EDA of JNJ

Refer to EDA-UNH for more detailed description for each plot.

Basic Time Series Plot

Show the code

# candlestick plot

JNJ_df <- as.data.frame(JNJ)

JNJ_df$Dates <- as.Date(rownames(JNJ_df))

fig_JNJ <- JNJ_df %>% plot_ly(x = ~Dates, type="candlestick",

open = ~JNJ.Open, close = ~JNJ.Close,

high = ~JNJ.High, low = ~JNJ.Low)

fig_JNJ <- fig_JNJ %>%

layout(title = "Basic Candlestick Chart for Johnson & Johnson")

fig_JNJLag plot

Show the code

JNJ_ts <- ts(stock_df$JNJ, start = c(2010,1),end = c(2023,1),

frequency = 251)

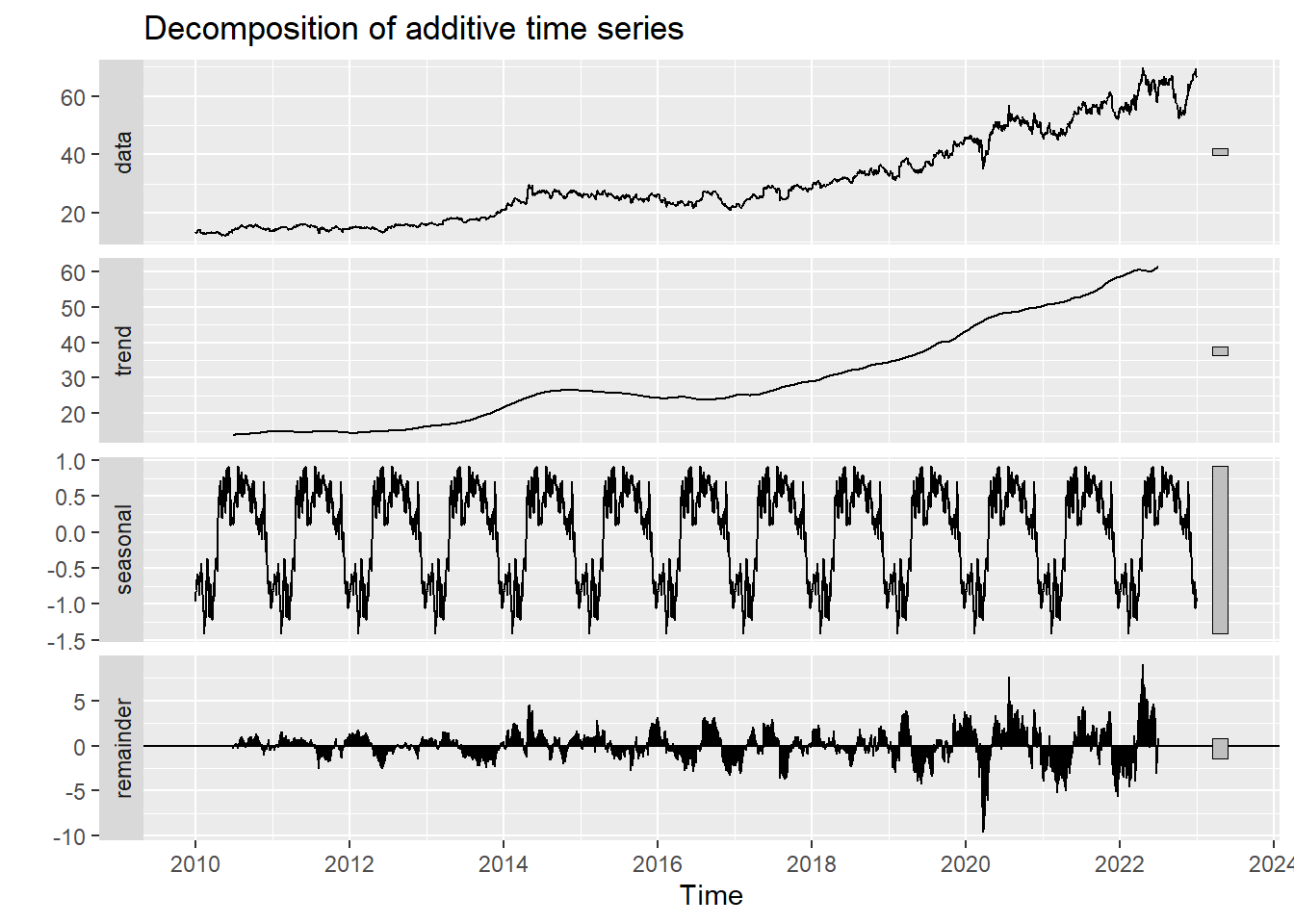

ts_lags(JNJ_ts)Decomposed times series

Show the code

decompose_JNJ <- decompose(JNJ_ts,'additive')

autoplot(decompose_JNJ)

