employment.l3 + stock_price.l4 + GDP.l4 + Employment.l4 + stock_price.l5 + GDP.l5 + Employment.l5 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 -1.30445 1.54245 -0.846 0.399555

GDP.l1 1.92765 0.26327 7.322 4.28e-11 ***

Employment.l1 -0.18525 0.03510 -5.277 6.65e-07 ***

stock_price.l2 7.85075 2.15990 3.635 0.000425 ***

GDP.l2 -0.49800 0.39656 -1.256 0.211852

Employment.l2 0.14315 0.06059 2.363 0.019907 *

stock_price.l3 1.97665 2.40806 0.821 0.413510

GDP.l3 -0.68441 0.38474 -1.779 0.078023 .

Employment.l3 0.07846 0.06066 1.293 0.198571

stock_price.l4 -3.50097 2.64351 -1.324 0.188127

GDP.l4 -0.53338 0.33481 -1.593 0.114012

Employment.l4 0.03338 0.05493 0.608 0.544643

stock_price.l5 -4.52830 2.87918 -1.573 0.118643

GDP.l5 0.62554 0.20300 3.081 0.002603 **

Employment.l5 -0.07633 0.03233 -2.361 0.019978 *

const 1593.63764 547.91857 2.909 0.004394 **

trend 21.22796 8.25642 2.571 0.011473 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 177.5 on 110 degrees of freedom

Multiple R-Squared: 0.999, Adjusted R-squared: 0.9988

F-statistic: 6815 on 16 and 110 DF, p-value: < 2.2e-16

Estimation results for equation Employment:

===========================================

Employment = stock_price.l1 + GDP.l1 + Employment.l1 + stock_price.l2 + GDP.l2 + Employment.l2 + stock_price.l3 + GDP.l3 + Employment.l3 + stock_price.l4 + GDP.l4 + Employment.l4 + stock_price.l5 + GDP.l5 + Employment.l5 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 -3.786e+01 1.190e+01 -3.182 0.00190 **

GDP.l1 6.787e+00 2.030e+00 3.343 0.00113 **

Employment.l1 -1.385e-02 2.707e-01 -0.051 0.95928

stock_price.l2 7.770e+01 1.666e+01 4.664 8.77e-06 ***

GDP.l2 -2.705e+00 3.058e+00 -0.885 0.37831

Employment.l2 6.207e-01 4.673e-01 1.328 0.18686

stock_price.l3 4.014e+00 1.857e+01 0.216 0.82927

GDP.l3 -8.103e+00 2.967e+00 -2.731 0.00736 **

Employment.l3 1.098e+00 4.678e-01 2.346 0.02075 *

stock_price.l4 -1.641e+01 2.039e+01 -0.805 0.42269

GDP.l4 -1.499e+00 2.582e+00 -0.581 0.56270

Employment.l4 -1.900e-01 4.237e-01 -0.448 0.65470

stock_price.l5 -2.700e+01 2.221e+01 -1.216 0.22657

GDP.l5 4.674e+00 1.566e+00 2.985 0.00349 **

Employment.l5 -5.865e-01 2.493e-01 -2.352 0.02044 *

const 1.222e+04 4.226e+03 2.891 0.00462 **

trend 1.203e+02 6.368e+01 1.890 0.06146 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1369 on 110 degrees of freedom

Multiple R-Squared: 0.9879, Adjusted R-squared: 0.9861

F-statistic: 560.4 on 16 and 110 DF, p-value: < 2.2e-16

Covariance matrix of residuals:

stock_price GDP Employment

stock_price 145.5 455.4 5503

GDP 455.4 31506.6 225145

Employment 5503.3 225144.8 1874014

Correlation matrix of residuals:

stock_price GDP Employment

stock_price 1.0000 0.2127 0.3333

GDP 0.2127 1.0000 0.9266

Employment 0.3333 0.9266 1.0000Show the code

summary(VAR(dd[, c(2:4)], p=9, type='both'))

VAR Estimation Results:

=========================

Endogenous variables: stock_price, GDP, Employment

Deterministic variables: both

Sample size: 123

Log Likelihood: -2076.371

Roots of the characteristic polynomial:

