Financial Time Series Models: CVS Example

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. It is often measured as either the standard deviation or variance between returns from the same security or market index.

At this section, I am going to fit financial time series models on CVS stock price.

Show the code

getSymbols("CVS", from="2010-1-1", src="yahoo")

CVS_df <- as.data.frame(CVS)

CVS_df$Date <- rownames(CVS_df)

CVS_df <- CVS_df[c('Date','CVS.Adjusted')]

CVS_df <- CVS_df %>%

mutate(Date = as.Date(Date)) %>%

complete(Date = seq.Date(min(Date), max(Date), by="day"))

# fill missing values in stock

CVS_df <- CVS_df %>% fill(CVS.Adjusted)

#new_dates <- seq(as.Date('2020-12-16'), as.Date('2023-3-21'),'week')

#CVS_df <- CVS_df[which((CVS_df$Date) %in% new_dates),]

CVS_ts <- ts(CVS_df$CVS.Adjusted, start = c(2010,1),

frequency = 365)Show the code

p<-CVS_df %>%

ggplot()+

geom_line(aes(y=CVS.Adjusted,x=Date),color="blue")

ggplotly(p)CVS Health Corporation is a healthcare company that operates a chain of pharmacies and retail clinics. The stock symbol for CVS is “CVS” and it is traded on the New York Stock Exchange (NYSE).

The stock price of CVS has shown a general trend of rising over the span of last 13 years. Since 2010, the stock price of CVS has been stably increased, with a few notable fluctuations. The price started the decade at around $30 per share and rose steadily to reach a peak of around $113 per share in July 2015. After that, the stock price went through a period of volatility and declined to around $60 per share in November 2016. Since then, the stock has been recovering and currently trading around $80 per share.

The COVID-19 pandemic has had a significant impact on the global economy and financial markets, including the stock price of CVS. As a healthcare company, CVS has been directly impacted by the pandemic, as demand for its pharmacy services and retail products has increased during this period. Like many other stocks, CVS experienced a decline in its stock price in March 2020, when the pandemic began to spread rapidly across the United States. The stock price fell from around $70 in February 2020 to around $50 in March 2020, as investors reacted to the uncertainty and potential economic impact of the pandemic. Despite the initial decline, the stock price of CVS recovered quickly and has been relatively resilient during the pandemic. This is likely due to the essential nature of CVS’s services, as well as the company’s strong financial position and diversified business model. During the pandemic, CVS has continued to grow and expand its business, including through acquisitions and partnerships. For example, CVS announced a partnership with Walgreens and federal and state governments to provide COVID-19 vaccines to long-term care facilities, which has helped to boost the company’s profile and reputation.

Calculaing Returns

Fit an appropriate AR+ARCH/ARMA+GARCH or ARIMA-ARCH/GARCH for the returns data.

Show the code

#### calculating Returns

returns = log(CVS_ts) %>% diff()

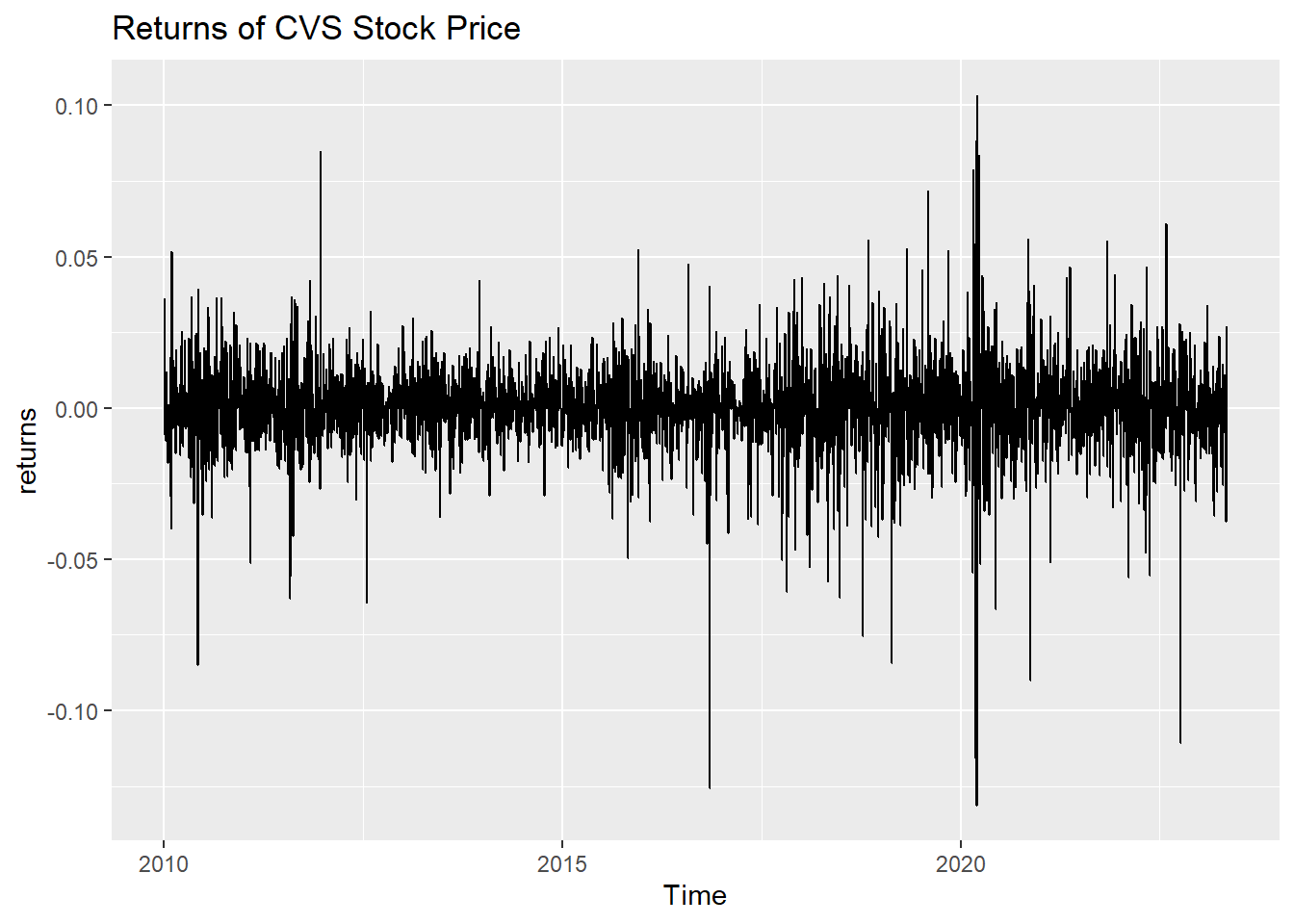

autoplot(returns) +ggtitle("Returns of CVS Stock Price")