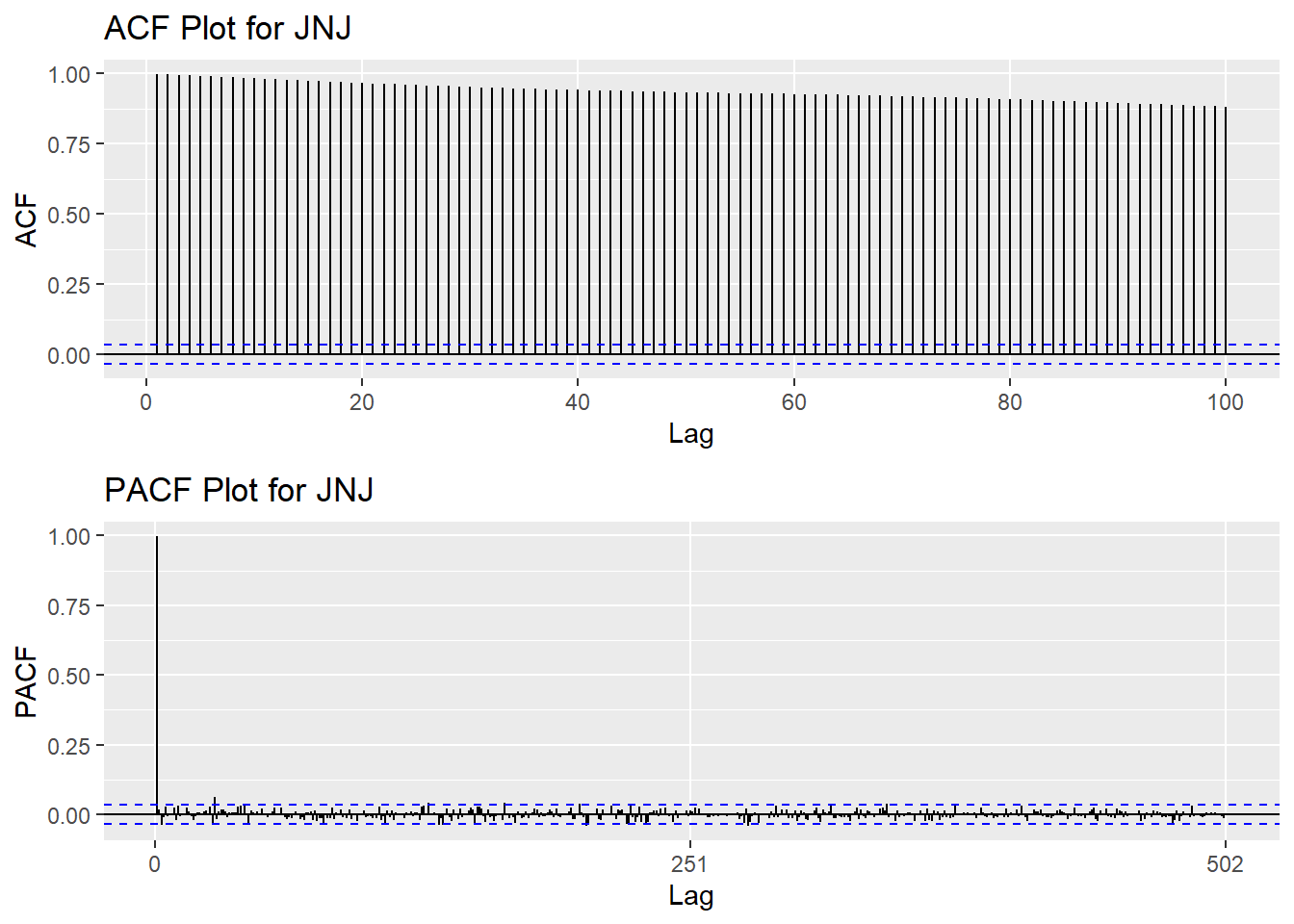

Autocorrelation in Time Series

Show the code

JNJ_acf <- ggAcf(JNJ_ts,100)+ggtitle("ACF Plot for JNJ")

JNJ_pacf <- ggPacf(JNJ_ts)+ggtitle("PACF Plot for JNJ")

grid.arrange(JNJ_acf, JNJ_pacf,nrow=2)

Augmented Dickey-Fuller Test

Show the code

tseries::adf.test(JNJ_ts)