1.058 1.051 1.018 1.018 1.012 1.012 1.012 1.012 1.005 1.005 1.003 1.003 0.9793 0.9793 0.9726 0.9726 0.8256 0.8256 0.8098 0.8098 0.7926 0.7926 0.6662 0.6662 0.4868 0.4868 0.0237

Call:

VAR(y = dd[, c(2:4)], p = 9, type = "both")

Estimation results for equation stock_price:

============================================

stock_price = stock_price.l1 + GDP.l1 + Employment.l1 + stock_price.l2 + GDP.l2 + Employment.l2 + stock_price.l3 + GDP.l3 + Employment.l3 + stock_price.l4 + GDP.l4 + Employment.l4 + stock_price.l5 + GDP.l5 + Employment.l5 + stock_price.l6 + GDP.l6 + Employment.l6 + stock_price.l7 + GDP.l7 + Employment.l7 + stock_price.l8 + GDP.l8 + Employment.l8 + stock_price.l9 + GDP.l9 + Employment.l9 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 0.6177986 0.1140057 5.419 4.61e-07 ***

GDP.l1 0.0415175 0.0139527 2.976 0.003717 **

Employment.l1 -0.0069645 0.0020733 -3.359 0.001131 **

stock_price.l2 0.3603716 0.1652332 2.181 0.031680 *

GDP.l2 -0.0157162 0.0211664 -0.743 0.459633

Employment.l2 0.0048987 0.0033424 1.466 0.146093

stock_price.l3 0.0177119 0.1607489 0.110 0.912499

GDP.l3 -0.0009781 0.0212811 -0.046 0.963439

Employment.l3 -0.0018913 0.0034992 -0.540 0.590135

stock_price.l4 -0.1568989 0.1711382 -0.917 0.361596

GDP.l4 -0.0352143 0.0218848 -1.609 0.110953

Employment.l4 0.0072039 0.0035652 2.021 0.046168 *

stock_price.l5 0.3383735 0.2044761 1.655 0.101294

GDP.l5 -0.0156536 0.0222246 -0.704 0.482964

Employment.l5 0.0016545 0.0036673 0.451 0.652934

stock_price.l6 0.1416245 0.2112799 0.670 0.504299

GDP.l6 -0.0184066 0.0221573 -0.831 0.408236

Employment.l6 -0.0012687 0.0036506 -0.348 0.728965

stock_price.l7 -0.9691876 0.2444899 -3.964 0.000144 ***

GDP.l7 0.0190303 0.0219980 0.865 0.389190

Employment.l7 -0.0017353 0.0035712 -0.486 0.628163

stock_price.l8 1.0643895 0.2599676 4.094 8.96e-05 ***

GDP.l8 0.0123808 0.0212167 0.584 0.560927

Employment.l8 -0.0058935 0.0033845 -1.741 0.084893 .

stock_price.l9 -0.2681893 0.2116088 -1.267 0.208149

GDP.l9 0.0063637 0.0130395 0.488 0.626663

Employment.l9 0.0035409 0.0021429 1.652 0.101786

const 79.8647702 39.9369777 2.000 0.048411 *

trend 0.9524397 0.5617195 1.696 0.093276 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 8.687 on 94 degrees of freedom

Multiple R-Squared: 0.9959, Adjusted R-squared: 0.9947

F-statistic: 819 on 28 and 94 DF, p-value: < 2.2e-16

Estimation results for equation GDP:

====================================

GDP = stock_price.l1 + GDP.l1 + Employment.l1 + stock_price.l2 + GDP.l2 + Employment.l2 + stock_price.l3 + GDP.l3 + Employment.l3 + stock_price.l4 + GDP.l4 + Employment.l4 + stock_price.l5 + GDP.l5 + Employment.l5 + stock_price.l6 + GDP.l6 + Employment.l6 + stock_price.l7 + GDP.l7 + Employment.l7 + stock_price.l8 + GDP.l8 + Employment.l8 + stock_price.l9 + GDP.l9 + Employment.l9 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 -5.605e+00 1.777e+00 -3.154 0.00217 **