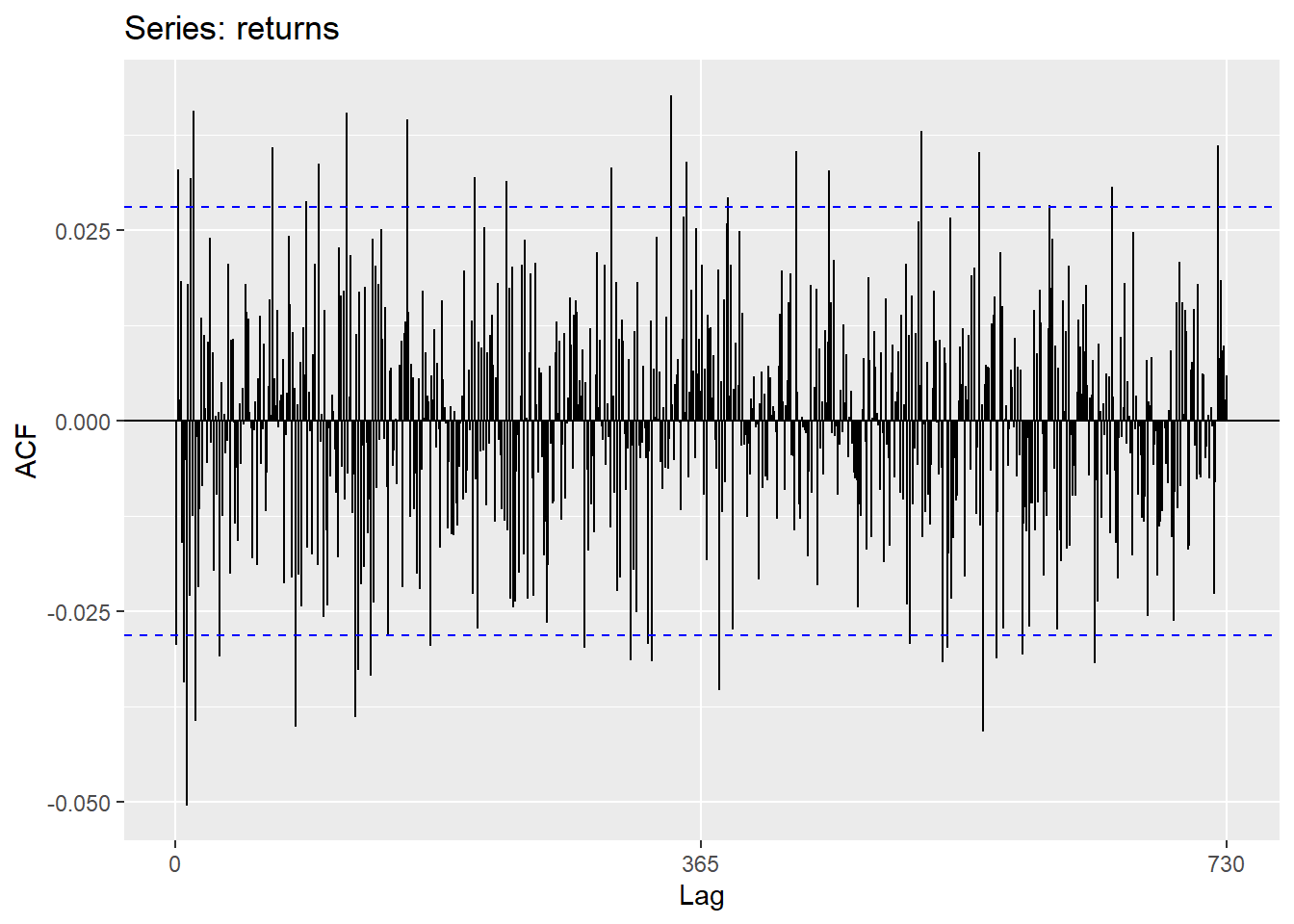

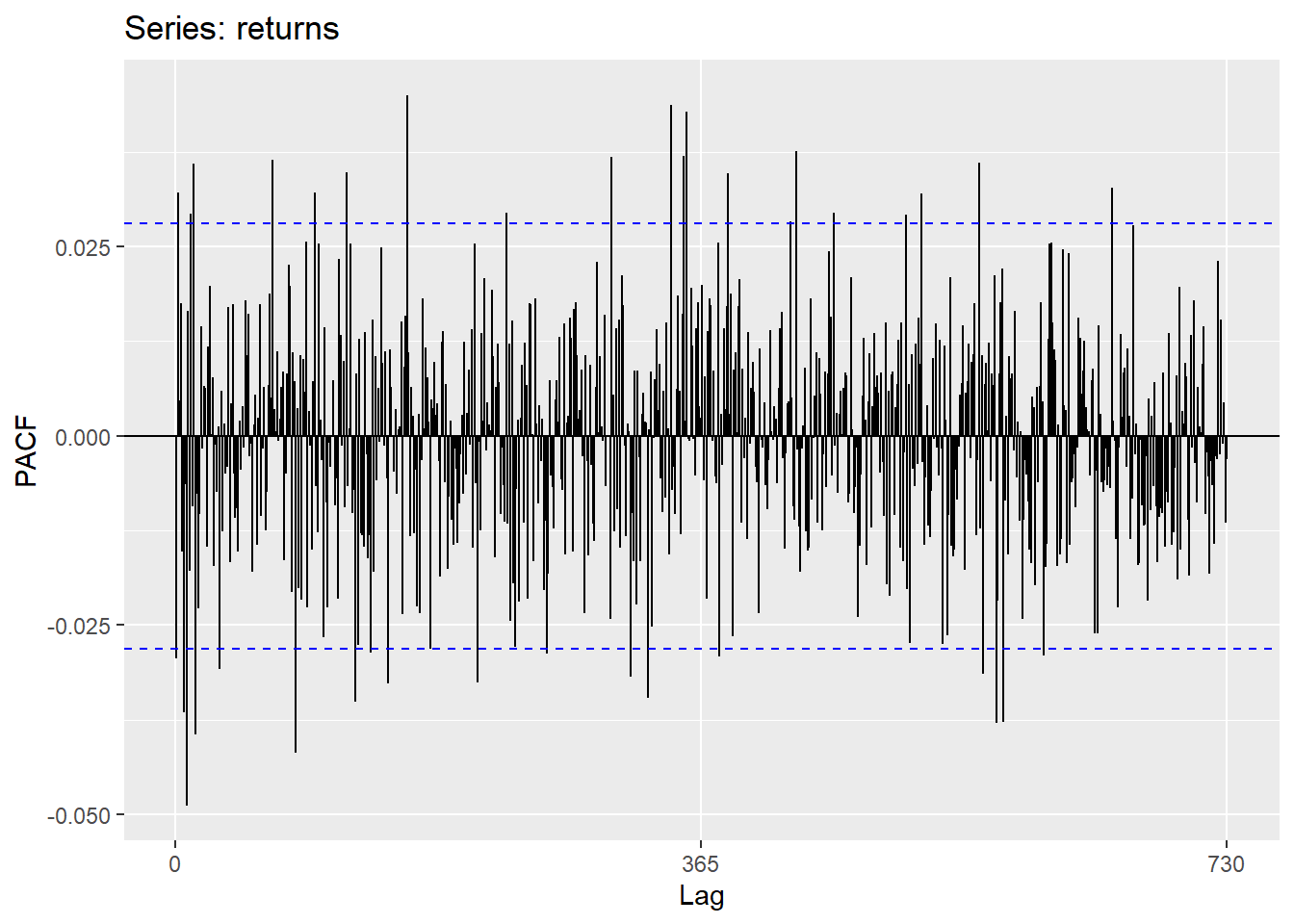

ACF, PACF plots of the returns

Show the code

ggAcf(returns)

Show the code

ggPacf(returns)

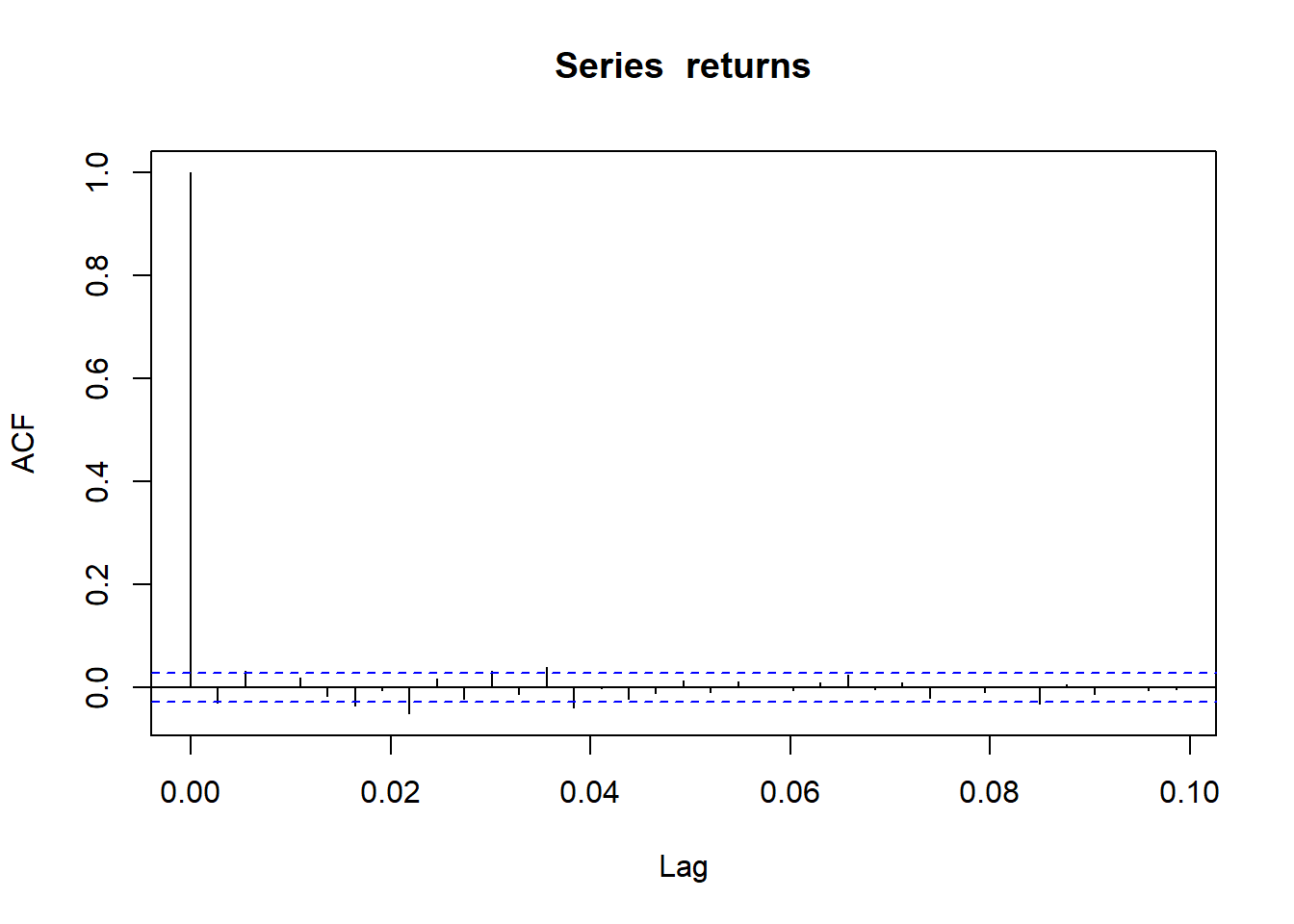

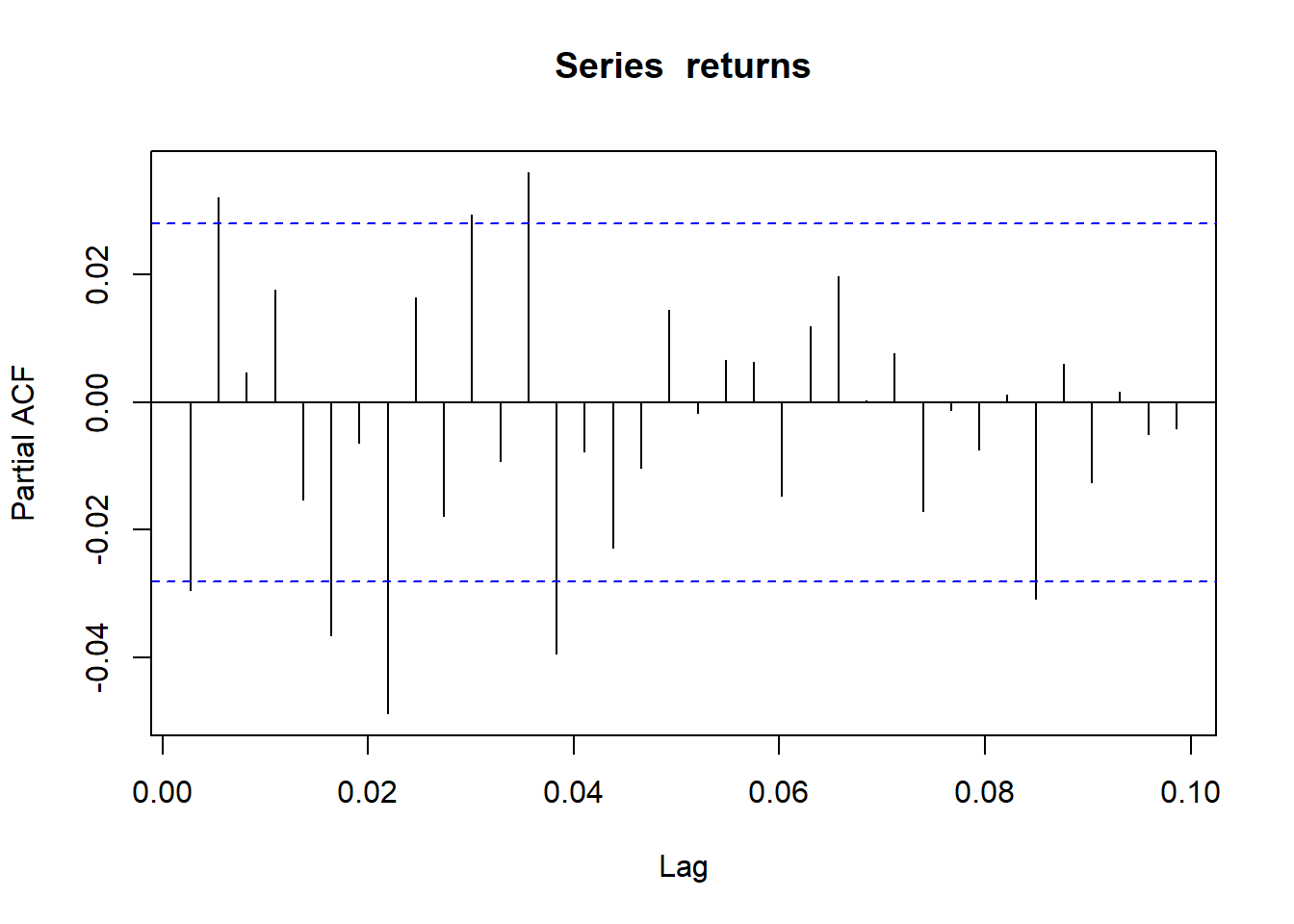

These plots here shows a closer look of ACF and PACF plots, which are weakly stationary.

