ARMA/ARIMA/SARIMA Models for AZN

Step 1: Determine the stationality of time series

Stationality is a pre-requirement of training ARIMA model. This is because term ‘Auto Regressive’ in ARIMA means it is a linear regression model that uses its own lags as predictors, which work best when the predictors are not correlated and are independent of each other. Stationary time series make sure the statistical properties of time series do not change over time.

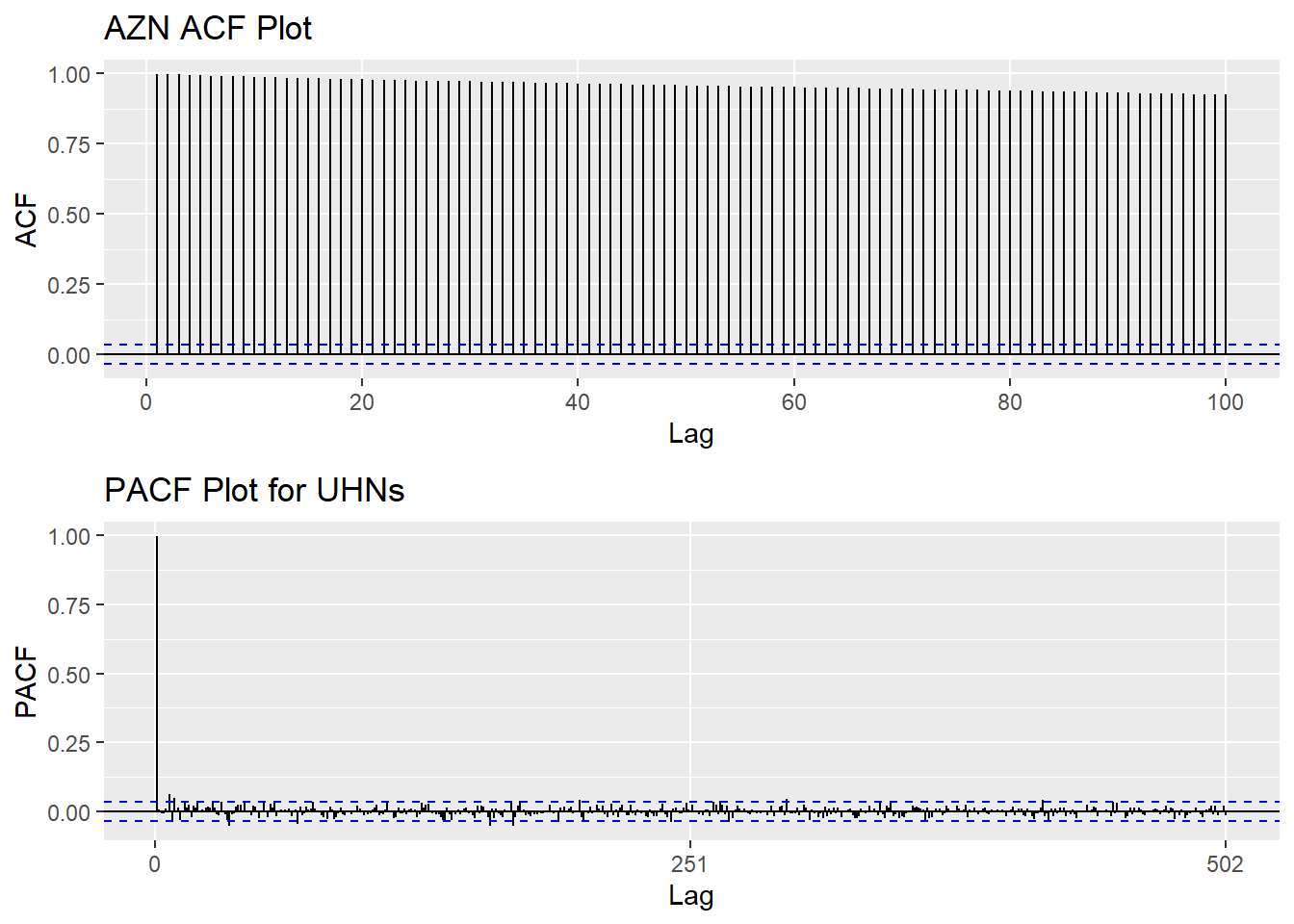

Based on information obtained from both ACF graphs and Augmented Dickey-Fuller Test, the time series data is non-stationary.

Show the code

AZN_acf <- ggAcf(AZN_ts,100)+ggtitle("AZN ACF Plot")

AZN_pacf <- ggPacf(AZN_ts)+ggtitle("PACF Plot for UHNs")

grid.arrange(AZN_acf, AZN_pacf,nrow=2)

Show the code

tseries::adf.test(AZN_ts)