GDP.l1 1.818e+00 2.175e-01 8.360 5.58e-13 ***

Employment.l1 -1.497e-01 3.232e-02 -4.631 1.17e-05 ***

stock_price.l2 1.352e+01 2.576e+00 5.250 9.43e-07 ***

GDP.l2 -7.098e-01 3.300e-01 -2.151 0.03403 *

Employment.l2 1.262e-01 5.211e-02 2.422 0.01734 *

stock_price.l3 -1.116e+00 2.506e+00 -0.445 0.65722

GDP.l3 -2.534e-01 3.318e-01 -0.764 0.44683

Employment.l3 3.585e-02 5.455e-02 0.657 0.51262

stock_price.l4 1.673e+00 2.668e+00 0.627 0.53208

GDP.l4 -8.506e-02 3.412e-01 -0.249 0.80365

Employment.l4 1.384e-02 5.558e-02 0.249 0.80384

stock_price.l5 -7.495e-01 3.188e+00 -0.235 0.81462

GDP.l5 1.171e-01 3.465e-01 0.338 0.73604

Employment.l5 -2.497e-02 5.717e-02 -0.437 0.66327

stock_price.l6 -1.389e+01 3.294e+00 -4.216 5.71e-05 ***

GDP.l6 2.705e-02 3.454e-01 0.078 0.93775

Employment.l6 -9.452e-03 5.691e-02 -0.166 0.86846

stock_price.l7 -1.613e+00 3.812e+00 -0.423 0.67319

GDP.l7 -2.916e-01 3.429e-01 -0.850 0.39727

Employment.l7 7.971e-02 5.567e-02 1.432 0.15551

stock_price.l8 7.701e+00 4.053e+00 1.900 0.06049 .

GDP.l8 9.947e-02 3.308e-01 0.301 0.76428

Employment.l8 -1.132e-01 5.276e-02 -2.144 0.03457 *

stock_price.l9 1.073e+00 3.299e+00 0.325 0.74571

GDP.l9 1.156e-01 2.033e-01 0.569 0.57100

Employment.l9 3.477e-02 3.341e-02 1.041 0.30064

const 1.603e+03 6.226e+02 2.575 0.01159 *

trend 2.134e+01 8.757e+00 2.437 0.01669 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 135.4 on 94 degrees of freedom

Multiple R-Squared: 0.9995, Adjusted R-squared: 0.9993

F-statistic: 6211 on 28 and 94 DF, p-value: < 2.2e-16

Estimation results for equation Employment:

===========================================

Employment = stock_price.l1 + GDP.l1 + Employment.l1 + stock_price.l2 + GDP.l2 + Employment.l2 + stock_price.l3 + GDP.l3 + Employment.l3 + stock_price.l4 + GDP.l4 + Employment.l4 + stock_price.l5 + GDP.l5 + Employment.l5 + stock_price.l6 + GDP.l6 + Employment.l6 + stock_price.l7 + GDP.l7 + Employment.l7 + stock_price.l8 + GDP.l8 + Employment.l8 + stock_price.l9 + GDP.l9 + Employment.l9 + const + trend

Estimate Std. Error t value Pr(>|t|)

stock_price.l1 -6.801e+01 1.216e+01 -5.595 2.17e-07 ***

GDP.l1 6.439e+00 1.488e+00 4.328 3.75e-05 ***

Employment.l1 1.372e-01 2.211e-01 0.621 0.53643

stock_price.l2 1.137e+02 1.762e+01 6.453 4.74e-09 ***

GDP.l2 -4.116e+00 2.257e+00 -1.824 0.07136 .

Employment.l2 5.335e-01 3.564e-01 1.497 0.13778

stock_price.l3 -4.159e+00 1.714e+01 -0.243 0.80882

GDP.l3 -3.838e+00 2.269e+00 -1.691 0.09408 .