Show the code

## have a closer look

acf(returns)

Show the code

pacf(returns)

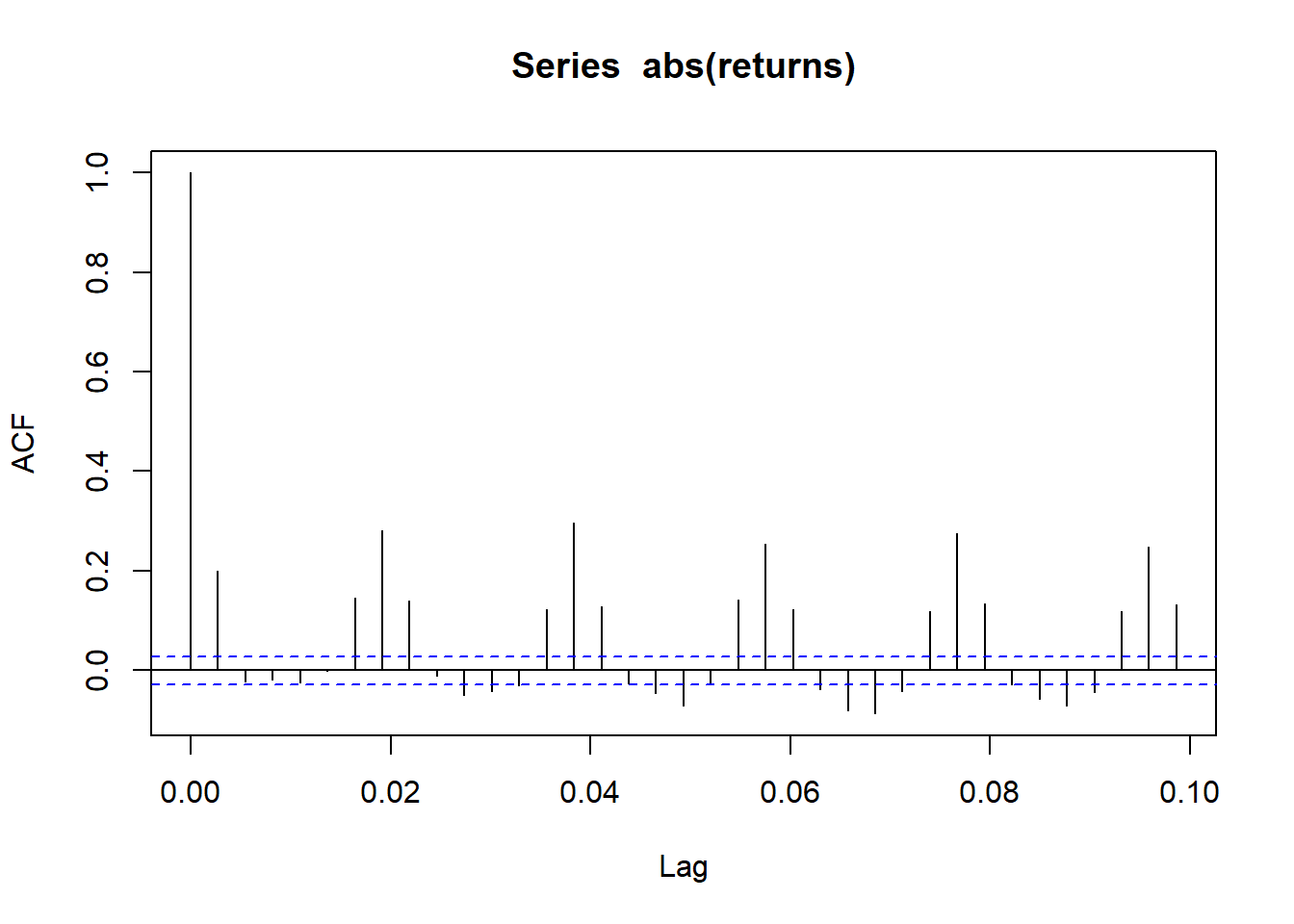

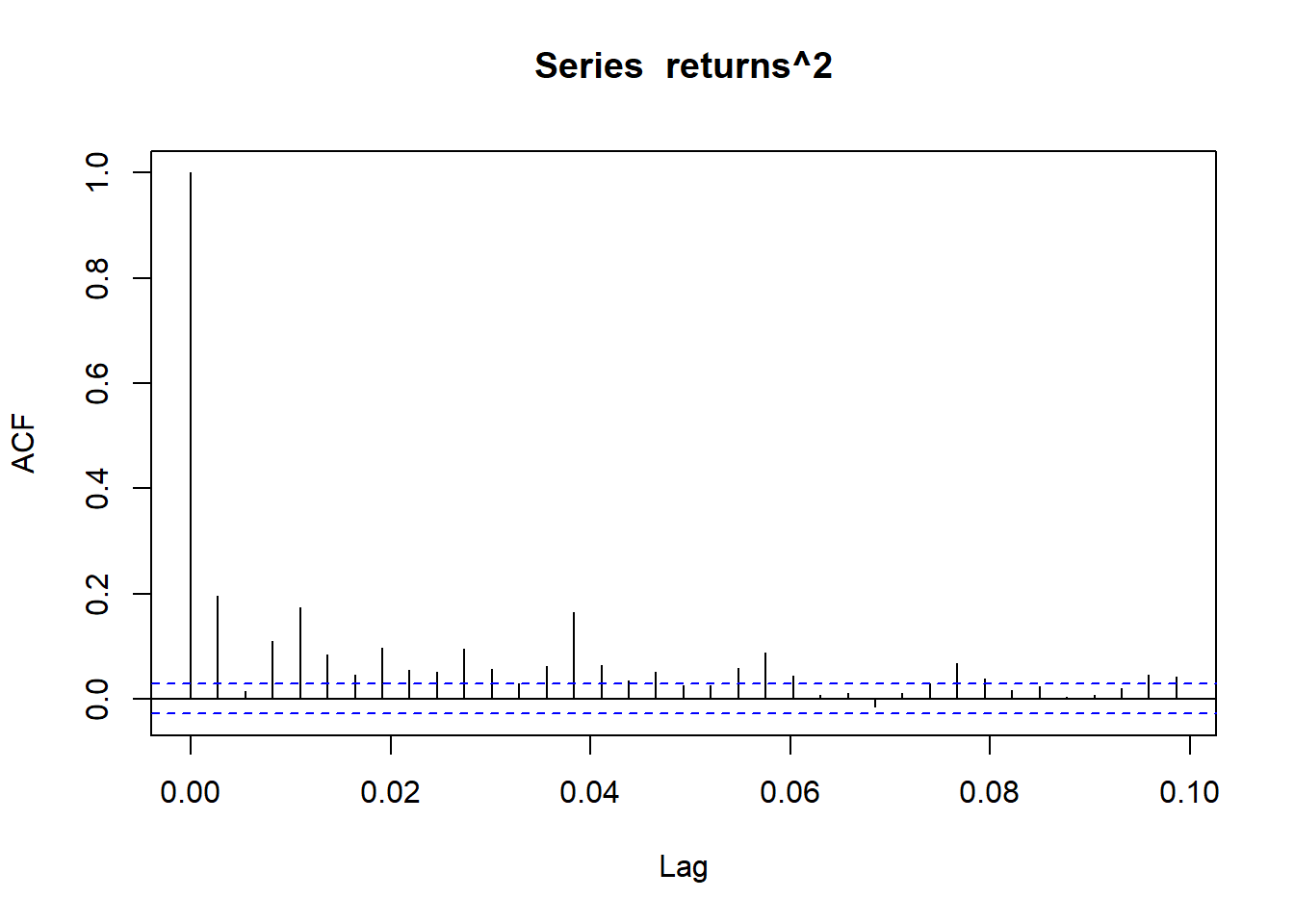

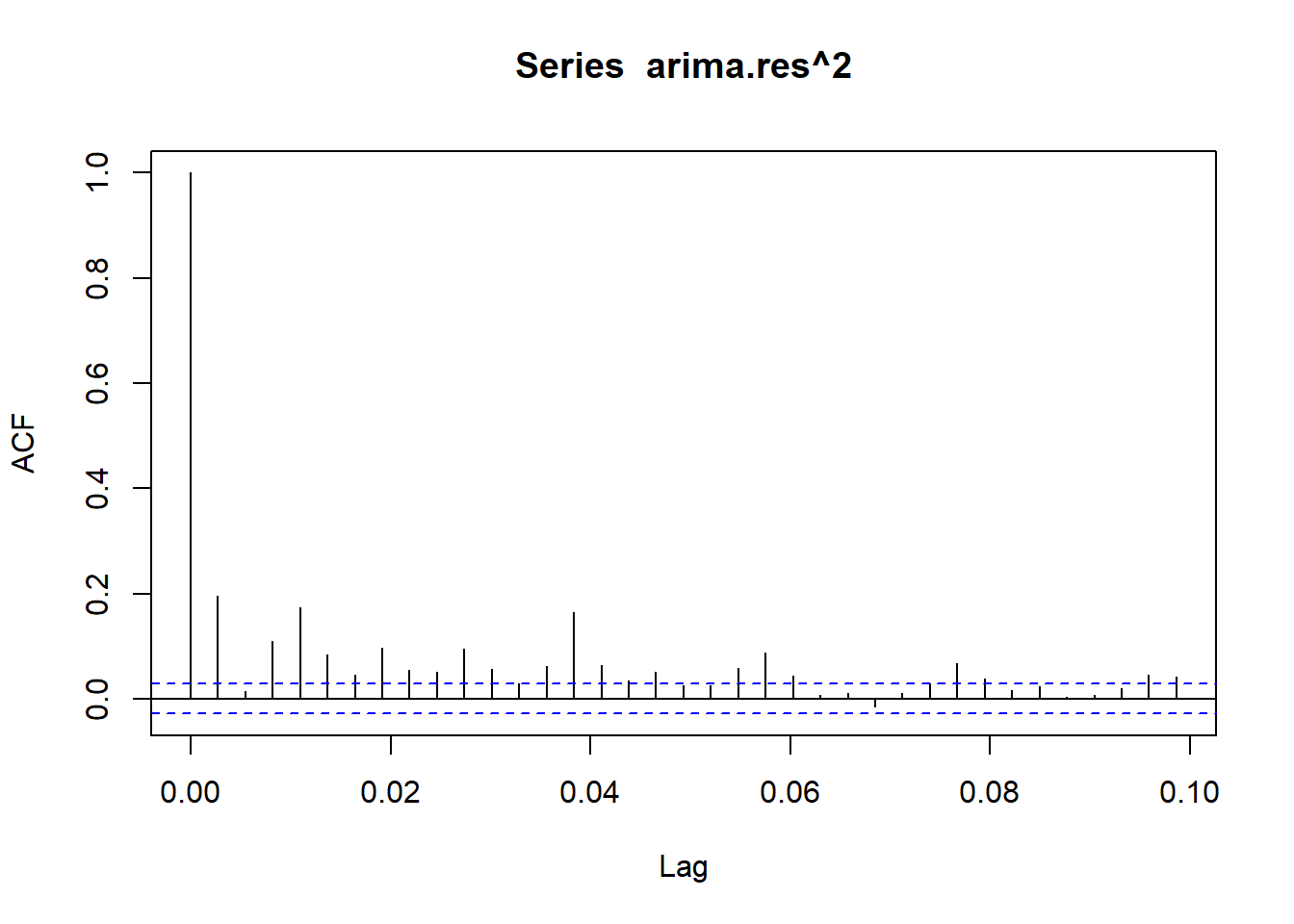

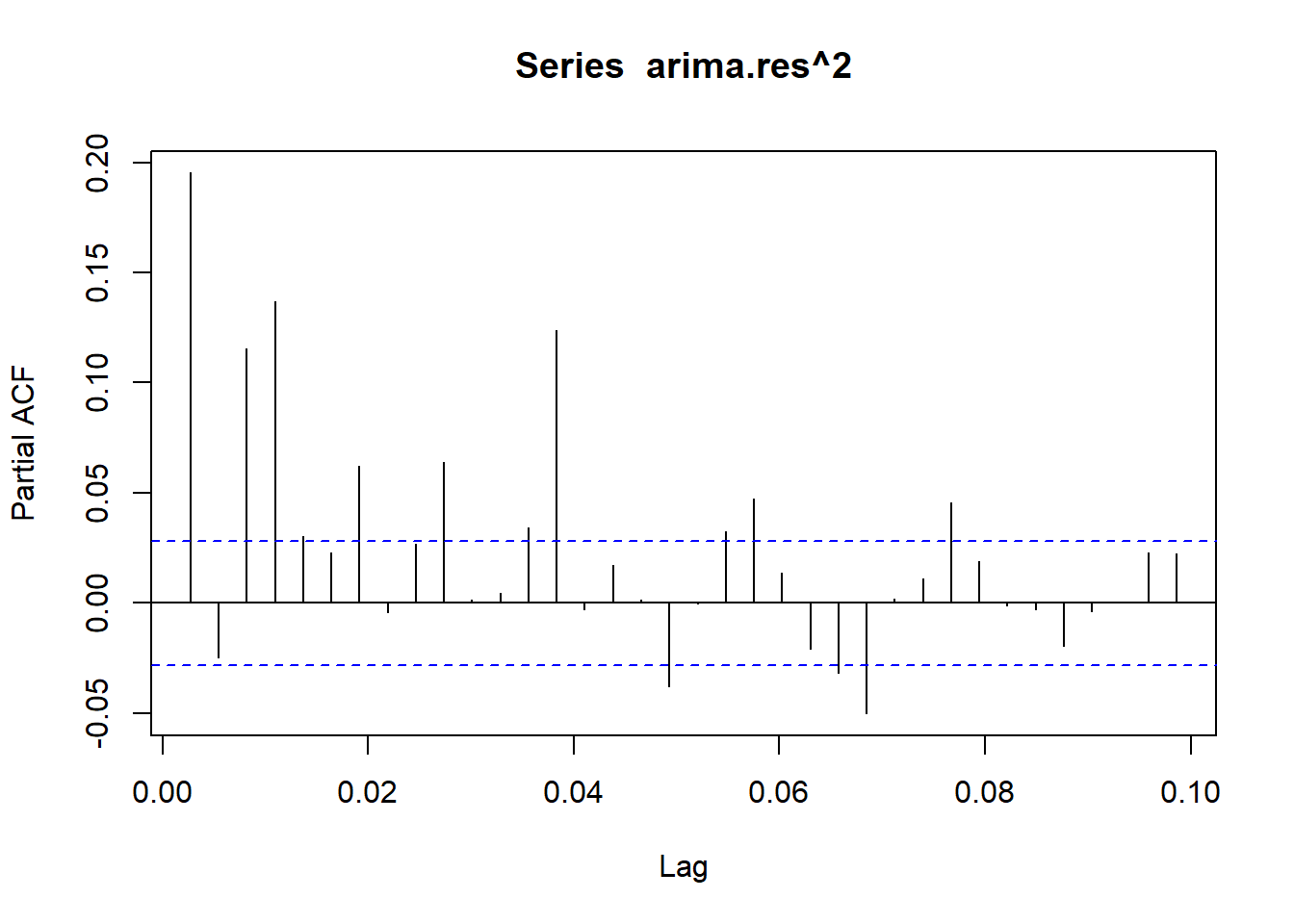

Let’s look at the ACF of absolute values of the returns and squared values. We can see clear correlation in both plots. This correlation is comming from the correlation in conditional variation.

Show the code

acf(abs(returns))

Show the code

acf(returns^2)

Model Fitting Method

There are two ways we can think of fitting the models. First is that we fit the ARIMA model first and fit a GARCH model for the residual. Second method will be fitting a GARRCH model for the squared returns directly.

Model Fitting Method 1: GARCH(p,q) model fittin

ArchTest

Show the code

library(FinTS)

Attaching package: 'FinTS'The following object is masked from 'package:forecast':

AcfShow the code

ArchTest(returns, lags=1, demean=TRUE)

ARCH LM-test; Null hypothesis: no ARCH effects

data: returns

Chi-squared = 185.64, df = 1, p-value < 2.2e-16Because the p-value is < 0.05, we reject the null hypothesis and conclude the presence of ARCH(1) effects.

Fitting an ARIMA model

Let’s fit the ARIMA model first.

Show the code

ARIMA.c=function(p1,p2,q1,q2,data){

temp=c()

d=1

i=1

temp= data.frame()

ls=matrix(rep(NA,6*50),nrow=50)

for (p in p1:p2)#

{

for(q in q1:q2)#

{

for(d in 0:2)#

{

if(p+d+q<=6)

{

model<- Arima(data,order=c(p,d,q))

ls[i,]= c(p,d,q,model$aic,model$bic,model$aicc)

i=i+1

}

}

}

}

temp= as.data.frame(ls)

names(temp)= c("p","d","q","AIC","BIC","AICc")

temp

}Show the code

#na.omit(log(bts)))

output <- ARIMA.c(0,2,0,2,data=log(CVS_ts))

output p d q AIC BIC AICc

1 0 0 0 5188.446 5201.428 5188.449

2 0 1 0 -28803.633 -28797.142 -28803.632

3 0 2 0 -25285.070 -25278.580 -25285.069

4 0 0 1 -1368.727 -1349.255 -1368.722

5 0 1 1 -28805.510 -28792.528 -28805.507

6 0 2 1 -28787.667 -28774.686 -28787.665

7 0 0 2 -6872.140 -6846.177 -6872.132

8 0 1 2 -28808.808 -28789.336 -28808.803

9 0 2 2 -28789.562 -28770.090 -28789.557

10 1 0 0 -28798.783 -28779.311 -28798.778

11 1 1 0 -28805.766 -28792.784 -28805.763

12 1 2 0 -26889.073 -26876.092 -26889.070

13 1 0 1 -28800.561 -28774.598 -28800.553

14 1 1 1 -28807.187 -28787.715 -28807.182