Augmented Dickey-Fuller Test

data: JNJ_ts

Dickey-Fuller = -2.4264, Lag order = 14, p-value = 0.3978

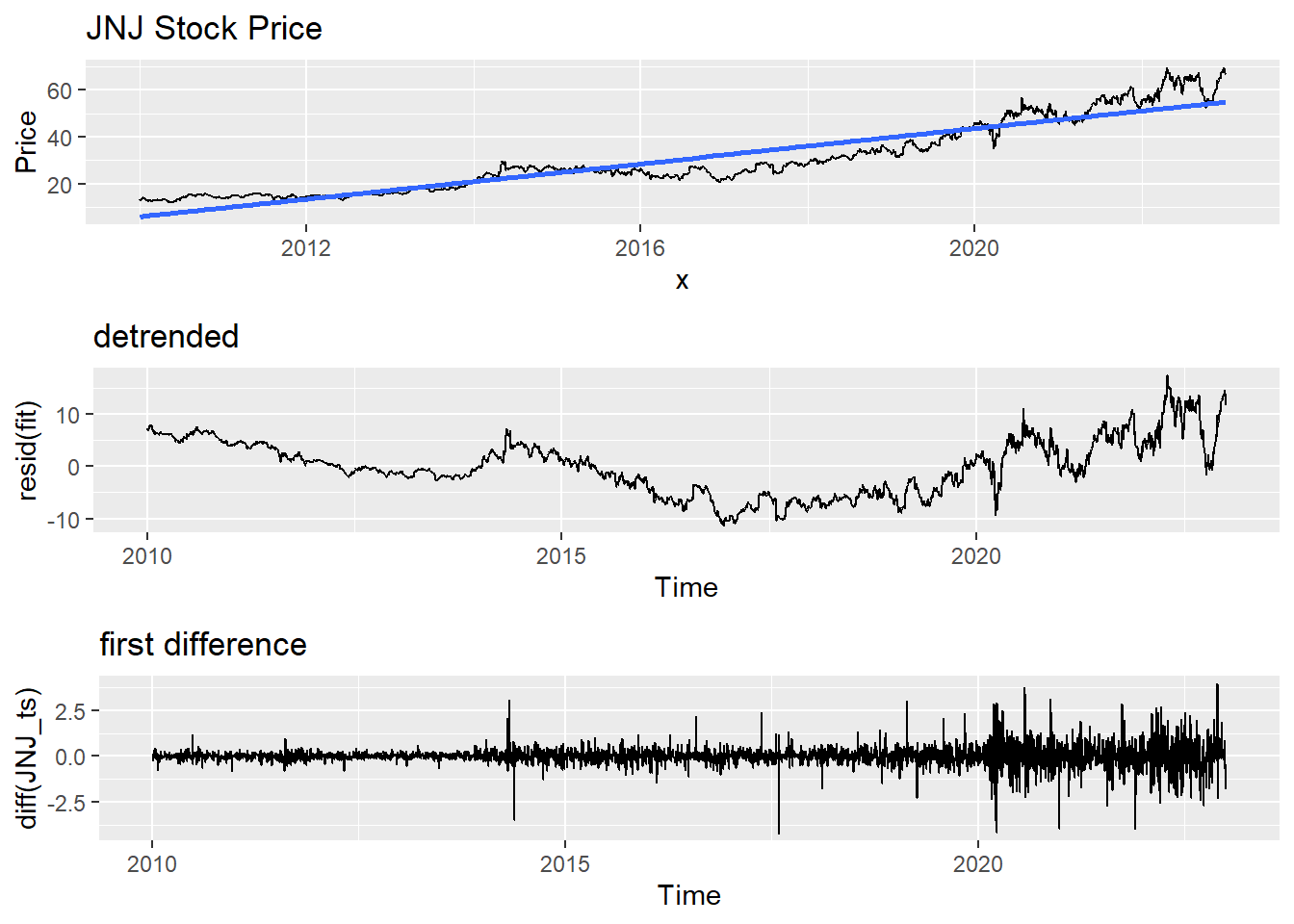

alternative hypothesis: stationaryDetrending

Show the code

fit = lm(JNJ_ts~time(JNJ_ts), na.action=NULL)

y= JNJ_ts

x=time(JNJ_ts)

DD<-data.frame(x,y)

ggp <- ggplot(DD, aes(x, y)) +

geom_line()

ggp <- ggp +

stat_smooth(method = "lm",

formula = y ~ x,

geom = "smooth") +ggtitle("JNJ Stock Price")+ylab("Price")

plot1<-autoplot(resid(fit), main="detrended")

plot2<-autoplot(diff(JNJ_ts), main="first difference")

grid.arrange(ggp, plot1, plot2,nrow=3)Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