Employment.l3 5.003e-01 3.731e-01 1.341 0.18318

stock_price.l4 1.066e+01 1.825e+01 0.584 0.56038

GDP.l4 -6.501e-02 2.334e+00 -0.028 0.97783

Employment.l4 1.168e-01 3.802e-01 0.307 0.75925

stock_price.l5 2.259e+01 2.180e+01 1.036 0.30277

GDP.l5 8.889e-01 2.370e+00 0.375 0.70845

Employment.l5 -2.821e-01 3.911e-01 -0.721 0.47245

stock_price.l6 -1.130e+02 2.253e+01 -5.017 2.48e-06 ***

GDP.l6 -1.567e+00 2.363e+00 -0.663 0.50891

Employment.l6 2.161e-01 3.893e-01 0.555 0.58019

stock_price.l7 -2.070e+01 2.607e+01 -0.794 0.42930

GDP.l7 -1.096e+00 2.346e+00 -0.467 0.64133

Employment.l7 4.753e-01 3.808e-01 1.248 0.21512

stock_price.l8 8.864e+01 2.772e+01 3.198 0.00189 **

GDP.l8 1.933e+00 2.262e+00 0.854 0.39515

Employment.l8 -1.204e+00 3.609e-01 -3.336 0.00122 **

stock_price.l9 -3.272e+01 2.256e+01 -1.450 0.15042

GDP.l9 8.076e-01 1.390e+00 0.581 0.56273

Employment.l9 4.222e-01 2.285e-01 1.848 0.06777 .

const 1.262e+04 4.259e+03 2.963 0.00386 **

trend 9.703e+01 5.990e+01 1.620 0.10859

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 926.4 on 94 degrees of freedom

Multiple R-Squared: 0.9945, Adjusted R-squared: 0.9928

F-statistic: 603.2 on 28 and 94 DF, p-value: < 2.2e-16

Covariance matrix of residuals:

stock_price GDP Employment

stock_price 75.47 290.5 2750

GDP 290.52 18342.3 112144

Employment 2749.66 112143.8 858125

Correlation matrix of residuals:

stock_price GDP Employment

stock_price 1.0000 0.2469 0.3417

GDP 0.2469 1.0000 0.8939

Employment 0.3417 0.8939 1.0000Step 4: Using Cross Validation

Show the code

n=length(dd$stock_price)

k=39

#n-k=92; 92/4=23;

rmse1 <- matrix(NA, 96,3)

rmse2 <- matrix(NA, 96,3)

rmse3 <- matrix(NA,23,4)

year<-c()

# Convert data frame to time series object

ts_obj <- ts(dd[, c(2:4)], star=decimal_date(as.Date("1990-01-01",format = "%Y-%m-%d")),frequency = 4)

st <- tsp(ts_obj )[1]+(k-1)/4

for(i in 1:23)

{

xtrain <- window(ts_obj, end=st + i-1)

xtest <- window(ts_obj, start=st + (i-1) + 1/4, end=st + i)

fit <- VAR(ts_obj, p=5, type='both')

fcast <- predict(fit, n.ahead = 4)

fgdp<-fcast$fcst$GDP

femp<-fcast$fcst$Employment

fsp<-fcast$fcst$stock_price

ff<-data.frame(fsp[,1],fgdp[,1],femp[,1])

year<-st + (i-1) + 1/4

ff<-ts(ff,start=c(year,1),frequency = 4)

a = 4*i-3

b= 4*i

rmse1[c(a:b),] <-sqrt((ff-xtest)^2)

fit2 <- VAR(ts_obj, p=9, type='both')

fcast2 <- predict(fit2, n.ahead = 4)

fgdp<-fcast2$fcst$GDP

femp<-fcast2$fcst$Employment

fsp<-fcast2$fcst$stock_price

ff2<-data.frame(fsp[,1],fgdp[,1],femp[,1])

year<-st + (i-1) + 1/4

ff2<-ts(ff2,start=c(year,1),frequency = 4)

a = 4*i-3

b= 4*i

rmse2[c(a:b),] <-sqrt((ff2-xtest)^2)

}

yr = rep(c(1999:2022),each =4)

qr = rep(paste0("Q",1:4),24)

rmse1 = data.frame(yr,qr,rmse1)

names(rmse1) =c("Year", "Quater","Stock_Price","GDP","Employment")

rmse2 = data.frame(yr,qr,rmse2)

names(rmse2) =c("Year", "Quater","Stock_Price","GDP","Employment")