15 1 2 1 -28789.827 -28770.356 -28789.822

16 1 0 2 -28803.967 -28771.513 -28803.955

17 1 1 2 -28806.786 -28780.823 -28806.778

18 1 2 2 -28785.523 -28759.561 -28785.514

19 2 0 0 -28800.794 -28774.831 -28800.786

20 2 1 0 -28808.910 -28789.438 -28808.905

21 2 2 0 -27443.617 -27424.146 -27443.612

22 2 0 1 -28802.321 -28769.867 -28802.308

23 2 1 1 -28806.931 -28780.969 -28806.923

24 2 2 1 -28792.937 -28766.976 -28792.929

25 2 0 2 -28796.612 -28757.666 -28796.594

26 2 1 2 -28804.961 -28772.508 -28804.949

27 2 2 2 -28787.125 -28754.673 -28787.113

28 NA NA NA NA NA NA

29 NA NA NA NA NA NA

30 NA NA NA NA NA NA

31 NA NA NA NA NA NA

32 NA NA NA NA NA NA

33 NA NA NA NA NA NA

34 NA NA NA NA NA NA

35 NA NA NA NA NA NA

36 NA NA NA NA NA NA

37 NA NA NA NA NA NA

38 NA NA NA NA NA NA

39 NA NA NA NA NA NA

40 NA NA NA NA NA NA

41 NA NA NA NA NA NA

42 NA NA NA NA NA NA

43 NA NA NA NA NA NA

44 NA NA NA NA NA NA

45 NA NA NA NA NA NA

46 NA NA NA NA NA NA

47 NA NA NA NA NA NA

48 NA NA NA NA NA NA

49 NA NA NA NA NA NA

50 NA NA NA NA NA NAShow the code

output[which.min(output$AIC),] p d q AIC BIC AICc

20 2 1 0 -28808.91 -28789.44 -28808.91Show the code

output[which.min(output$BIC),] p d q AIC BIC AICc

2 0 1 0 -28803.63 -28797.14 -28803.63Show the code

output[which.min(output$AICc),] p d q AIC BIC AICc

20 2 1 0 -28808.91 -28789.44 -28808.91Show the code

auto.arima(log(CVS_ts))Series: log(CVS_ts)

ARIMA(3,1,0)

Coefficients:

ar1 ar2 ar3

-0.0284 0.0327 0.0050

s.e. 0.0143 0.0143 0.0144

sigma^2 = 0.0001576: log likelihood = 14407.52

AIC=-28807.03 AICc=-28807.02 BIC=-28781.07Show the code

data=log(CVS_ts)

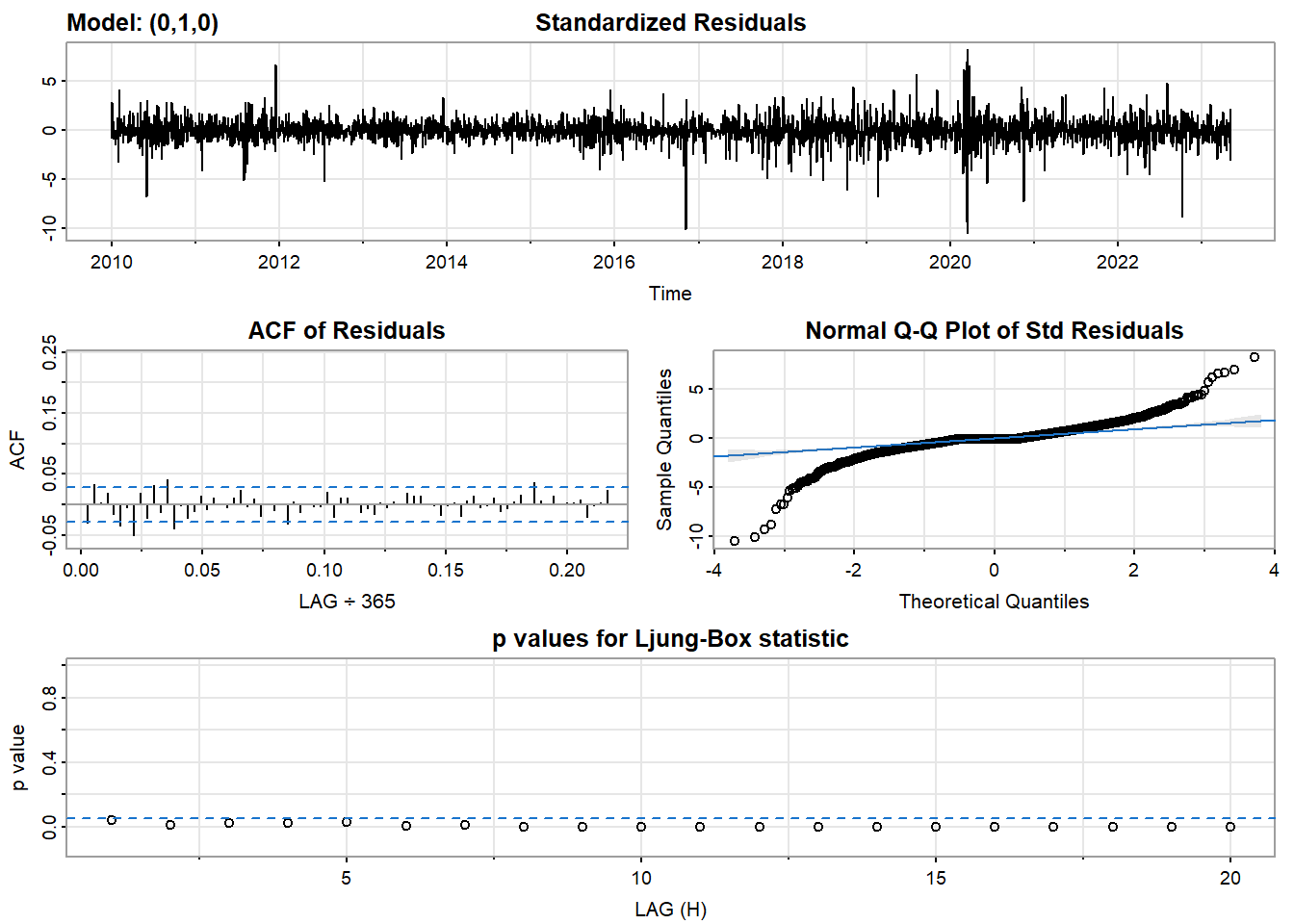

sarima(data, 0,1,0) #has lower BICinitial value -4.377149

iter 1 value -4.377149

final value -4.377149

converged

initial value -4.377149

iter 1 value -4.377149

final value -4.377149

converged

$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

constant

2e-04

s.e. 2e-04

sigma^2 estimated as 0.0001578: log likelihood = 14403.53, aic = -28803.05

$degrees_of_freedom

[1] 4868

$ttable

Estimate SE t.value p.value

constant 2e-04 2e-04 1.1879 0.2349

$AIC

[1] -5.915599

$AICc

[1] -5.915599

$BIC

[1] -5.912933I’m going to choose ARIMA(0,1,0) because it has the lowest BIC and the hole model diagnostics are the same.