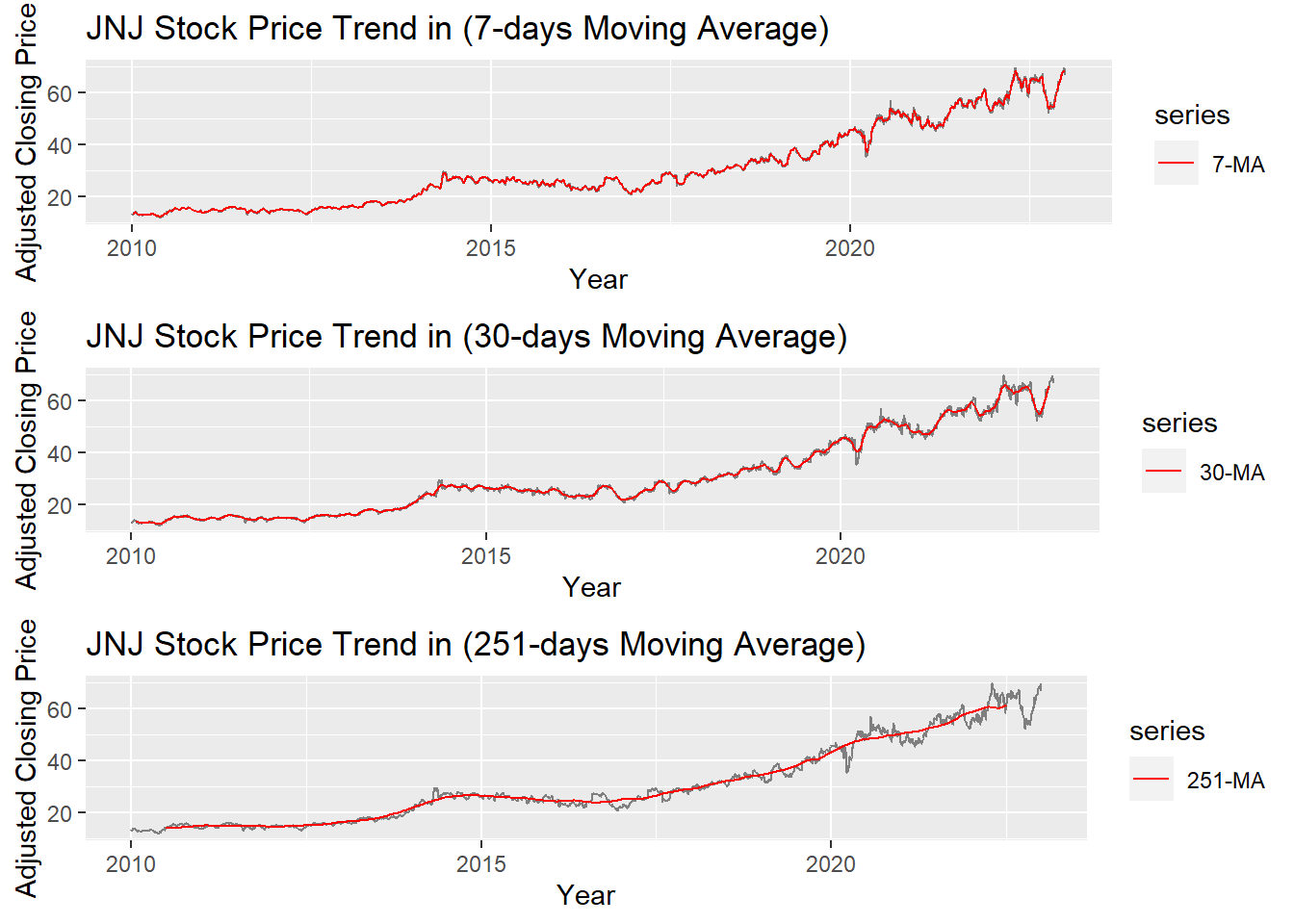

Moving Average Smoothing

Smoothing methods are a family of forecasting methods that average values over multiple periods in order to reduce the noise and uncover patterns in the data. It is useful as a data preparation technique as it can reduce the random variation in the observations and better expose the structure of the underlying causal processes. We call this an m-MA, meaning a moving average of order m.

Show the code

MA_7 <- autoplot(JNJ_ts, series="Data") +

autolayer(ma(JNJ_ts,7), series="7-MA") +

xlab("Year") + ylab("Adjusted Closing Price") +

ggtitle("JNJ Stock Price Trend in (7-days Moving Average)") +

scale_colour_manual(values=c("JNJ_ts"="grey50","7-MA"="red"),

breaks=c("JNJ_ts","7-MA"))

MA_30 <- autoplot(JNJ_ts, series="Data") +

autolayer(ma(JNJ_ts,30), series="30-MA") +

xlab("Year") + ylab("Adjusted Closing Price") +

ggtitle("JNJ Stock Price Trend in (30-days Moving Average)") +

scale_colour_manual(values=c("JNJ_ts"="grey50","30-MA"="red"),

breaks=c("JNJ_ts","30-MA"))

MA_251 <- autoplot(JNJ_ts, series="Data") +

autolayer(ma(JNJ_ts,251), series="251-MA") +

xlab("Year") + ylab("Adjusted Closing Price") +

ggtitle("JNJ Stock Price Trend in (251-days Moving Average)") +

scale_colour_manual(values=c("JNJ_ts"="grey50","251-MA"="red"),

breaks=c("JNJ_ts","251-MA"))

grid.arrange(MA_7, MA_30, MA_251, ncol=1)

The graph above shows the moving average of 7 days, 30 days and 251 days. 251 days was choose because there are around 251 days of stock price data per year. According to the plots, it can be observed that When MA is very large(MA=251), some parts of smoothing line(red) do not fit the real stock price line. While When MA is small(MA=7), the smoothing line(red) fits the real price line. MA-30 greatly fits the real price line. Therefore, MA-30 might be a good parameter for smoothing.