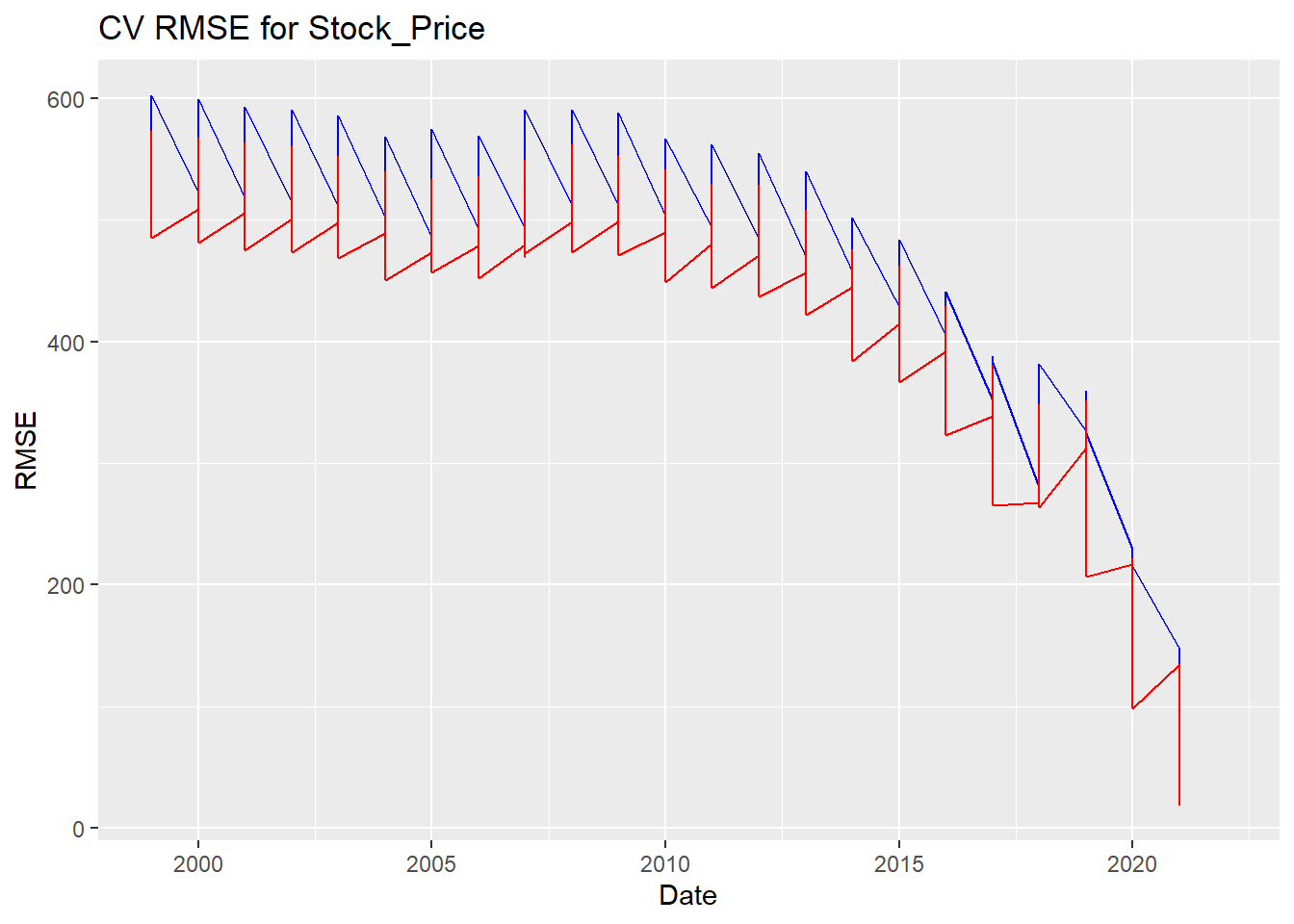

ggplot() +

geom_line(data = rmse1, aes(x = Year, y = Stock_Price),color = "blue") +

geom_line(data = rmse2, aes(x = Year, y = Stock_Price),color = "red") +

labs(

title = "CV RMSE for Stock_Price",

x = "Date",

y = "RMSE",

guides(colour=guide_legend(title="Fit")))