Fit the GARCH model

First fit the ARIMA model and fitting a GARCH model to the residuals of the ARIMA model.

Show the code

arima.fit<-Arima(data,order=c(0,1,0),include.drift = TRUE)

arima.res<-arima.fit$residuals

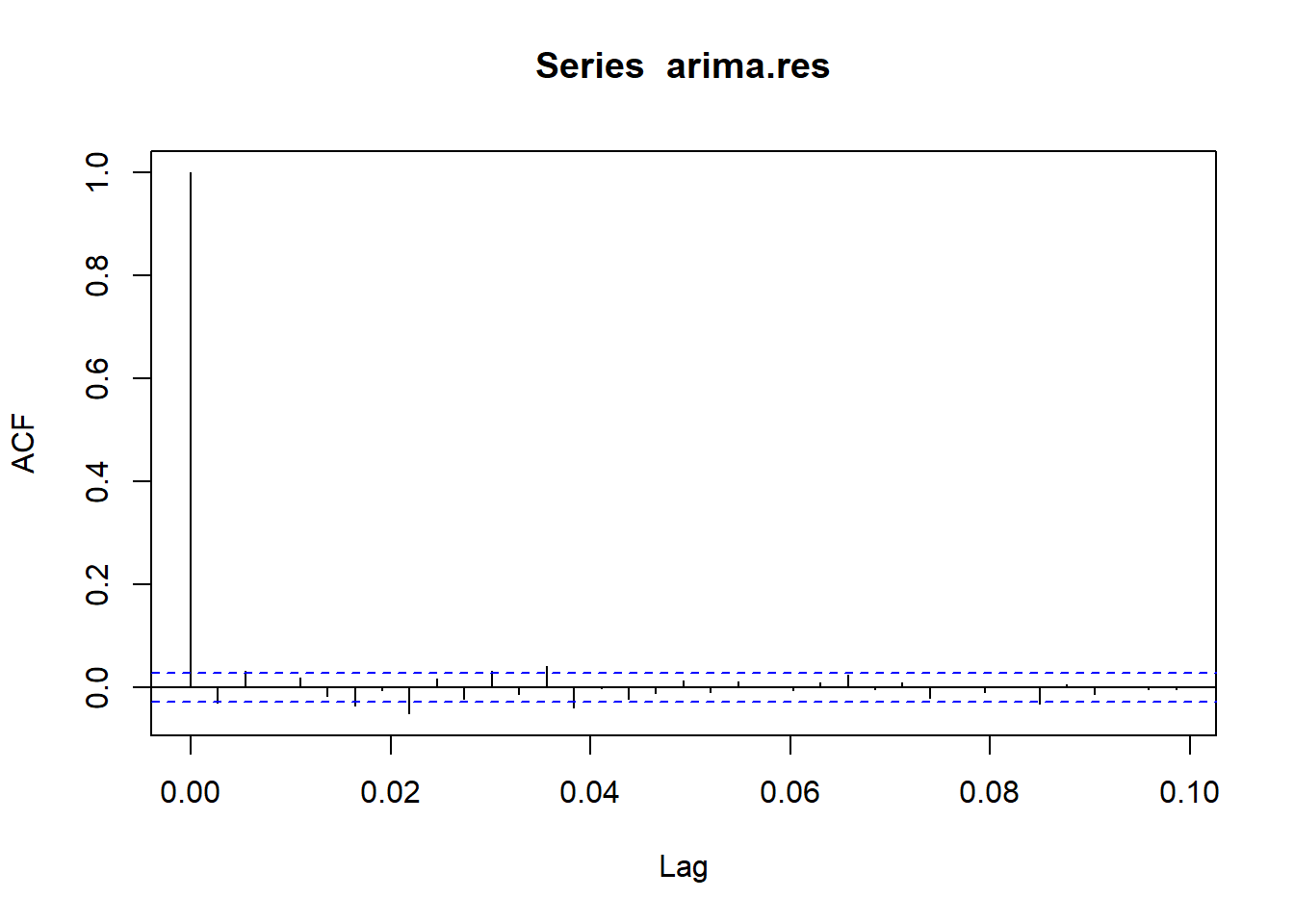

acf(arima.res)

Show the code

acf(arima.res^2) #clear correlation 1,3,4,5,6,7

Show the code

pacf(arima.res^2) #1,3,4,7

Show the code

model <- list() ## set counter

cc <- 1

for (p in 1:7) {

for (q in 1:7) {

model[[cc]] <- garch(arima.res,order=c(q,p),trace=F)

cc <- cc + 1

}

}

## get AIC values for model evaluation

GARCH_AIC <- sapply(model, AIC) ## model with lowest AIC is the best

which(GARCH_AIC == min(GARCH_AIC))[1] 7Show the code

model[[which(GARCH_AIC == min(GARCH_AIC))]]

Call:

garch(x = arima.res, order = c(q, p), trace = F)

Coefficient(s):

a0 a1 b1 b2 b3 b4 b5

9.954e-06 1.886e-01 1.034e-08 7.187e-02 5.132e-03 7.429e-02 1.092e-01

b6 b7

2.588e-01 2.296e-01 Show the code

summary(garchFit(~garch(1,3), arima.res,trace = F))

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 3), data = arima.res, trace = F)

Mean and Variance Equation:

data ~ garch(1, 3)

<environment: 0x000001953db8c950>

[data = arima.res]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1 beta2 beta3

6.5984e-06 7.7096e-06 1.1708e-01 1.0000e-08 6.0691e-01 2.3160e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 6.598e-06 1.553e-04 0.042 0.96612

omega 7.710e-06 2.105e-06 3.663 0.00025 ***

alpha1 1.171e-01 2.496e-02 4.690 2.73e-06 ***

beta1 1.000e-08 2.671e-01 0.000 1.00000

beta2 6.069e-01 8.319e-02 7.296 2.97e-13 ***

beta3 2.316e-01 1.851e-01 1.251 0.21076

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14765.65 normalized: 3.031961

Description:

Sat May 6 19:21:46 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 13768.98 0

Shapiro-Wilk Test R W 0.8849537 0

Ljung-Box Test R Q(10) 16.40464 0.08862022

Ljung-Box Test R Q(15) 21.02519 0.1360265

Ljung-Box Test R Q(20) 24.48768 0.2217382

Ljung-Box Test R^2 Q(10) 12.52544 0.251428

Ljung-Box Test R^2 Q(15) 23.88171 0.0671297

Ljung-Box Test R^2 Q(20) 37.28578 0.01081188

LM Arch Test R TR^2 13.95831 0.3033781

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.061457 -6.053460 -6.061460 -6.058651 beta 3 is not significant. So I’m going to try GARCH(1,1) and GARCH(1,2).

Show the code

summary(garchFit(~garch(1,2), arima.res,trace = F))

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 2), data = arima.res, trace = F)

Mean and Variance Equation:

data ~ garch(1, 2)

<environment: 0x000001953da0c198>

[data = arima.res]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1 beta2

6.5984e-06 6.6528e-06 9.7007e-02 1.5783e-01 7.0639e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 6.598e-06 1.563e-04 0.042 0.966

omega 6.653e-06 1.450e-06 4.588 4.48e-06 ***

alpha1 9.701e-02 1.186e-02 8.183 2.22e-16 ***

beta1 1.578e-01 3.856e-02 4.092 4.27e-05 ***

beta2 7.064e-01 3.909e-02 18.073 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14757.81 normalized: 3.03035

Description:

Sat May 6 19:21:48 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 13277.74 0

Shapiro-Wilk Test R W 0.885234 0

Ljung-Box Test R Q(10) 16.12467 0.0961187

Ljung-Box Test R Q(15) 20.97592 0.1376006

Ljung-Box Test R Q(20) 24.21644 0.2330654

Ljung-Box Test R^2 Q(10) 13.41383 0.2014453

Ljung-Box Test R^2 Q(15) 24.89258 0.05140473

Ljung-Box Test R^2 Q(20) 38.30603 0.00812319

LM Arch Test R TR^2 14.54909 0.2670261

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.058647 -6.051983 -6.058649 -6.056308 Show the code

summary(garchFit(~garch(1,1), arima.res,trace = F))

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 1), data = arima.res, trace = F)

Mean and Variance Equation:

data ~ garch(1, 1)

<environment: 0x000001953bee5b98>

[data = arima.res]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1

6.5984e-06 3.2972e-06 5.0081e-02 9.3069e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 6.598e-06 1.578e-04 0.042 0.967

omega 3.297e-06 7.454e-07 4.423 9.72e-06 ***

alpha1 5.008e-02 6.617e-03 7.569 3.77e-14 ***

beta1 9.307e-01 9.836e-03 94.616 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14736.05 normalized: 3.025883

Description:

Sat May 6 19:21:49 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 15641.72 0

Shapiro-Wilk Test R W 0.8830468 0

Ljung-Box Test R Q(10) 15.06102 0.1298529

Ljung-Box Test R Q(15) 19.81811 0.1790219

Ljung-Box Test R Q(20) 23.49551 0.2651236

Ljung-Box Test R^2 Q(10) 14.27008 0.1610251

Ljung-Box Test R^2 Q(15) 24.61863 0.05530551

Ljung-Box Test R^2 Q(20) 35.98932 0.01542563

LM Arch Test R TR^2 16.29535 0.1780798

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.050124 -6.044793 -6.050125 -6.048253 Since all the models has similar AIC ,BIC values, I would go with GARCH(1,1) which all the coefficients are significant.

Final Model

Show the code

summary(arima.fit<-Arima(data,order=c(0,1,0),include.drift = TRUE))Series: data

ARIMA(0,1,0) with drift

Coefficients:

drift

2e-04

s.e. 2e-04

sigma^2 = 0.0001578: log likelihood = 14403.53

AIC=-28803.05 AICc=-28803.05 BIC=-28790.07

Training set error measures:

ME RMSE MAE MPE MAPE

Training set 6.598419e-07 0.01255991 0.007331295 -0.0001026668 0.1847525

MASE ACF1

Training set 0.03791226 -0.0294275Show the code

summary(final.fit <- garchFit(~garch(1,1), arima.res,trace = F))

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 1), data = arima.res, trace = F)

Mean and Variance Equation:

data ~ garch(1, 1)

<environment: 0x000001953d506130>

[data = arima.res]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1

6.5984e-06 3.2972e-06 5.0081e-02 9.3069e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 6.598e-06 1.578e-04 0.042 0.967

omega 3.297e-06 7.454e-07 4.423 9.72e-06 ***

alpha1 5.008e-02 6.617e-03 7.569 3.77e-14 ***

beta1 9.307e-01 9.836e-03 94.616 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14736.05 normalized: 3.025883

Description:

Sat May 6 19:21:51 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 15641.72 0

Shapiro-Wilk Test R W 0.8830468 0

Ljung-Box Test R Q(10) 15.06102 0.1298529

Ljung-Box Test R Q(15) 19.81811 0.1790219

Ljung-Box Test R Q(20) 23.49551 0.2651236

Ljung-Box Test R^2 Q(10) 14.27008 0.1610251

Ljung-Box Test R^2 Q(15) 24.61863 0.05530551

Ljung-Box Test R^2 Q(20) 35.98932 0.01542563

LM Arch Test R TR^2 16.29535 0.1780798

Information Criterion Statistics:

AIC BIC SIC HQIC

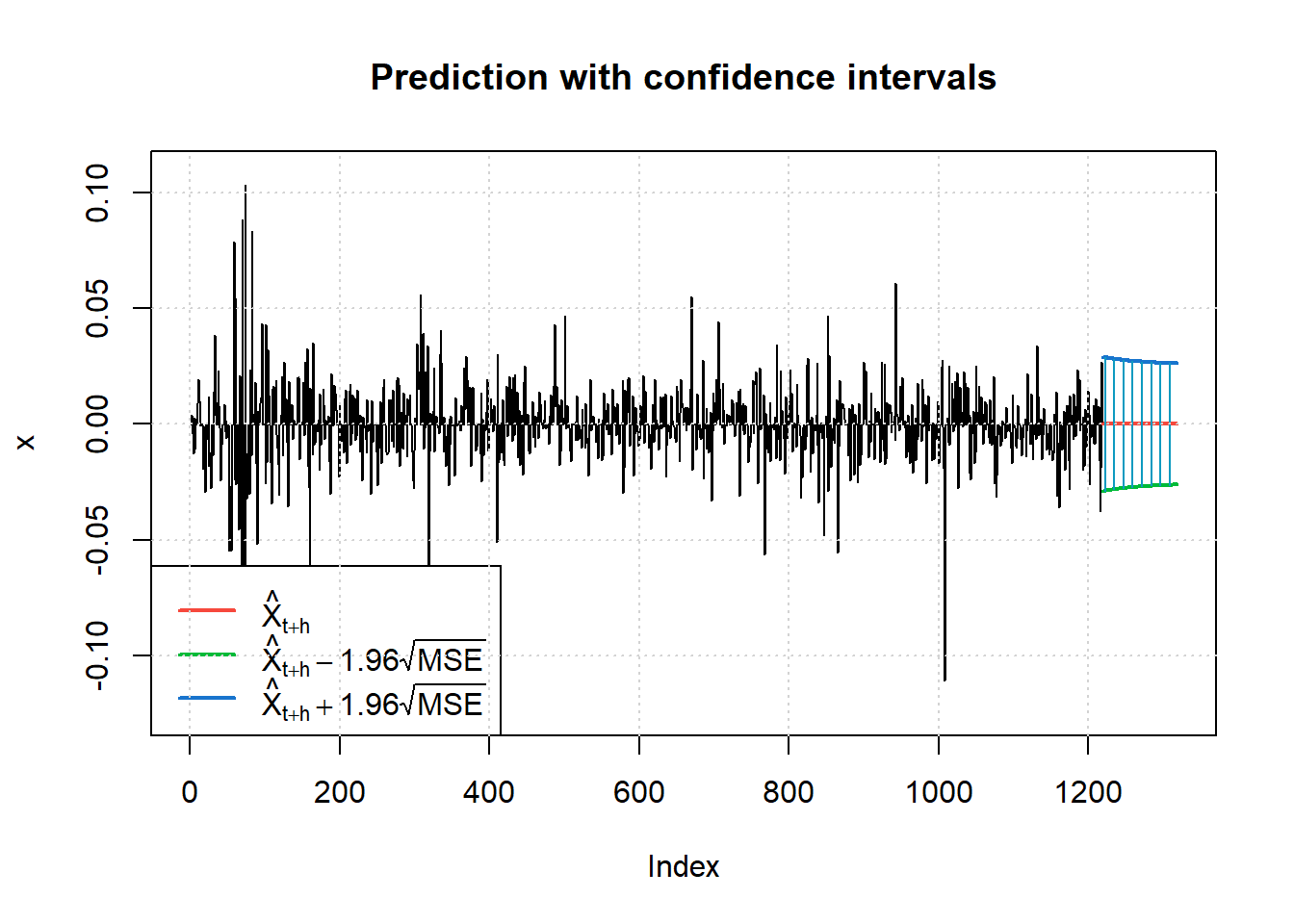

-6.050124 -6.044793 -6.050125 -6.048253 Forecast

Show the code

predict(final.fit, n.ahead = 100, plot=TRUE)