Augmented Dickey-Fuller Test

data: AZN_ts

Dickey-Fuller = -3.3602, Lag order = 14, p-value = 0.06026

alternative hypothesis: stationaryStep 2: Eliminate Non-Stationality

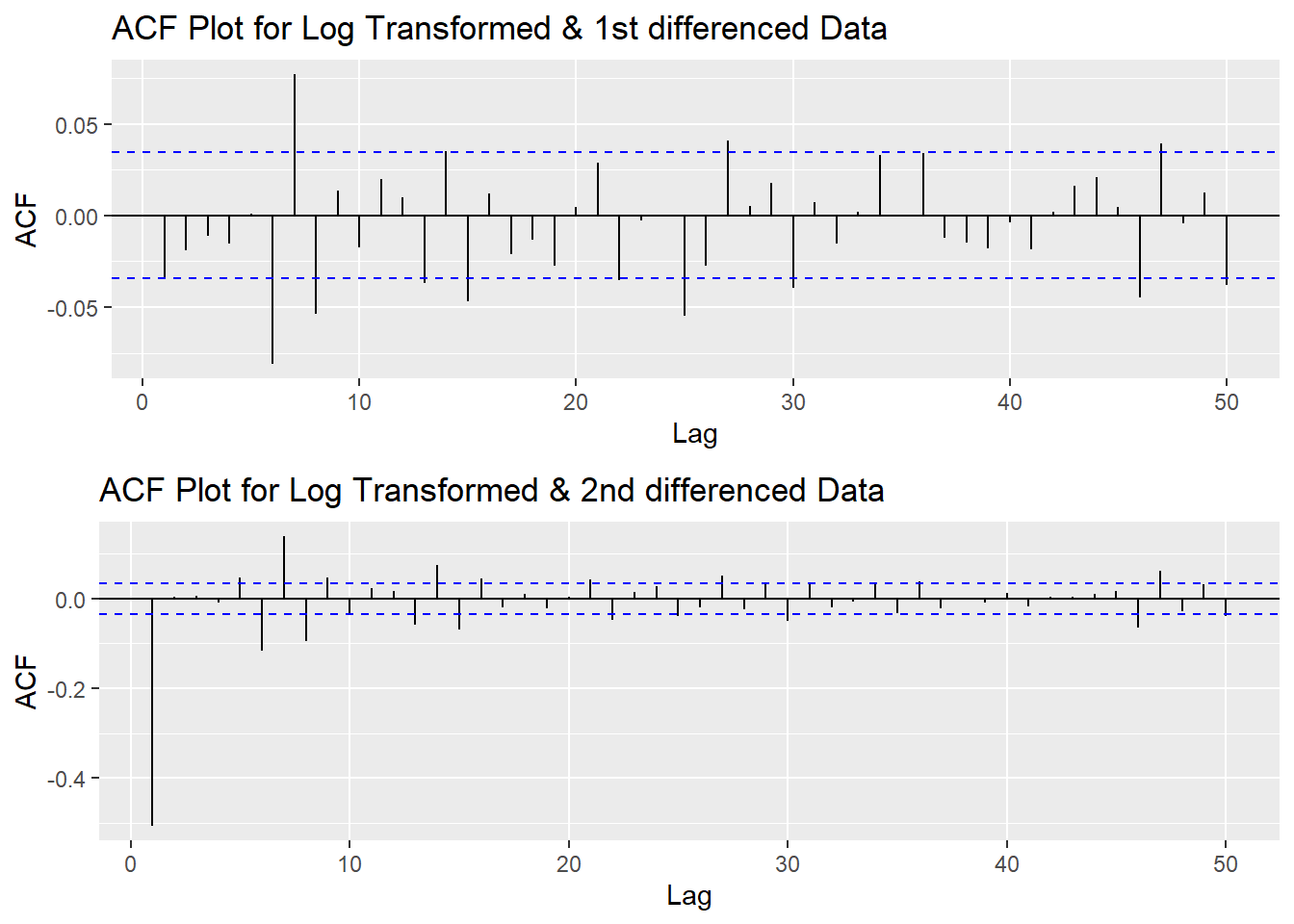

Since this data is non-stationary, it is important to necessary to convert it to stationary time series. This step employs a series of actions to eliminate non-stationality, i.e. log transformation and differencing the data. It turns out the log transformed and 1st differened data has shown good stationary property, there are no need to go further at 2nd differencing. What is more, the Augmented Dickey-Fuller Test also confirmed that the log transformed and 1st differenced data is stationary. Therefore, the log transformation and 1st differencing would be the actions taken to eliminate the non-stationality.

Show the code

plot1<- ggAcf(log(AZN_ts) %>%diff(), 50, main="ACF Plot for Log Transformed & 1st differenced Data")

plot2<- ggAcf(log(AZN_ts) %>%diff()%>%diff(),50, main="ACF Plot for Log Transformed & 2nd differenced Data")

grid.arrange(plot1, plot2,nrow=2)

Show the code

tseries::adf.test(log(AZN_ts) %>%diff())

Augmented Dickey-Fuller Test

data: log(AZN_ts) %>% diff()

Dickey-Fuller = -15.655, Lag order = 14, p-value = 0.01

alternative hypothesis: stationaryStep 3: Determine p,d,q Parameters

The standard notation of ARIMA(p,d,q) include p,d,q 3 parameters. Here are the representations: - p: The number of lag observations included in the model, also called the lag order; order of the AR term. - d: The number of times that the raw observations are differenced, also called the degree of differencing; number of differencing required to make the time series stationary. - q: order of moving average; order of the MA term. It refers to the number of lagged forecast errors that should go into the ARIMA Model.