Show the code

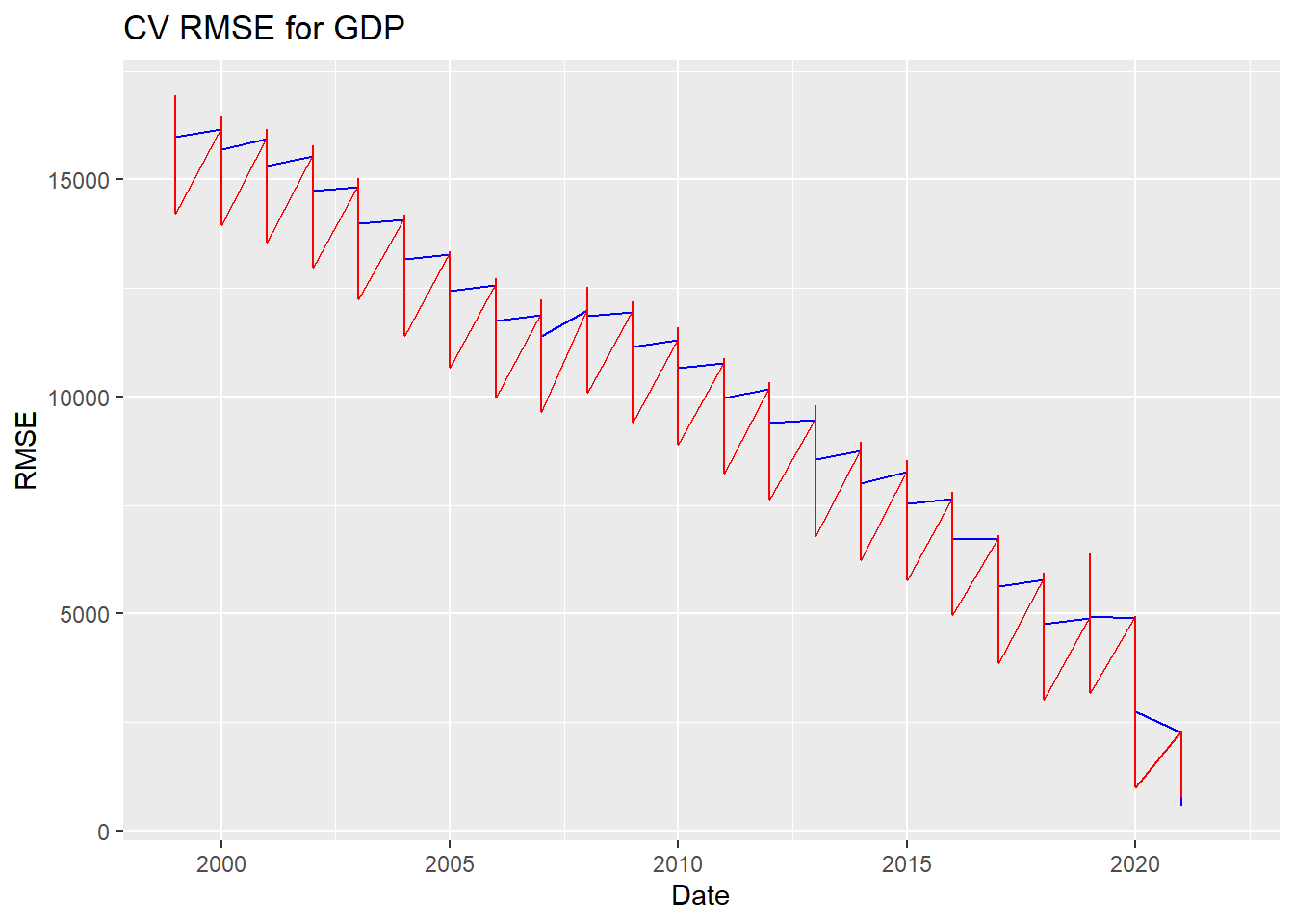

ggplot() +

geom_line(data = rmse1, aes(x = Year, y = GDP),color = "blue") +

geom_line(data = rmse2, aes(x = Year, y = GDP),color = "red") +

labs(

title = "CV RMSE for GDP",

x = "Date",

y = "RMSE",

guides(colour=guide_legend(title="Fit")))Warning: Removed 4 rows containing missing values (`geom_line()`).

Removed 4 rows containing missing values (`geom_line()`).