meanForecast meanError standardDeviation lowerInterval upperInterval

1 6.598419e-06 0.01476927 0.01476927 -0.02894064 0.02895384

2 6.598419e-06 0.01473888 0.01473888 -0.02888108 0.02889428

3 6.598419e-06 0.01470902 0.01470902 -0.02882255 0.02883574

4 6.598419e-06 0.01467967 0.01467967 -0.02876502 0.02877822

5 6.598419e-06 0.01465083 0.01465083 -0.02870849 0.02872169

6 6.598419e-06 0.01462248 0.01462248 -0.02865294 0.02866614

7 6.598419e-06 0.01459463 0.01459463 -0.02859835 0.02861155

8 6.598419e-06 0.01456726 0.01456726 -0.02854471 0.02855791

9 6.598419e-06 0.01454037 0.01454037 -0.02849200 0.02850520

10 6.598419e-06 0.01451395 0.01451395 -0.02844022 0.02845341

11 6.598419e-06 0.01448799 0.01448799 -0.02838933 0.02840253

12 6.598419e-06 0.01446248 0.01446248 -0.02833934 0.02835253

13 6.598419e-06 0.01443742 0.01443742 -0.02829022 0.02830342

14 6.598419e-06 0.01441279 0.01441279 -0.02824196 0.02825516

15 6.598419e-06 0.01438861 0.01438861 -0.02819455 0.02820775

16 6.598419e-06 0.01436484 0.01436484 -0.02814797 0.02816117

17 6.598419e-06 0.01434150 0.01434150 -0.02810222 0.02811541

18 6.598419e-06 0.01431856 0.01431856 -0.02805727 0.02807047

19 6.598419e-06 0.01429603 0.01429603 -0.02801312 0.02802631

20 6.598419e-06 0.01427391 0.01427391 -0.02796974 0.02798294

21 6.598419e-06 0.01425217 0.01425217 -0.02792714 0.02794033

22 6.598419e-06 0.01423082 0.01423082 -0.02788529 0.02789849

23 6.598419e-06 0.01420984 0.01420984 -0.02784418 0.02785738

24 6.598419e-06 0.01418924 0.01418924 -0.02780381 0.02781701

25 6.598419e-06 0.01416901 0.01416901 -0.02776416 0.02777735

26 6.598419e-06 0.01414914 0.01414914 -0.02772521 0.02773840

27 6.598419e-06 0.01412962 0.01412962 -0.02768696 0.02770015

28 6.598419e-06 0.01411046 0.01411046 -0.02764939 0.02766259

29 6.598419e-06 0.01409163 0.01409163 -0.02761249 0.02762569

30 6.598419e-06 0.01407315 0.01407315 -0.02757626 0.02758946

31 6.598419e-06 0.01405499 0.01405499 -0.02754068 0.02755387

32 6.598419e-06 0.01403716 0.01403716 -0.02750573 0.02751893

33 6.598419e-06 0.01401965 0.01401965 -0.02747142 0.02748462

34 6.598419e-06 0.01400246 0.01400246 -0.02743772 0.02745092

35 6.598419e-06 0.01398558 0.01398558 -0.02740463 0.02741783

36 6.598419e-06 0.01396900 0.01396900 -0.02737214 0.02738534

37 6.598419e-06 0.01395272 0.01395272 -0.02734024 0.02735343

38 6.598419e-06 0.01393674 0.01393674 -0.02730891 0.02732210

39 6.598419e-06 0.01392104 0.01392104 -0.02727815 0.02729134

40 6.598419e-06 0.01390563 0.01390563 -0.02724794 0.02726114

41 6.598419e-06 0.01389050 0.01389050 -0.02721829 0.02723149

42 6.598419e-06 0.01387565 0.01387565 -0.02718917 0.02720237

43 6.598419e-06 0.01386106 0.01386106 -0.02716059 0.02717379

44 6.598419e-06 0.01384675 0.01384675 -0.02713252 0.02714572

45 6.598419e-06 0.01383269 0.01383269 -0.02710497 0.02711817

46 6.598419e-06 0.01381888 0.01381888 -0.02707792 0.02709111

47 6.598419e-06 0.01380533 0.01380533 -0.02705136 0.02706456

48 6.598419e-06 0.01379203 0.01379203 -0.02702529 0.02703848

49 6.598419e-06 0.01377897 0.01377897 -0.02699969 0.02701289

50 6.598419e-06 0.01376615 0.01376615 -0.02697456 0.02698776

51 6.598419e-06 0.01375357 0.01375357 -0.02694990 0.02696309

52 6.598419e-06 0.01374121 0.01374121 -0.02692568 0.02693888

53 6.598419e-06 0.01372908 0.01372908 -0.02690191 0.02691511

54 6.598419e-06 0.01371718 0.01371718 -0.02687858 0.02689177

55 6.598419e-06 0.01370549 0.01370549 -0.02685567 0.02686887

56 6.598419e-06 0.01369402 0.01369402 -0.02683319 0.02684639

57 6.598419e-06 0.01368276 0.01368276 -0.02681112 0.02682432

58 6.598419e-06 0.01367171 0.01367171 -0.02678946 0.02680265

59 6.598419e-06 0.01366086 0.01366086 -0.02676819 0.02678139

60 6.598419e-06 0.01365021 0.01365021 -0.02674732 0.02676052

61 6.598419e-06 0.01363976 0.01363976 -0.02672684 0.02674003

62 6.598419e-06 0.01362950 0.01362950 -0.02670673 0.02671993

63 6.598419e-06 0.01361943 0.01361943 -0.02668700 0.02670019

64 6.598419e-06 0.01360955 0.01360955 -0.02666763 0.02668082

65 6.598419e-06 0.01359985 0.01359985 -0.02664862 0.02666181

66 6.598419e-06 0.01359033 0.01359033 -0.02662996 0.02664315

67 6.598419e-06 0.01358099 0.01358099 -0.02661164 0.02662484

68 6.598419e-06 0.01357182 0.01357182 -0.02659367 0.02660687

69 6.598419e-06 0.01356282 0.01356282 -0.02657603 0.02658923

70 6.598419e-06 0.01355398 0.01355398 -0.02655872 0.02657192

71 6.598419e-06 0.01354532 0.01354532 -0.02654173 0.02655493

72 6.598419e-06 0.01353681 0.01353681 -0.02652506 0.02653826

73 6.598419e-06 0.01352846 0.01352846 -0.02650870 0.02652189

74 6.598419e-06 0.01352027 0.01352027 -0.02649264 0.02650583

75 6.598419e-06 0.01351223 0.01351223 -0.02647688 0.02649008

76 6.598419e-06 0.01350434 0.01350434 -0.02646141 0.02647461

77 6.598419e-06 0.01349659 0.01349659 -0.02644624 0.02645943

78 6.598419e-06 0.01348899 0.01348899 -0.02643135 0.02644454

79 6.598419e-06 0.01348154 0.01348154 -0.02641673 0.02642993

80 6.598419e-06 0.01347422 0.01347422 -0.02640239 0.02641559

81 6.598419e-06 0.01346704 0.01346704 -0.02638831 0.02640151

82 6.598419e-06 0.01345999 0.01345999 -0.02637450 0.02638770

83 6.598419e-06 0.01345308 0.01345308 -0.02636095 0.02637415

84 6.598419e-06 0.01344629 0.01344629 -0.02634765 0.02636085

85 6.598419e-06 0.01343964 0.01343964 -0.02633461 0.02634780

86 6.598419e-06 0.01343310 0.01343310 -0.02632180 0.02633500

87 6.598419e-06 0.01342669 0.01342669 -0.02630924 0.02632243

88 6.598419e-06 0.01342040 0.01342040 -0.02629691 0.02631011

89 6.598419e-06 0.01341423 0.01341423 -0.02628481 0.02629801

90 6.598419e-06 0.01340818 0.01340818 -0.02627294 0.02628614

91 6.598419e-06 0.01340223 0.01340223 -0.02626130 0.02627449

92 6.598419e-06 0.01339640 0.01339640 -0.02624987 0.02626306

93 6.598419e-06 0.01339068 0.01339068 -0.02623866 0.02625185

94 6.598419e-06 0.01338507 0.01338507 -0.02622765 0.02624085

95 6.598419e-06 0.01337956 0.01337956 -0.02621686 0.02623006

96 6.598419e-06 0.01337416 0.01337416 -0.02620627 0.02621946

97 6.598419e-06 0.01336885 0.01336885 -0.02619587 0.02620907

98 6.598419e-06 0.01336365 0.01336365 -0.02618568 0.02619887

99 6.598419e-06 0.01335855 0.01335855 -0.02617567 0.02618887

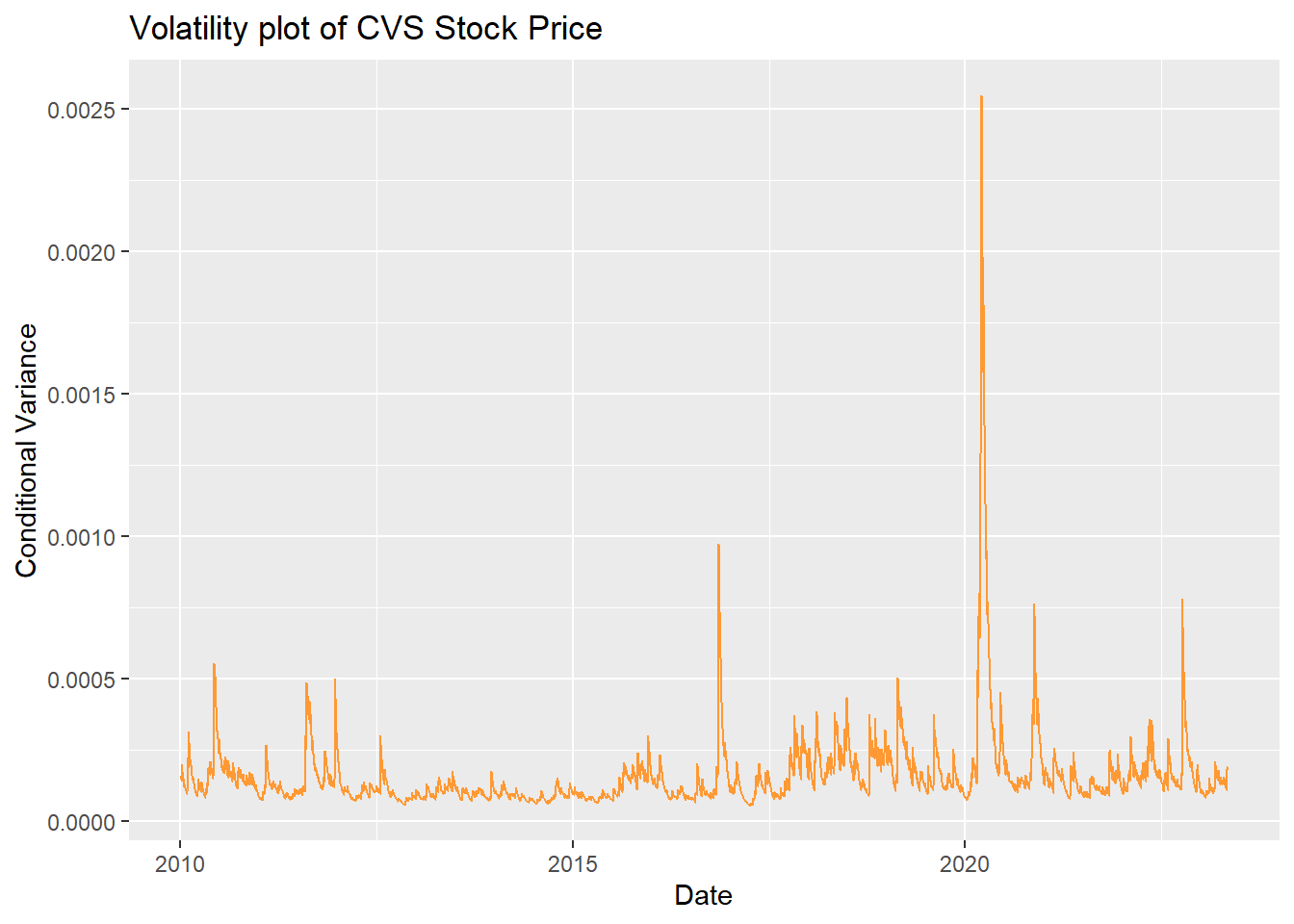

100 6.598419e-06 0.01335354 0.01335354 -0.02616586 0.02617905Volatality plot

Show the code

ht <- final.fit@h.t

data= data.frame(ht,CVS_df$Date)

ggplot(data, aes(y = ht, x = CVS_df$Date)) + geom_line(col = '#ff9933') + ylab('Conditional Variance') + xlab('Date')+ggtitle("Volatility plot of CVS Stock Price")

There’s obvious volatality 2016 that’s when U.S. presidential election and potential changes to healthcare policy, then even more volatality in 2020 because of COVID.

Model Fitting Method 2: GARCH(p,q) model fitting

Here is going to fit a GARCH model directly.

Show the code

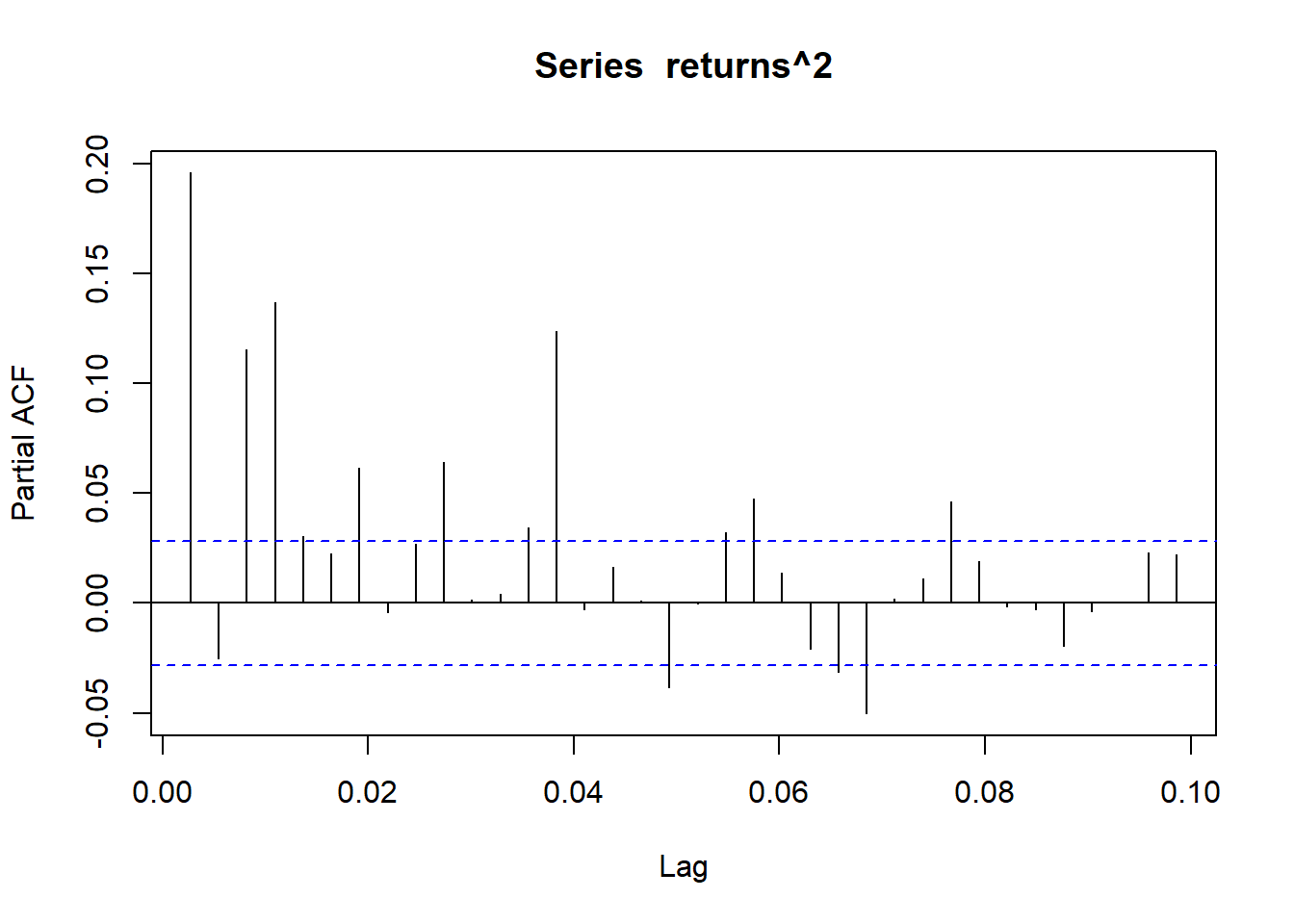

pacf(returns^2) #p=1,3,4

Show the code

model <- list() ## set counter

cc <- 1

for (p in 1:7) {

for (q in 1:7) {

model[[cc]] <- garch(returns,order=c(q,p),trace=F)

cc <- cc + 1

}

}

## get AIC values for model evaluation

GARCH_AIC <- sapply(model, AIC) ## model with lowest AIC is the best

which(GARCH_AIC == min(GARCH_AIC))[1] 7Show the code

model[[which(GARCH_AIC == min(GARCH_AIC))]]

Call:

garch(x = returns, order = c(q, p), trace = F)

Coefficient(s):

a0 a1 b1 b2 b3 b4 b5

9.365e-06 1.889e-01 3.534e-03 7.306e-02 1.971e-09 7.335e-02 1.122e-01

b6 b7

2.612e-01 2.304e-01 Show the code

summary(garchFit(~garch(1,3), returns,trace = F))

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 3), data = returns, trace = F)

Mean and Variance Equation:

data ~ garch(1, 3)

<environment: 0x000001953daa83a8>

[data = returns]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1 beta2 beta3

3.5413e-04 7.7412e-06 1.1746e-01 1.0000e-08 6.0492e-01 2.3303e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 3.541e-04 1.554e-04 2.279 0.022696 *

omega 7.741e-06 2.103e-06 3.681 0.000232 ***

alpha1 1.175e-01 2.465e-02 4.765 1.89e-06 ***

beta1 1.000e-08 2.635e-01 0.000 1.000000

beta2 6.049e-01 8.425e-02 7.180 6.97e-13 ***

beta3 2.330e-01 1.812e-01 1.286 0.198408

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14762.73 normalized: 3.031983

Description:

Sat May 6 19:21:54 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 13757.84 0

Shapiro-Wilk Test R W 0.8853728 0

Ljung-Box Test R Q(10) 16.46796 0.08699736

Ljung-Box Test R Q(15) 21.05861 0.1349671

Ljung-Box Test R Q(20) 24.53261 0.2199005

Ljung-Box Test R^2 Q(10) 12.43878 0.2567628

Ljung-Box Test R^2 Q(15) 23.71456 0.07010195

Ljung-Box Test R^2 Q(20) 37.0202 0.01163694

LM Arch Test R TR^2 13.88701 0.3079816

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.061502 -6.053504 -6.061505 -6.058695 Beta 3 is not significant. So I’m going to try GARCH(1,1), GARCH(2,2), GARCH(1,2) and GARCH(2,1)

Show the code

summary(garchFit(~garch(1,1), returns,trace = F)) #all significant

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 1), data = returns, trace = F)

Mean and Variance Equation:

data ~ garch(1, 1)

<environment: 0x000001953e0d4e60>

[data = returns]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1

3.5116e-04 3.2985e-06 5.0176e-02 9.3060e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 3.512e-04 1.577e-04 2.226 0.026 *

omega 3.298e-06 7.474e-07 4.413 1.02e-05 ***

alpha1 5.018e-02 6.646e-03 7.550 4.37e-14 ***

beta1 9.306e-01 9.880e-03 94.191 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14733.01 normalized: 3.02588

Description:

Sat May 6 19:21:55 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 15608.8 0