Show the code

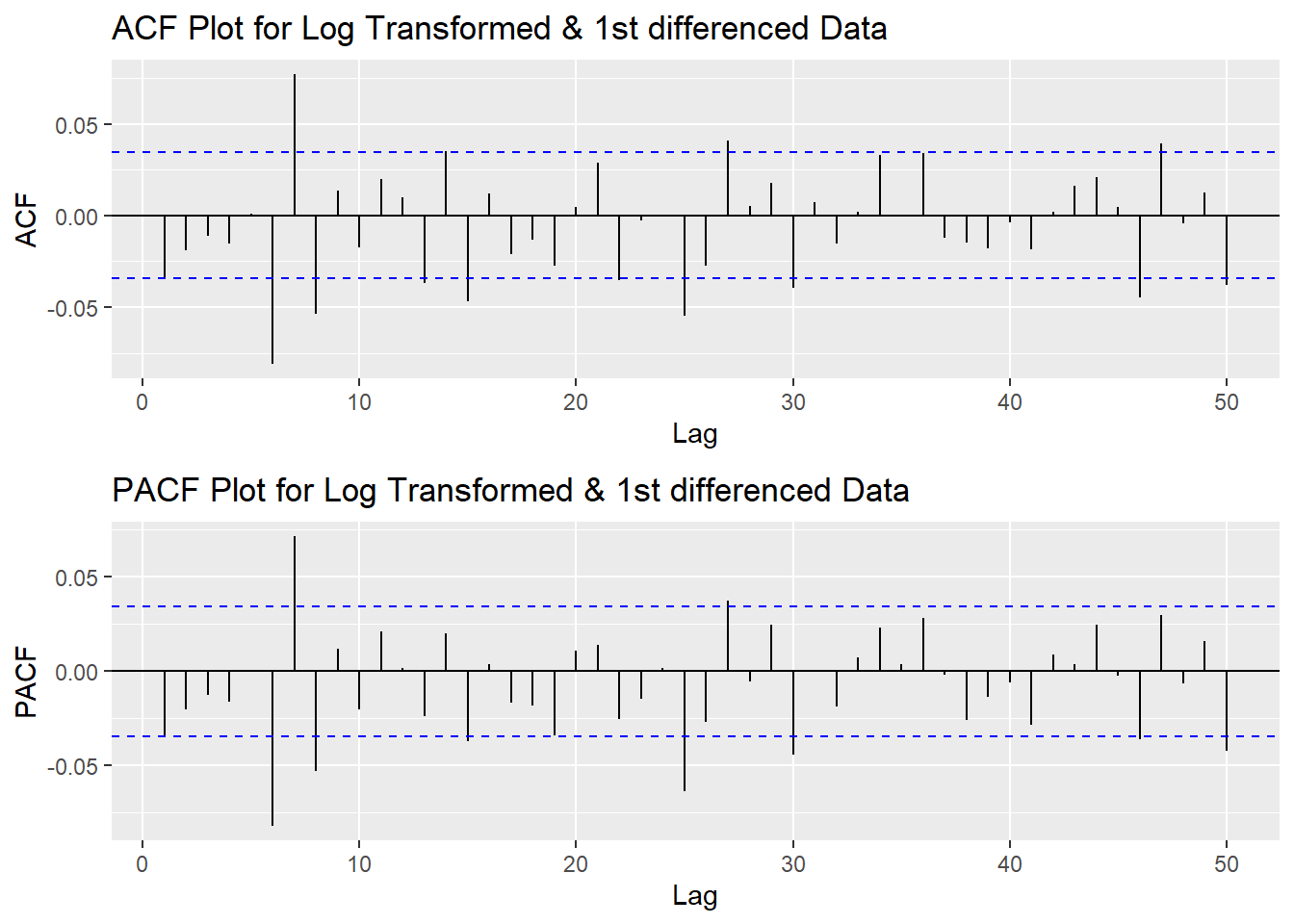

plot3<- ggPacf(log(AZN_ts) %>%diff(),50, main="PACF Plot for Log Transformed & 1st differenced Data")

grid.arrange(plot1,plot3)

According to the PACF plot and ACF plot above, both plots have 3 significant peak at 6,7,8. To avoid over-complexity, here choose the value of p and q as 0. Since I only differenced the data once, the d would be 1.

Step 4: Fit ARIMA(p,d,q) model

Show the code

fit1 <- Arima(log(AZN_ts), order=c(0, 1, 0),include.drift = TRUE)

summary(fit1)Series: log(AZN_ts)

ARIMA(0,1,0) with drift

Coefficients:

drift

5e-04

s.e. 3e-04

sigma^2 = 0.0002423: log likelihood = 8953.58

AIC=-17903.16 AICc=-17903.16 BIC=-17890.98

Training set error measures:

ME RMSE MAE MPE MAPE

Training set 1.15802e-06 0.01555995 0.01046885 -0.0005720625 0.227243

MASE ACF1

Training set 0.05903222 -0.03420903Model Diagnostics

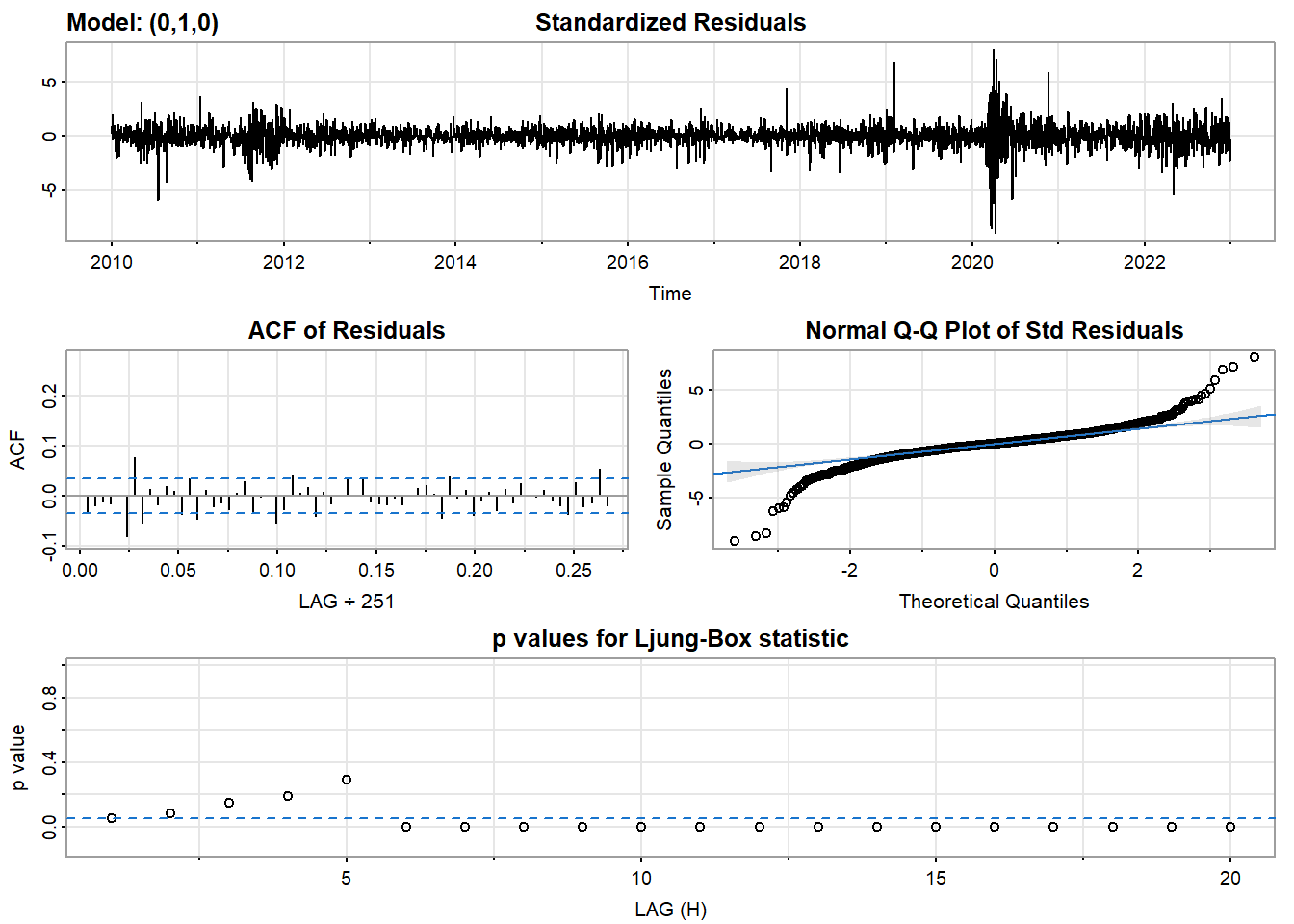

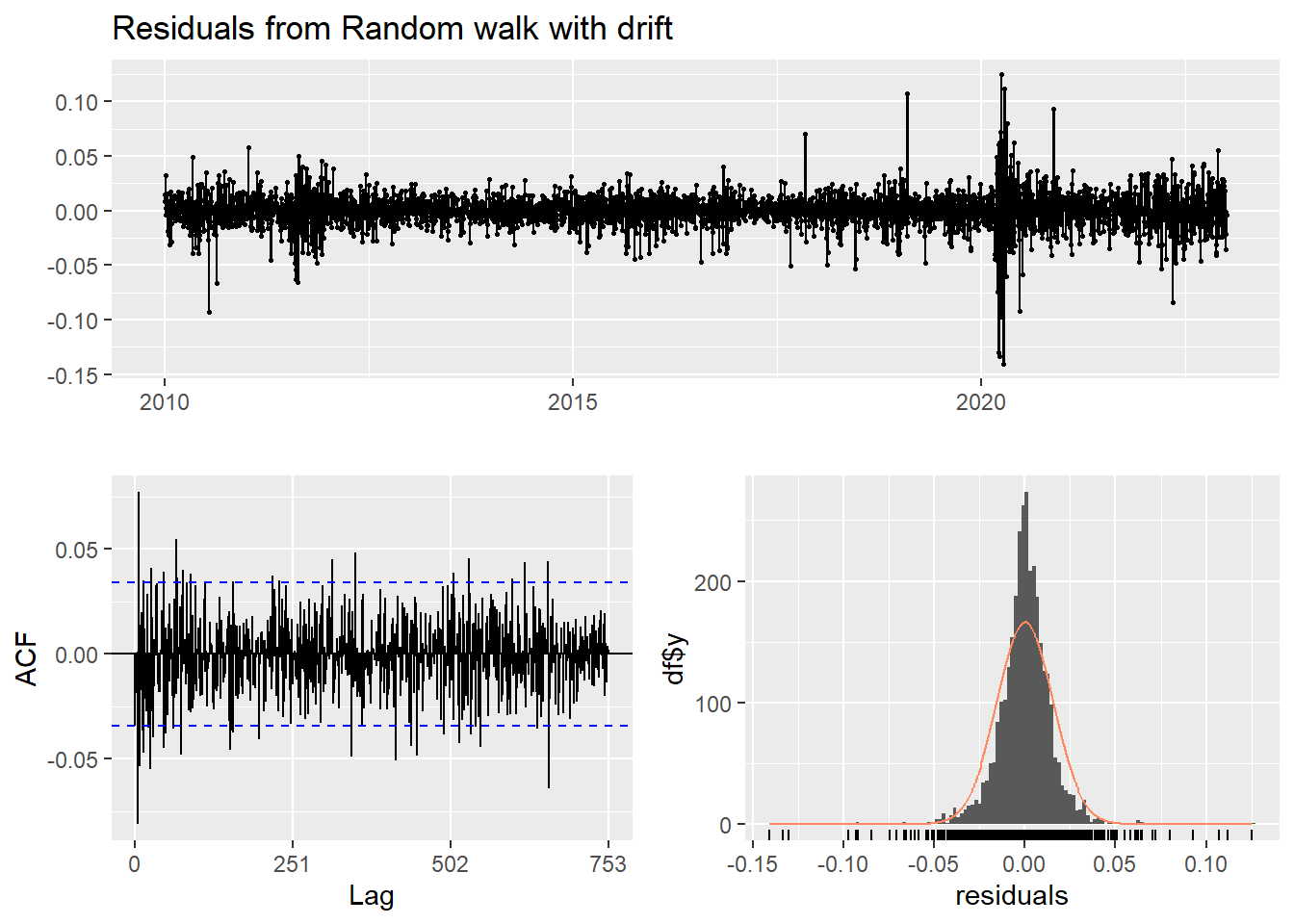

- Inspection of the time plot of the standardized residuals below shows no obvious patterns.

- Notice that there may be outliers, with a few values exceeding 3 standard deviations in magnitude.

- The ACF of the standardized residuals shows no apparent departure from the model assumptions, no significant lags shown.

- The normal Q-Q plot of the residuals shows that the assumption of normality is reasonable, with the exception of the fat-tailed.

- The model appears to fit well.

Show the code

model_output <- capture.output(sarima(log(AZN_ts), 0,1,0))

Show the code

cat(model_output[9:38], model_output[length(model_output)], sep = "\n") #to get rid of the convergence status and details of the optimization algorithm used by the sarima() $fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

constant

5e-04

s.e. 3e-04

sigma^2 estimated as 0.0002422: log likelihood = 8953.58, aic = -17903.16

$degrees_of_freedom

[1] 3262

$ttable

Estimate SE t.value p.value

constant 5e-04 3e-04 1.8978 0.0578

$AIC

[1] -5.486718

$AICc

[1] -5.486718

$BIC

[1] -5.482985Compare with auto.arima() function

auto.arima() returns best ARIMA model according to either AIC, AICc or BIC value. The function conducts a search over possible model within the order constraints provided. However, this method is not reliable sometimes. It fits a different model than ACF/PACF plots suggest. This is because auto.arima() usually return models that are more complex as it prefers more parameters compared than to the for example BIC.

Show the code

auto.arima(log(AZN_ts))Series: log(AZN_ts)