Show the code

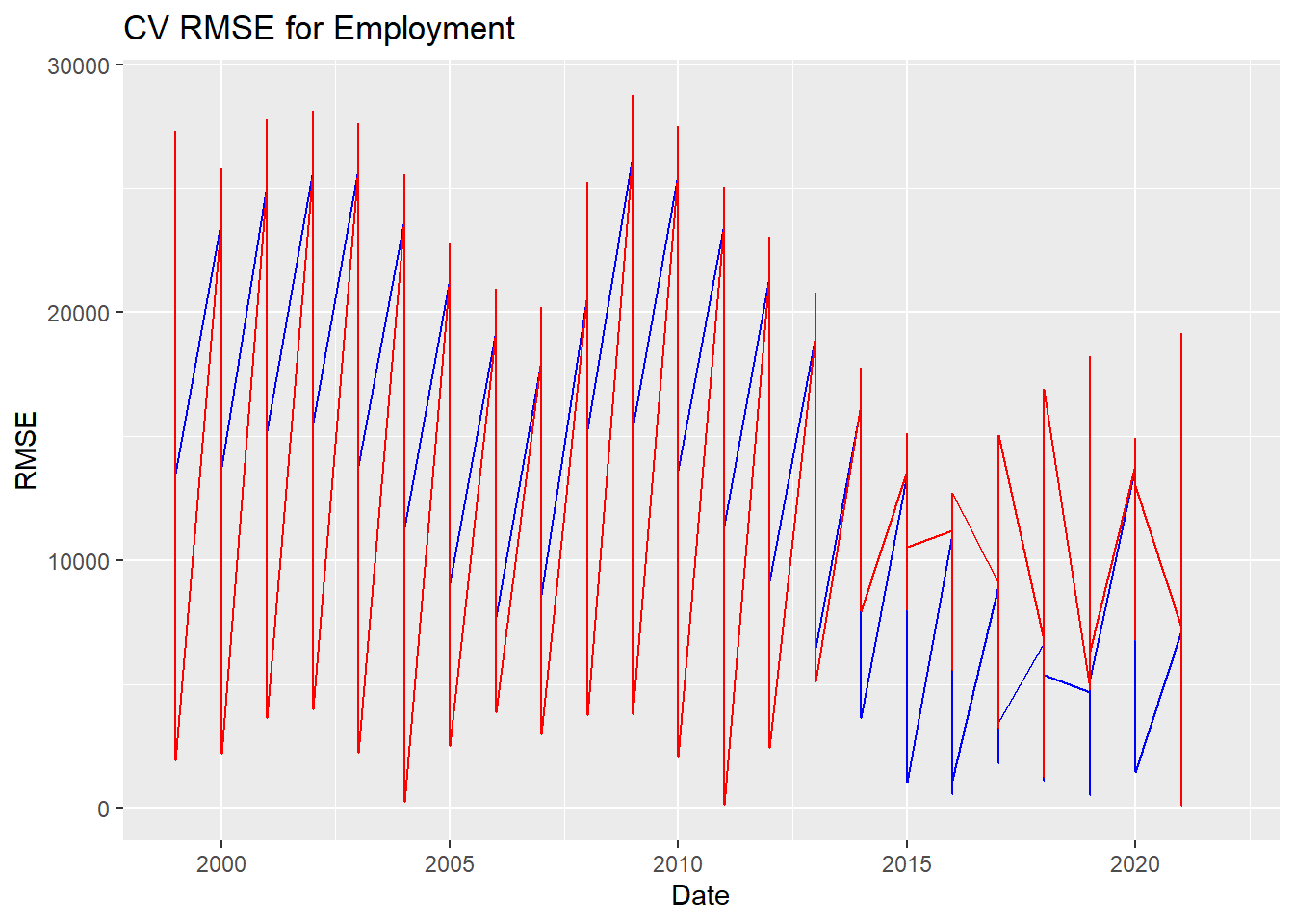

ggplot() +

geom_line(data = rmse1, aes(x = Year, y = Employment),color = "blue") +

geom_line(data = rmse2, aes(x = Year, y = Employment),color = "red") +

labs(

title = "CV RMSE for Employment",

x = "Date",

y = "RMSE",

guides(colour=guide_legend(title="Fit")))Warning: Removed 4 rows containing missing values (`geom_line()`).

Removed 4 rows containing missing values (`geom_line()`).

fit 1 is better

Step 5: Forecast

Show the code

forecasts <- predict(VAR(dd[, c(2:4)], p=5, type='both'))

# visualize the iterated forecasts

plot(forecasts)