Shapiro-Wilk Test R W 0.8834462 0

Ljung-Box Test R Q(10) 15.12868 0.1274403

Ljung-Box Test R Q(15) 19.86589 0.1771381

Ljung-Box Test R Q(20) 23.54299 0.2629252

Ljung-Box Test R^2 Q(10) 14.20457 0.1638634

Ljung-Box Test R^2 Q(15) 24.50026 0.05707071

Ljung-Box Test R^2 Q(20) 35.79802 0.0162434

LM Arch Test R TR^2 16.24371 0.1803268

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.050116 -6.044784 -6.050118 -6.048245 Show the code

summary(garchFit(~garch(1,2), returns,trace = F)) #all significant

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 2), data = returns, trace = F)

Mean and Variance Equation:

data ~ garch(1, 2)

<environment: 0x000001953f631e88>

[data = returns]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1 beta2

3.4949e-04 6.6517e-06 9.7054e-02 1.5883e-01 7.0537e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 3.495e-04 1.562e-04 2.237 0.0253 *

omega 6.652e-06 1.451e-06 4.583 4.58e-06 ***

alpha1 9.705e-02 1.189e-02 8.165 2.22e-16 ***

beta1 1.588e-01 3.879e-02 4.094 4.24e-05 ***

beta2 7.054e-01 3.928e-02 17.955 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14754.64 normalized: 3.030323

Description:

Sat May 6 19:21:56 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 13263.95 0

Shapiro-Wilk Test R W 0.885622 0

Ljung-Box Test R Q(10) 16.18024 0.09458772

Ljung-Box Test R Q(15) 21.00404 0.1367002

Ljung-Box Test R Q(20) 24.2514 0.2315831

Ljung-Box Test R^2 Q(10) 13.31937 0.2063598

Ljung-Box Test R^2 Q(15) 24.71042 0.05397016

Ljung-Box Test R^2 Q(20) 38.0359 0.008766562

LM Arch Test R TR^2 14.46658 0.2719102

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.058593 -6.051928 -6.058595 -6.056254 Show the code

garch.fit1 <- garchFit(~garch(1,1), data = returns, trace = F)

summary(garch.fit1)

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 1), data = returns, trace = F)

Mean and Variance Equation:

data ~ garch(1, 1)

<environment: 0x000001953e153bc0>

[data = returns]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1

3.5116e-04 3.2985e-06 5.0176e-02 9.3060e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 3.512e-04 1.577e-04 2.226 0.026 *

omega 3.298e-06 7.474e-07 4.413 1.02e-05 ***

alpha1 5.018e-02 6.646e-03 7.550 4.37e-14 ***

beta1 9.306e-01 9.880e-03 94.191 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

14733.01 normalized: 3.02588

Description:

Sat May 6 19:21:56 2023 by user: yujia

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 15608.8 0

Shapiro-Wilk Test R W 0.8834462 0

Ljung-Box Test R Q(10) 15.12868 0.1274403

Ljung-Box Test R Q(15) 19.86589 0.1771381

Ljung-Box Test R Q(20) 23.54299 0.2629252

Ljung-Box Test R^2 Q(10) 14.20457 0.1638634

Ljung-Box Test R^2 Q(15) 24.50026 0.05707071

Ljung-Box Test R^2 Q(20) 35.79802 0.0162434

LM Arch Test R TR^2 16.24371 0.1803268

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.050116 -6.044784 -6.050118 -6.048245 Show the code

garch.fit11<- garch(returns,order=c(1,1),trace=F)

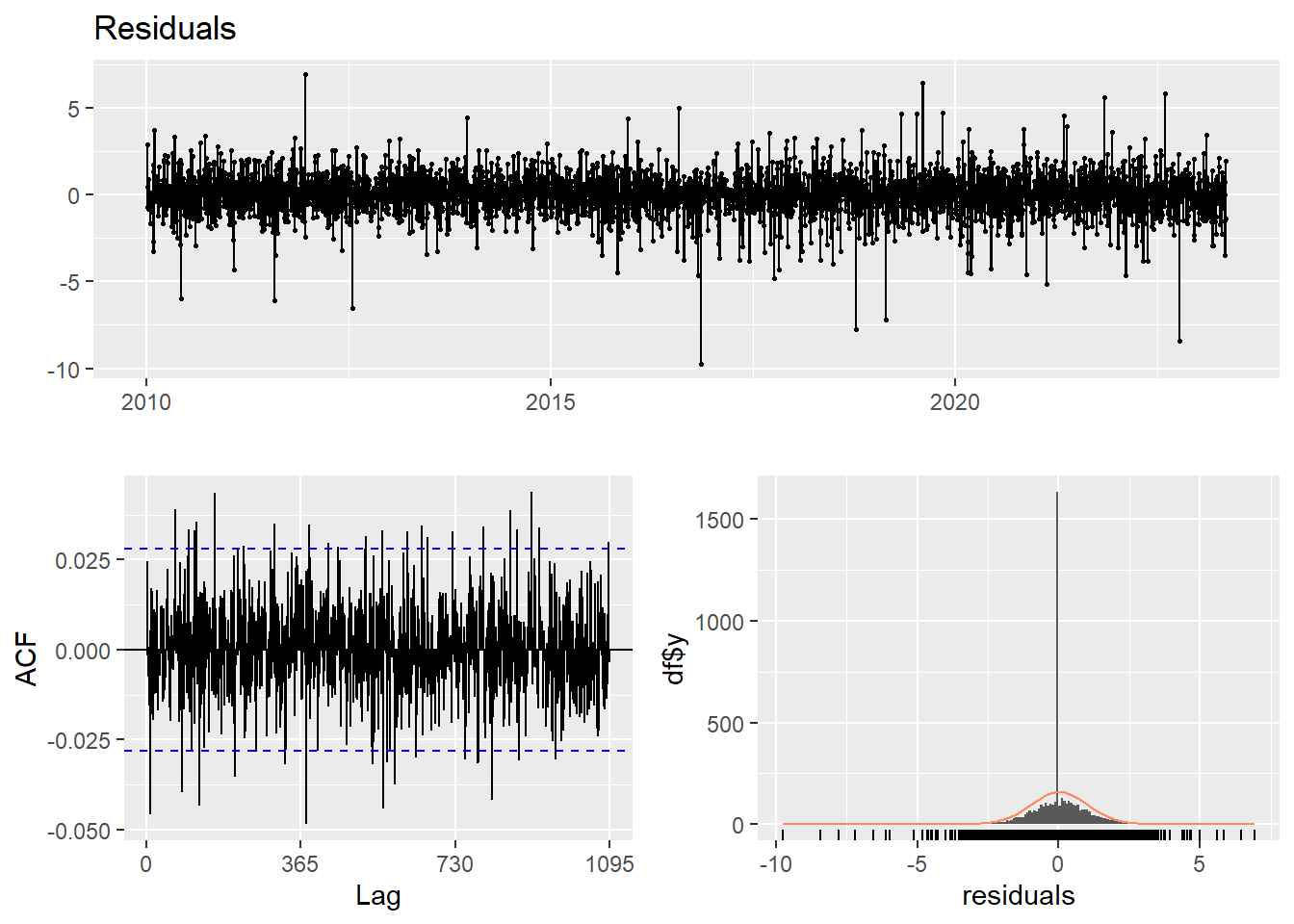

checkresiduals(garch.fit11)Warning in modeldf.default(object): Could not find appropriate degrees of

freedom for this model.

There’s still correlation left.

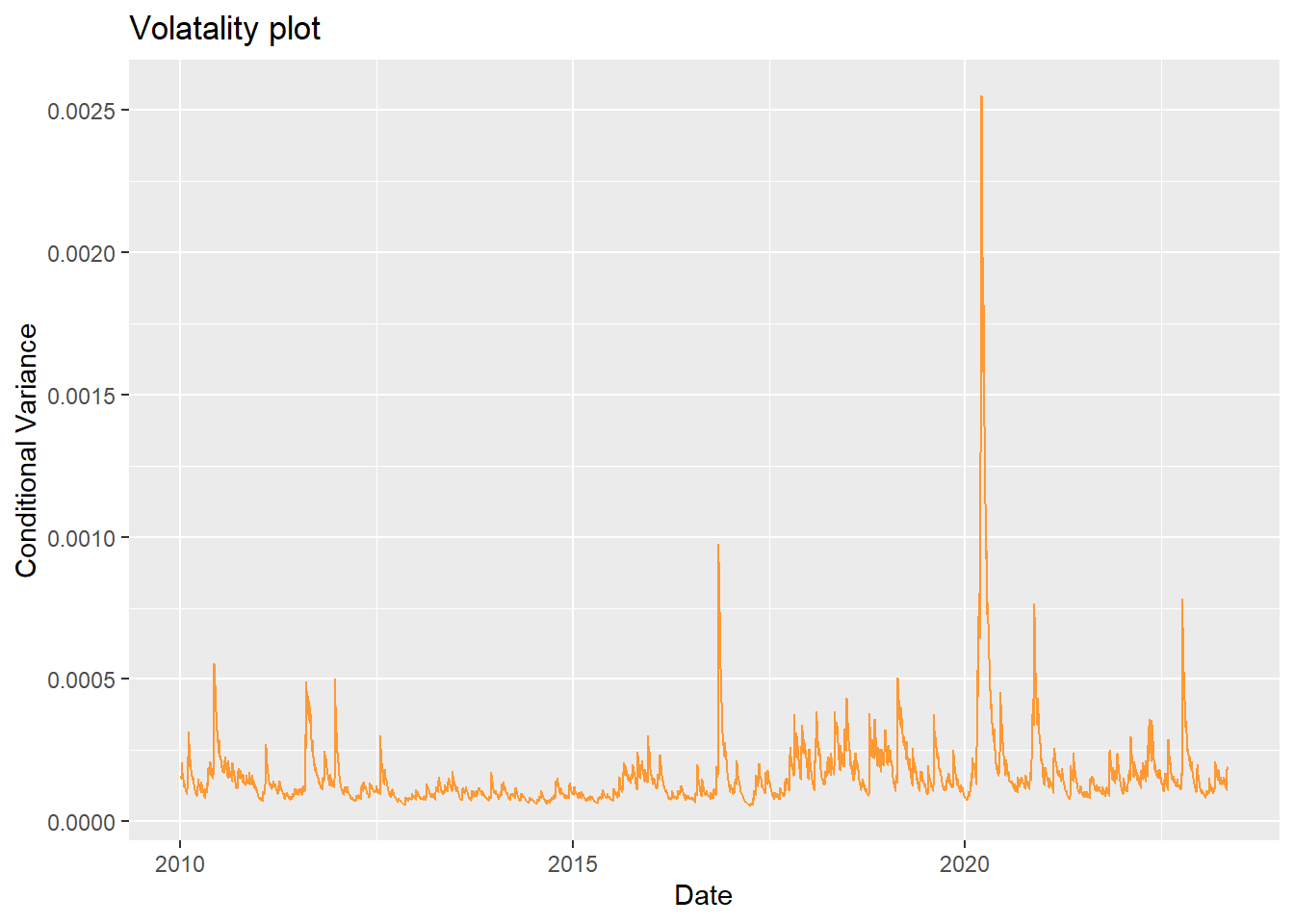

Volatality plot

Show the code

ht <- garch.fit1@h.t #a numeric vector with the conditional variances (h.t = sigma.t^delta)

data= data.frame(ht,CVS_df$Date[-length(CVS_df$Date)])

names(data) <- c('ht','Date')

ggplot(data, aes(y = ht, x = Date)) + geom_line(col = '#ff9933') + ylab('Conditional Variance') + xlab('Date')+ggtitle("Volatality plot")

Model Comparison

We were looking at Method 1: ARIMA(0,1,0)+GARCH(1,1) and Method 2: GARCH(1,1) Perhaps Method 1 is better because Method 2 has correlation left.