ARIMA(1,1,1) with drift

Coefficients:

ar1 ma1 drift

0.9292 -0.9519 5e-04

s.e. 0.0365 0.0305 2e-04

sigma^2 = 0.0002415: log likelihood = 8959.68

AIC=-17911.36 AICc=-17911.35 BIC=-17887Step 5: Forecast

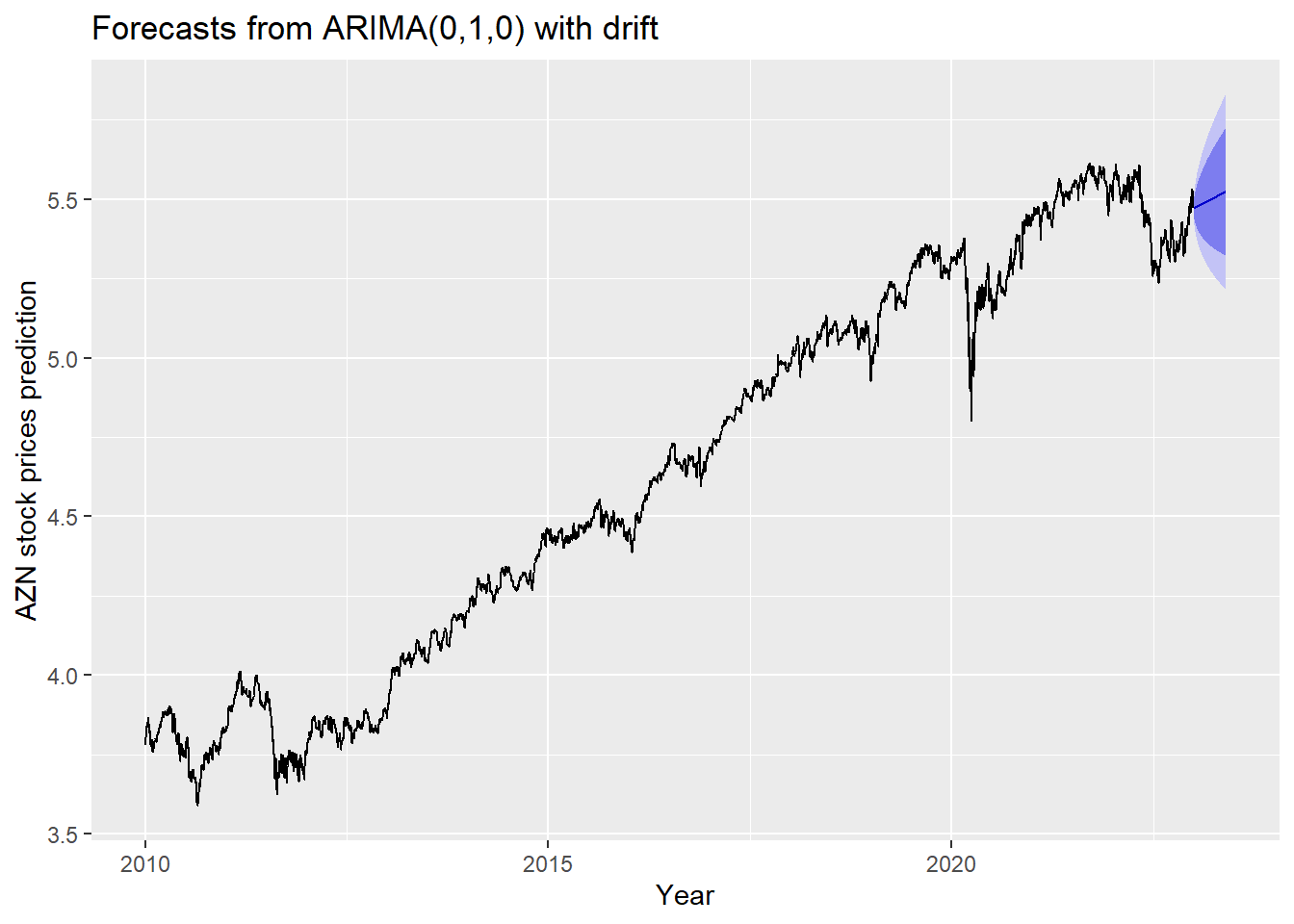

The blue part in graph below forecast the next 100 values of AZN stock price in 80% and 95% confidence level.

Show the code

log(AZN_ts) %>%

Arima(order=c(0,1,0),include.drift = TRUE) %>%

forecast(100) %>%

autoplot() +

ylab("AZN stock prices prediction") + xlab("Year")

