Conclusion

The conclusion section summarizes the project by answering key data science questions in introduction pages:

How has the stock price of healthcare companies evolved?

Over the past 10 years, the US healthcare industry has undergone significant changes and faced a range of challenges, including regulatory changes, technological advancements, and the COVID-19 pandemic. Despite fluctuations and challenges, the US healthcare sector has generally experienced overall growth over the past decade, with stock prices of many healthcare companies increasing significantly. This is due in part to the essential nature of healthcare services, as well as demographic trends such as an aging population.

The pharmaceutical and biotechnology sectors, e.g. LLY and MRNA, have been among the strongest performers in the healthcare industry over the past decade, with many companies experiencing significant growth in stock prices. This is due in part to the development of new treatments and therapies, as well as the increasing demand for personalized medicine and targeted therapies.

What type of healthcare industry create biggest sales?

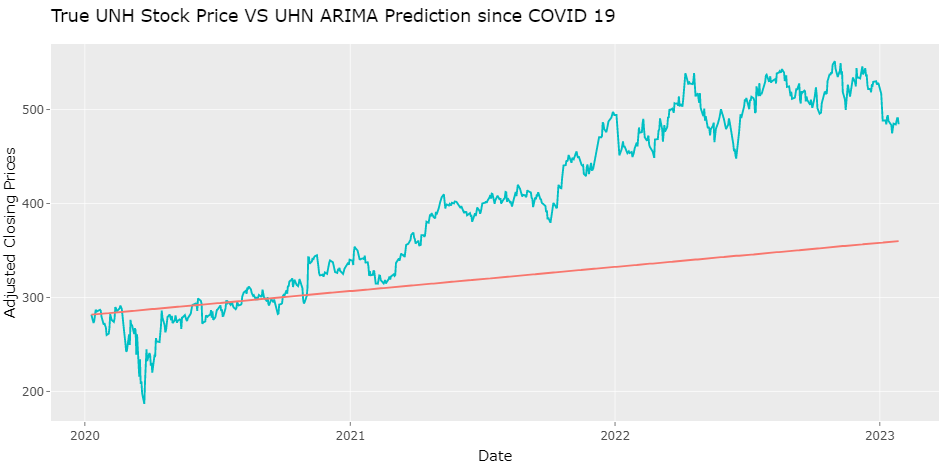

Healthcare services companies, such as UHN, have also experienced growth in stock prices over the past decade, as demand for healthcare services has increased. This includes companies such as hospitals, clinics, and insurance providers. UnitedHealth Group (UNH) has become one of the largest healthcare companies in the world, with a market capitalization of over $450 billion as of April 2023. The company’s stock price is also one of the highest in the healthcare industry.

How pandemic affect healthcare industry?

Even though the healthcare sector has always been a relatively stable markets because of the necessity of the industry, the novel COVID-19 pandemic still exert some mixed effects on the industry. At the beginning of the pandemic, many healthcare stocks initially decreased as investors worried about the potential financial impact of the pandemic on the healthcare industry. However, as the pandemic continued and the demand for healthcare services increased, many healthcare stocks rebounded and some even reached record highs. For example, by comparing the prediction value of pre-COVID value to the real time value, it suggeststhat UNH stock price would not be that high without COVID-19.

When would be think as more risky to invest in healthcare stock market?

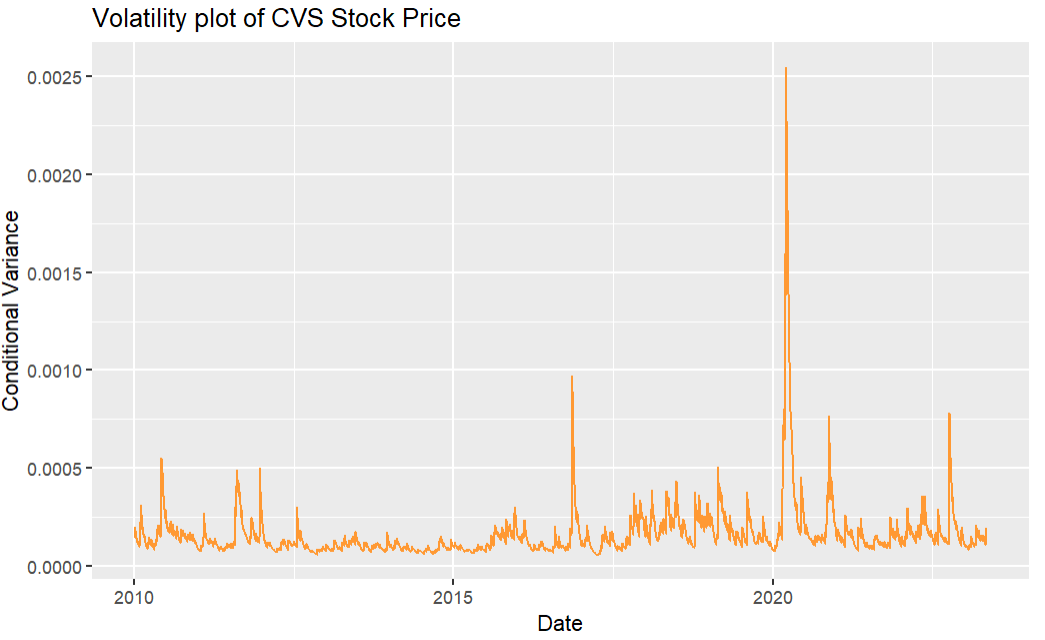

While healthcare stock prices have generally experienced growth over the past decade, there has also been significant volatility and uncertainty, particularly around changes in healthcare policy and the impact of the COVID-19 pandemic. The higher the volatility, the riskier the security. High volatility can also create risks for companies and their shareholders, as it can make it difficult to predict earnings or plan for the future. On the other hand, volatility can create opportunities for investors to buy stocks at a lower price and earn a higher return when the market recovers.

Is there any factors affecting healthcare stock prices?

The stock price is influenced by a wide range of factors, including the company’s financial performance, strategic decisions, and broader trends in the healthcare industry and the economy, such as GDP and Unemployment rate. Especially during the COVID-19 time, COVID-19 case numbers and COVID-19 vaccine rates can affect the stock prices. The COVID-19 vaccine rates would mainly affect the biotechnology companies, such as Moderna, while other healthcare companies who are involved in other areas are less likely affected by number of COVID-19 vaccine rates, such as United Health Group.

Are we able to predict the stock prices of these companies?

There are a bunch of models can predict the stock prices, as we discussed in this project, including ARIMA, ARIMAX, ARCH, deep learning and etc. An ARIMA model is far easier to set up and should be considered, especially with its ability to be interpretable, but a neural network is an excellent alternative.