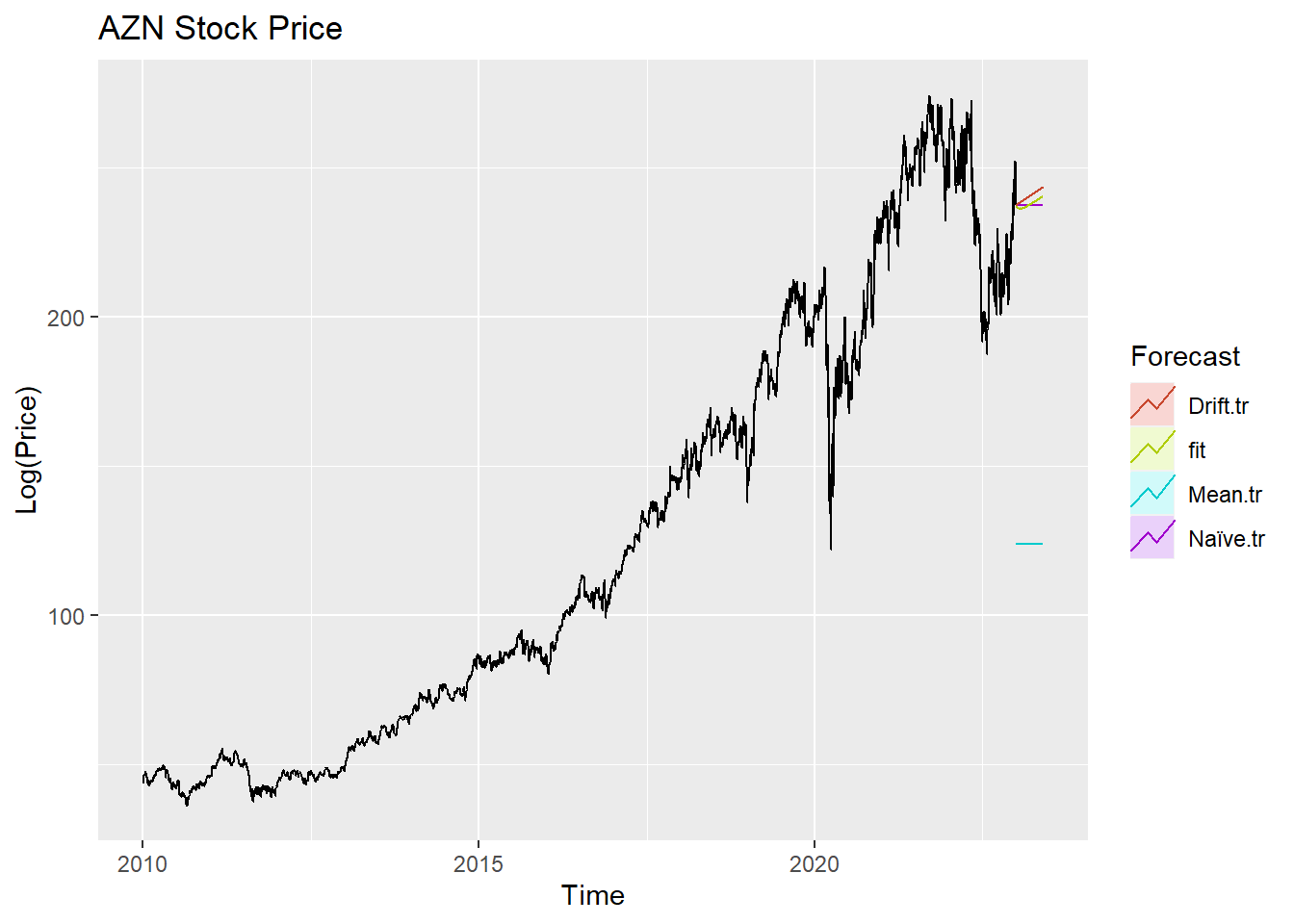

Step 6: Compare ARIMA model with the benchmark methods

Forecasting benchmarks are very important when testing new forecasting methods, to see how well they perform against some simple alternatives.

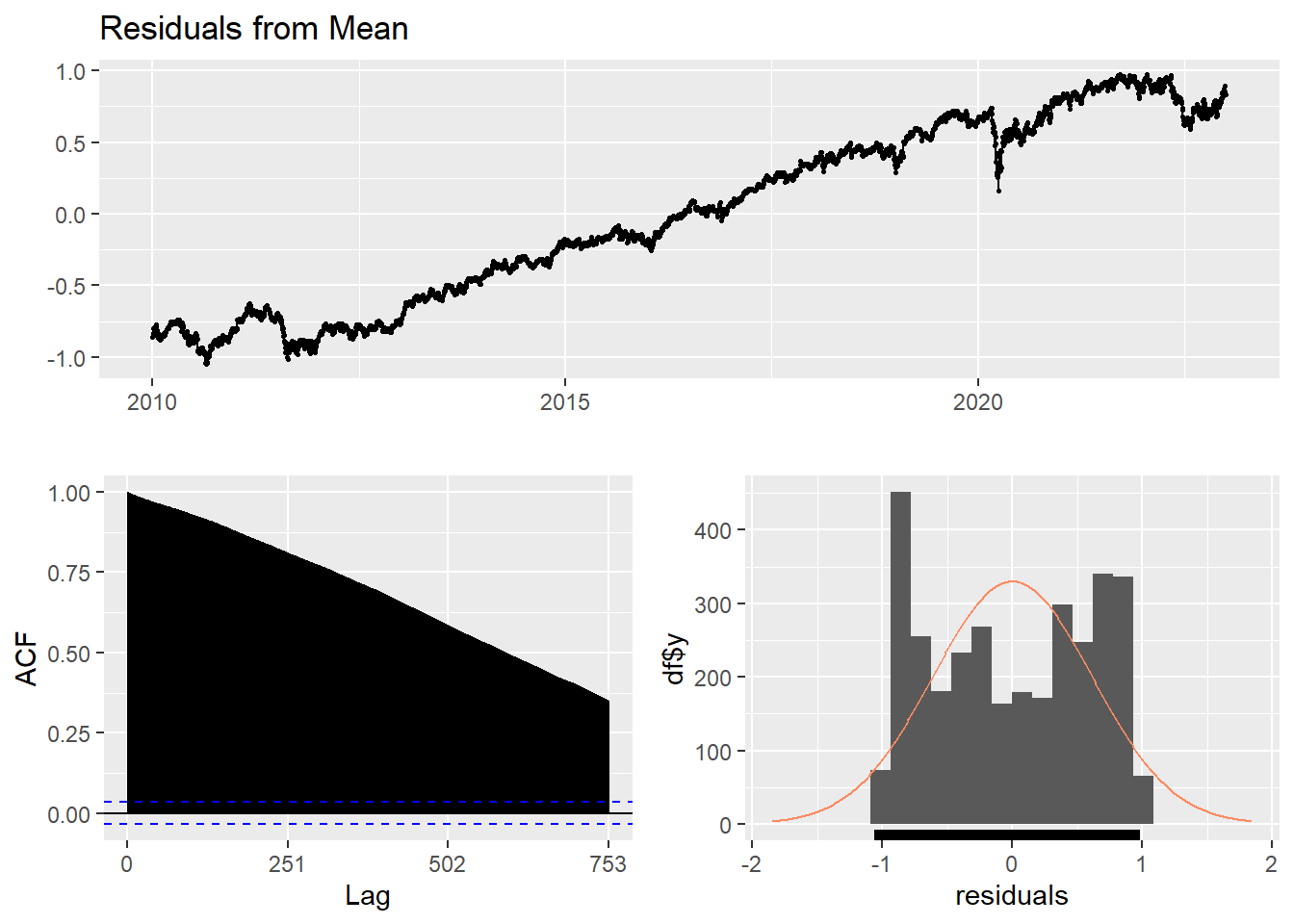

Average method

Here, the forecast of all future values are equal to the average of the historical data. The residual plot of this method is not stationary.

Show the code

f1<-meanf(log(AZN_ts), h=251) #mean

#summary(f1)

checkresiduals(f1)#serial correlation ; Lung Box p <0.05

Ljung-Box test

data: Residuals from Mean

Q* = 1165071, df = 501, p-value < 2.2e-16

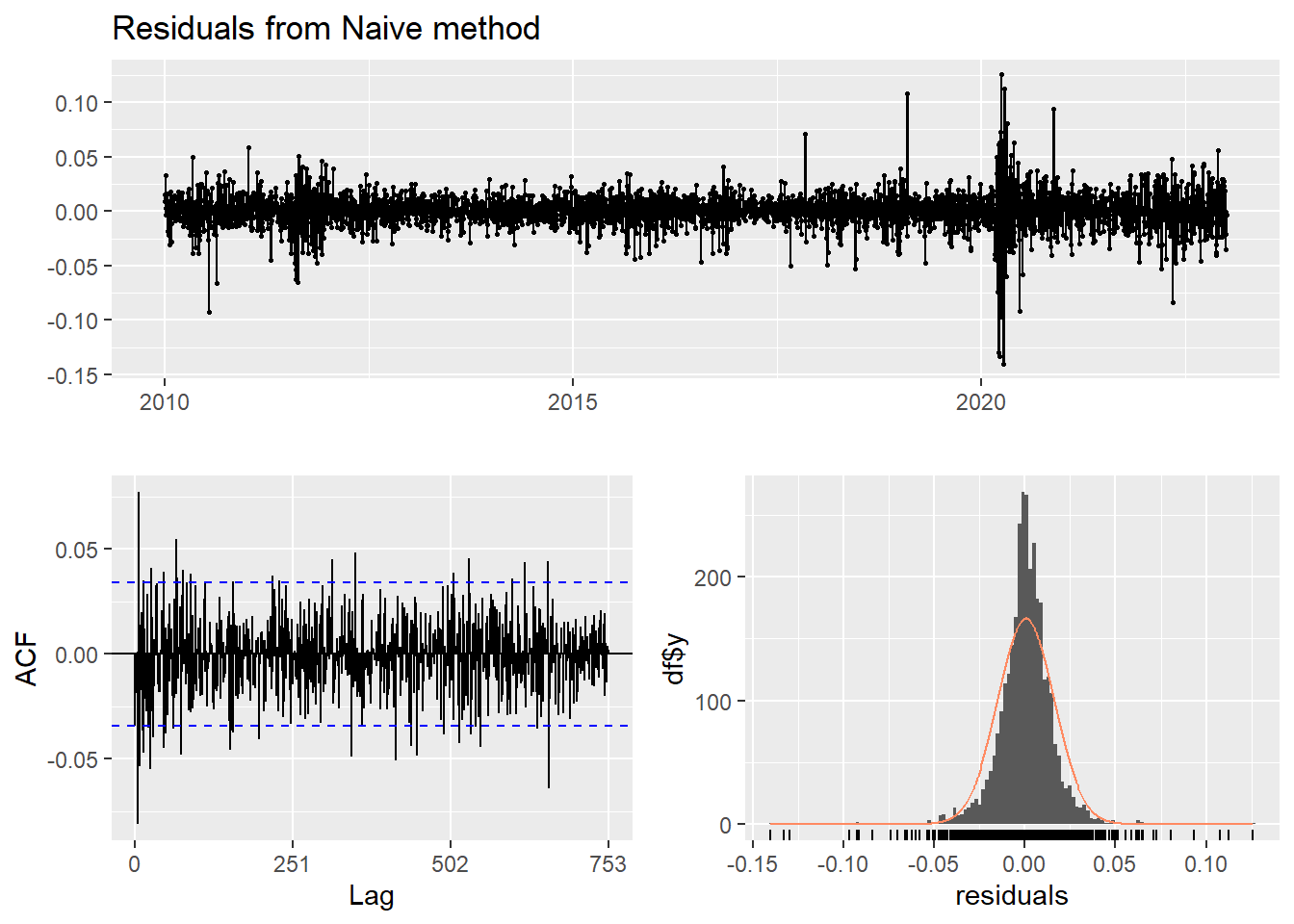

Model df: 1. Total lags used: 502Naive method

This method simply set all forecasts to be the value of the last observation. According to error measurement here, ARIMA(0,1,0) outperform the average method.

Show the code

f2<-naive(log(AZN_ts), h=11) # naive method

summary(f2)

Forecast method: Naive method

Model Information:

Call: naive(y = log(AZN_ts), h = 11)

Residual sd: 0.0156

Error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.0005180792 0.01557082 0.01049512 0.01076463 0.2277994 0.05918031

ACF1

Training set -0.03425189

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

2023.004 5.470789 5.450834 5.490744 5.440271 5.501307

2023.008 5.470789 5.442569 5.499010 5.427630 5.513949

2023.012 5.470789 5.436226 5.505352 5.417930 5.523648

2023.016 5.470789 5.430880 5.510699 5.409753 5.531826

2023.020 5.470789 5.426169 5.515410 5.402548 5.539030

2023.024 5.470789 5.421910 5.519668 5.396035 5.545543

2023.028 5.470789 5.417994 5.523585 5.390046 5.551533

2023.032 5.470789 5.414349 5.527230 5.384471 5.557108

2023.036 5.470789 5.410925 5.530654 5.379234 5.562344

2023.040 5.470789 5.407687 5.533892 5.374282 5.567296

2023.044 5.470789 5.404607 5.536972 5.369572 5.572007Show the code

checkresiduals(f2)#serial correlation ; Lung Box p <0.05

Ljung-Box test

data: Residuals from Naive method

Q* = 627.23, df = 502, p-value = 0.0001143

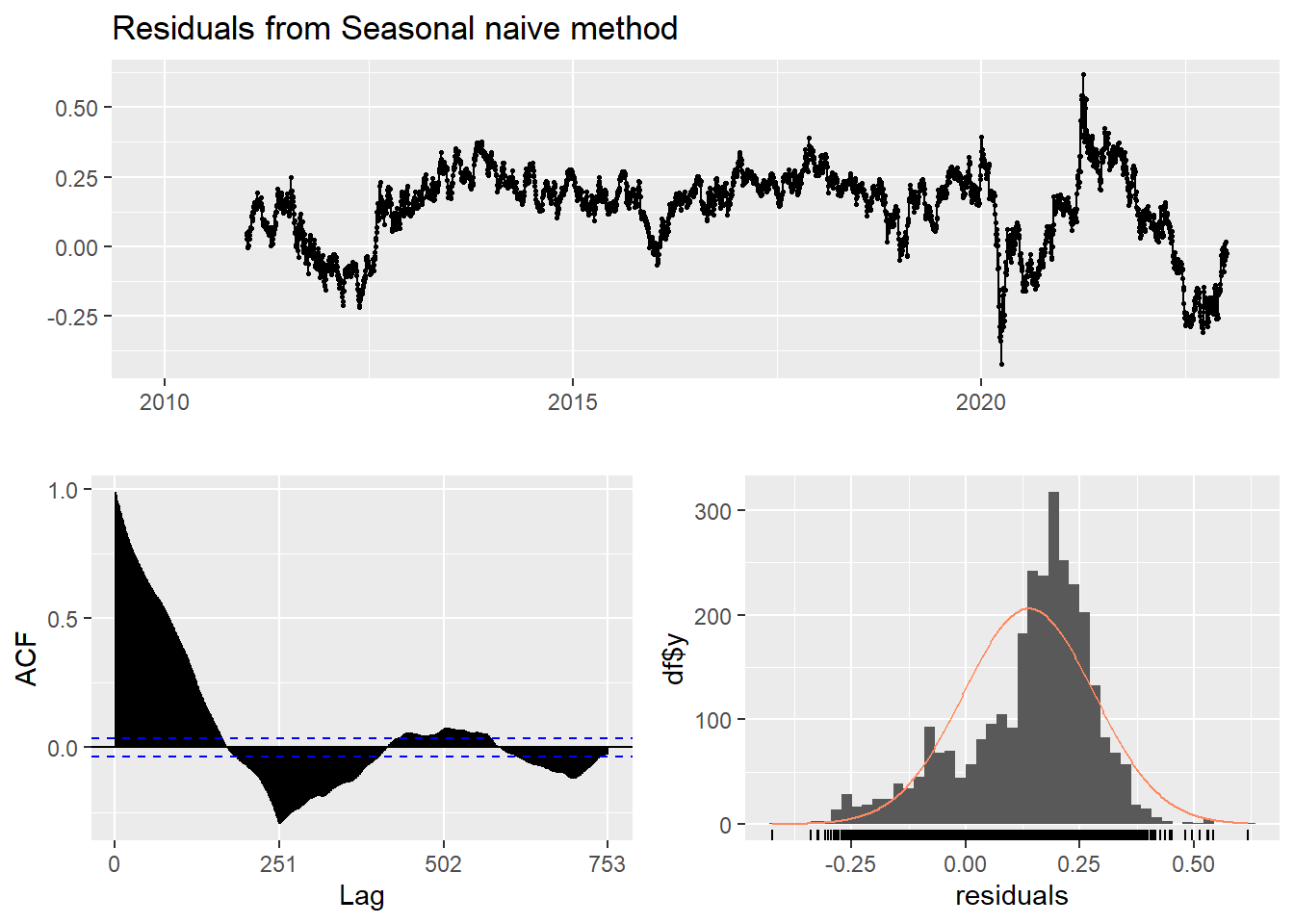

Model df: 0. Total lags used: 502Seasonal naive method

This method is useful for highly seasonal data, which can set each forecast to be equal to the last observed value from the same season of the year. Here seasonal naive is used to forecast the next 4 values for the AZN stock price series.

Show the code

f3<-snaive(log(AZN_ts), h=4) #seasonal naive method

summary(f3)

Forecast method: Seasonal naive method

Model Information:

Call: snaive(y = log(AZN_ts), h = 4)

Residual sd: 0.1989

Error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.1378916 0.1988982 0.1773414 2.933481 3.770862 1 0.9881511

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

2023.004 5.528218 5.273320 5.783116 5.138385 5.918052

2023.008 5.558320 5.303422 5.813219 5.168487 5.948154

2023.012 5.574101 5.319203 5.828999 5.184268 5.963934

2023.016 5.582158 5.327260 5.837056 5.192325 5.971991Show the code

checkresiduals(f3) #serial correlation ; Lung Box p <0.05

Ljung-Box test

data: Residuals from Seasonal naive method

Q* = 174670, df = 502, p-value < 2.2e-16

Model df: 0. Total lags used: 502Drift Method

A variation on the naïve method is to allow the forecasts to increase or decrease over time, where the amount of change over time is set to be the average change seen in the historical data.

Show the code

f4 <- rwf(log(AZN_ts),drift=TRUE, h=20)

summary(f4)

Forecast method: Random walk with drift

Model Information:

Call: rwf(y = log(AZN_ts), h = 20, drift = TRUE)

Drift: 5e-04 (se 3e-04)

Residual sd: 0.0156

Error measures:

ME RMSE MAE MPE MAPE MASE

Training set 2.353136e-16 0.0155622 0.0104709 -0.0006028803 0.227282 0.05904378

ACF1

Training set -0.03425189

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

2023.004 5.471307 5.451357 5.491257 5.440797 5.501818

2023.008 5.471825 5.443608 5.500043 5.428670 5.514981

2023.012 5.472343 5.437779 5.506908 5.419481 5.525206

2023.016 5.472862 5.432943 5.512780 5.411812 5.533911

2023.020 5.473380 5.428743 5.518016 5.405114 5.541645

2023.024 5.473898 5.424993 5.522802 5.399105 5.548691

2023.028 5.474416 5.421585 5.527247 5.393618 5.555214

2023.032 5.474934 5.418447 5.531421 5.388544 5.561324

2023.036 5.475452 5.415529 5.535375 5.383808 5.567096

2023.040 5.475970 5.412796 5.539144 5.379354 5.572586

2023.044 5.476488 5.410221 5.542756 5.375141 5.577836

2023.048 5.477006 5.407781 5.546231 5.371136 5.582876

2023.052 5.477524 5.405462 5.549587 5.367314 5.587734

2023.056 5.478042 5.403248 5.552836 5.363655 5.592430

2023.060 5.478560 5.401129 5.555991 5.360140 5.596981

2023.064 5.479078 5.399096 5.559061 5.356756 5.601401

2023.068 5.479597 5.397140 5.562053 5.353490 5.605703

2023.072 5.480115 5.395254 5.564975 5.350332 5.609897

2023.076 5.480633 5.393434 5.567832 5.347273 5.613992

2023.080 5.481151 5.391673 5.570629 5.344306 5.617995Show the code

checkresiduals(f4)

Ljung-Box test

data: Residuals from Random walk with drift

Q* = 627.23, df = 501, p-value = 0.0001014

Model df: 1. Total lags used: 502Show the code

autoplot(AZN_ts) +

autolayer(meanf(AZN_ts, h=100),

series="Mean.tr", PI=FALSE) +

autolayer(naive((AZN_ts), h=100),

series="Naïve.tr", PI=FALSE) +

autolayer(rwf((AZN_ts), drift=TRUE, h=100),

series="Drift.tr", PI=FALSE) +

autolayer(forecast(Arima((AZN_ts), order=c(4, 1, 3),include.drift = TRUE),100),

series="fit",PI=FALSE) +

ggtitle("AZN Stock Price") +

xlab("Time") + ylab("Log(Price)") +

guides(colour=guide_legend(title="Forecast"))

According to the graph above, ARIMA(0,1,0) outperform most of benchmark method, though its performance is very similar to drift method.